Volatility based Exchange Traded Products (ETPs) have only been on the market for a few years (see volatility tickers for the full list of USA based funds). The oldest one, Barclays’ VXX only started trading in late January 2009. Because of their relative youth we don’t have actual trade data on how they would have performed through critical periods—for example the 2008/2009 crash. Fortunately the CBOE provides historical data starting in March 2004 for the VIX futures that underlie the VXX, so it’s possible to objectively simulate how it would have performed from that point forward.

Some aspects of the VXX simulation are tricky. For example some VIX future expiration months did not trade in the 2004 to 2008 time frame so those values need to be interpolated / extrapolated. The prospectus does not spell out whether closing or settlement values of the futures are used for the index calculations (they use settlement values), and the calculation using the daily rolled and rebalanced futures is not straightforward. Even the final step, figuring out the daily fees is not a trivial exercise.

If you are interested in purchasing the results of the VXX simulation back to March 2004 I have made a spreadsheet available for purchase (see bottom of post) that includes the simulated values including the annual fee (0.89%). The maximum deviation in my results from the Barclays’ published closing indicative values since the product started trading is less than +-0.04%.

The chart below shows the reverse split adjusted results (as of Dec 2013).

Clearly VXX would have performed horribly over the 2004 to 2013 time frame with a brief respite in 2008/2009. If you had invested $1000 in VXX in March 2004 you would now have $1.80 left of your initial investment—a 99.8% decline. The long volatility funds have a structural tendency to decline because they hold VIX futures that are historically in contango 70% to 80% of the time, for more on this process see How Does VXX Work? and The Cost of Contango.

If you are interested in purchasing the results of the VXX simulation back to March 2004 I have made a spreadsheet available for purchase (see bottom of post) that includes the simulated values with and without the annual fee (0.89%). The maximum deviation in my results from the Barclays’ published closing indicative values since the product started trading is less than +-0.04%.

The chart below shows VXX’s performance (in black) relative to a few other volatility based Exchange Traded Products.

Among the long funds, the 2X leveraged short term TVIX from VelocityShares fares even worse than VXX, declining 99.99999%. Barclays’ medium term VXZ only declines 78%. The daily inverse funds do better with VelocityShares’ medium term ZIV going up 43% and its short term XIV going up 13 fold—however not without some serious dips along the way.

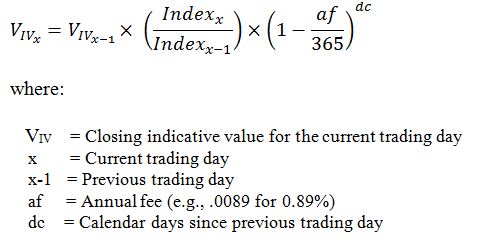

Earlier in this post I mentioned that computing VXX’s fee was surprisingly difficult. The appropriate equation is not present in any ETP prospectus I have seen—instead you are treated to prose that would make an IRS agent proud.

Exchange Traded Products typically state their fees on an annual basis (e.g., 0.89%), but in practice they deduct a fee each day from the assets under management. In computing the fees it’s tempting to start with the daily value of the underlying index (SPVXSTR in the case of VXX) but the actual calculation starts with the final indicative value of the ETP from the previous trading day. It multiplies the previous value by the index gain at close for the current day (one if it is a non-trading day) and then applies the fee. The applicable formula is:

While it’s interesting to simulate how a security would have behaved in the past it’s only one of many possible outcomes. If VXX had existed in 2004, it’s likely the VIX futures that underlie it would have been affected—at least in small ways. Looking forward the uncertainties multiply—there’s no guarantee that VIX futures will behave the same way through upcoming corrections and market crashes and with the open interest on VIX futures growing 40% a year we can anticipate that someday they, and indirectly VXX will be influencing the behavior of the S&P 500 itself.

More information on the VXX simulation spreadsheet see this readme.

If you purchase the spreadsheet you will be eventually be directed to paypal where you can pay via your paypal account or a credit card. When you successfully complete the paypal portion you will be shown a “Return to Six Figure Investing“ link. Click on this link to reach the page where can download the spreadsheet. Please email me at vh2solutions@gmail.com if you have problems, questions, or requests.