The focus of this letter is to show people how to make money through investing in fast growing, highly profitable companies which have stiff, long term macroeconomic winds at their backs. That means I ignore a large part of the US economy whose time has passed and are headed for the dustbin of history.

According to the Department of Labor’s Bureau of Labor Statistics, the ten industries listed below are least likely to generate positive job growth in the next decade. As most of these stocks are already bombed out, it is way too late to short them. As an investor, you should consider this a ‘no go’ list. I have added my comments, not all of which should be taken seriously.

1) Construction – Gale force headwinds of 80 million retiring and downsizing baby boomers have saddled this industry with a decade’s worth of unwanted inventory. Rent, don’t own, and let the landlord unclog your toilet.

2) Automotive manufacturing – At its peak a few years ago, 20 million cars rolled off the assembly lines. Six years later, it will struggle to make 16 million, and most of those will be by much more efficient factories that use far fewer workers. What’s left of the industry is far leaner and meaner than the bloated dinosaurs of the past, from management, down to the manufacturing plants and the dealer networks. My next car is going to be a second Tesla (TSLA), the four wheel drive Model X.

3) Realtors – The number of realtors is only down 10% from its 1.3 million peak in 2006. I have always been amazed at how realtors who add so little in value take home so much in fees, still around 6% of the gross sales price. Someone is going to figure out how to break this monopoly.

4) Pharmaceuticals – With a number of blockbuster drugs seeing patents expire soon and going generic, the downsizing at the major firms has been ferocious. The survivors will merge to cut costs, sending more masses to the unemployment office.

5) Newspapers – these probably won’t exist in five years, as five decades of hurtling technological advances have already shrunk the labor force by 90%. Go online, or go away.

6) Airline employees – This is your worst nightmare of an industry, as management has no idea what interest rates, fuel costs, or the economy will do, which are the largest inputs into their business. Pilots will eventually work for minimum wage just to keep their flight hours up.

7) Big telecom – Can you hear me now? Nobody uses landlines anymore, leaving these companies with giant rusting networks that are costly to maintain. Since cell phone market penetration is 90%, survivors are slugging it out through price competition, cost cutting, and all that annoying advertising.

8) State and Local Government – With employment still at levels private industry hasn’t seen since the seventies, firing state and municipal workers will be the principal method of balancing ailing budgets. Expect class sizes to soar to 80, to put out your own damn fires, and keep the 9 mm loaded and the back door booby trapped for home protection.

9) Installation, Maintenance, and Repair – I have explained to my mechanic that the motor in my new electric car has only five moving parts, compared to 300 in my old clunker, and this won’t be good for business. But he just doesn’t get it. The winding down of our wars in the Middle East is about to dump a million more applicants into this sector. The last refuge of the trained blue collar worker is about to get cleaned out.

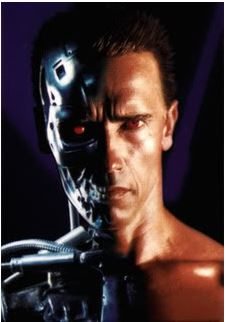

10) Bank Tellers – Since the ATM made its debut in 1968, this profession has been on a long downhill slide. Banks have lost so much money in the financial crisis, they can’t afford to hire humans any more. It hasn’t helped that 283 banks have closed during the recession, with many survivors merging to cut costs (read fire more people). Your next bank teller may be a Terminator.