KISS – Keep it simple st …. Sometimes the easiest analysis really is the most effective and accurate analysis. Here’s a very simple way to test if gold’s rally is for real, almost like a litmus test.

Gold is up 12.6% since the beginning of the year and gold ETFs, like the SPDR Gold Shares (NYSEArca: GLD) and iShares Gold Trust (NYSEArca: IAU), are back in vogue.

A 12.6% gain is pretty good, especially when considering that the S&P 500 (NYSEArca: SPY) is essentially flat over the same period of time.

Gold always polarizes. Some love gold (no matter what) and others hate gold (no matter what), but for those of us who just want to make money with gold, we simply ask:

Is this gold rally for real or just a bull trap?

We’ll take a look at two lines of evidence. One is anecdotal (and should put a smile on your face), but has proven indisputably correct. The other is based on technical analysis.

Anecdotal … surprisingly Accurate

The December 22, 2013 Profit Radar Report issued the following observation and forecast:

“Gold sentiment is bearish enough to cause a sizeable bounce. Below are just some recent headlines:

Gold May be on the Verge of a Waterfall-Style Decline – Forbes

2014 Could be a Sequel for Gold and That’s Not Good – ETFtrends

Gold is Testing Last Ditch Support Before it Falls Further into the Abyss – WSJ

Gold’s Gimmer Gone, Mutual Funds Feel the Pinch – WSJ

We would likely buy on any move below 1,160 followed by a move back above.”

Unfortunately, gold didn’t quite dip enough to trigger our 1,160 buy trigger, but the excessive pessimism lifted gold prices as proposed.

Gold may have come full circle, as sentiment is now quite optimistic.

The March 16 Profit Radar Report read as follows:

“Perhaps there’s a new gold bull market unbeknownst to me, but generally the kind of optimism expressed by the headlines below is seen towards highs, not new bull markets.

“Ride the Gold Rally” – Barron’s

“Why Gold is Back in Vogue” – Yahoo Breakout

“Why Gold Appears Cheap and May Just be Entering a Bull Market” – MarketWatch

“How the Big Money is Betting on Gold Now” – CNBC

“Gold Losing Stigma for UBS, 2014 Forecast Increased” – Bloomberg”

Sentiment doesn’t always work as an exact timing tool, but at this point it suggests that gold prices, the SPDR Gold Shares and iShares Gold Trust are closer to a high than a low.

Technical Analysis

In situations like this, the message of sentiment analysis can be greatly enhanced with the results of technical analysis.

Sentiment suggests that we may have to start looking for a top. Technical analysis will help us pinpoint where exactly (in terms of price) to look for a top.

A detailed short-term technical analysis for gold can be found here: Short-term Technical Analysis for Gold

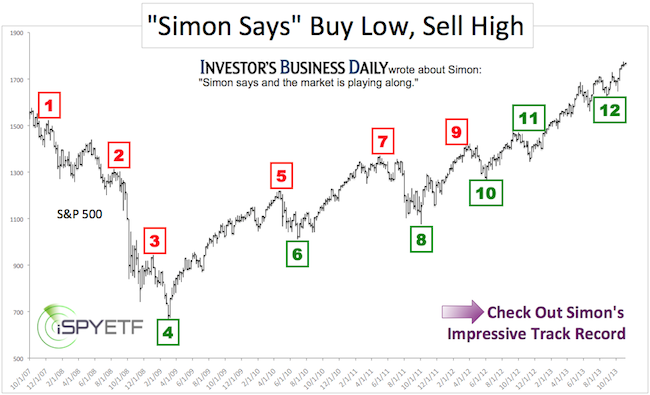

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.