This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 28, 2014.

Changes and comments from surferdude808:

The FDIC released its enforcement action activity through February 2014 today as anticipated. In that month, the FDIC was very busy terminating enforcement actions. For the week, there were 14 removals that leave the list at 538 institutions with assets of $174.3 billion. A year ago, the list held 791 institutions with assets of $290.0 billion. During March 2014, the list declined by 28 institutions and $8.0 billion in assets after 23 action terminations, four mergers, and one voluntary liquidation.

Removals included 12 action terminations against the following: Florida Bank, Tampa, FL ($536 million); Foundation Bank, Bellevue, WA ($364 million); First Bank of Dalton, Dalton, GA ($188 million); Proficio Bank, Cottonwood Heights, UT ($169 million); Regal Bank & Trust, Owings Mills, MD ($143 million); Bank of George, Las Vegas, NV ($112 million); RiverBank, Spokane, WA ($103 million); Security State Bank, Iron River, WI ($81 million); Bank of Bozeman, Bozeman, MT ($59 million); OmniBank, Bay Springs, MS ($47 million); Key Community Bank, Inver Grove Heights, MN ($42 million); and Cowboy State Bank, Ranchester, WY ($41 million). Hartford Savings Bank, Hartford, WI ($175 million) exited through a voluntary liquidation and Great Northern Bank, Saint Michael, MN ($71 million) through an unassisted merger.

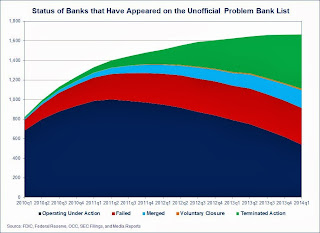

We have updated the Unofficial Problem Bank List transition matrix through the first quarter of 2014. Full details are available in the accompanying table and a visual of the trends may be found in accompanying chart. Since the Unofficial Problem Bank List appeared in August 2009, 1,665 institutions have graced the list with only 32.3% or 538 remaining on the list. Removals total 1,127 with 555 coming through action termination. Another 375 have failed, 183 found a merger partner, and 14 exited through a voluntary liquidation. In the first quarter of 2014, action terminations accelerated to their fastest pace as 9.7 percent or 60 of the 595 institutions at the start of the quarter had their action terminated.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 129 | (43,313,416) | |

| Unassisted Merger | 31 | (6,663,407) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 153 | (184,209,338) | |

| Asset Change | (11,291,149) | ||

| Still on List at 3/31/2014 | 72 | 20,252,005 | |

| Additions after 8/7/2009 |

466 | 154,056,606 | |

| End (3/31/2014) | 538 | 174,308,611 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 426 | 187,850,337 | |

| Unassisted Merger | 152 | 70,216,490 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 222 | 110,834,945 | |

| Total | 810 | 371,225,914 | |

| 1Institution not on 8/7/2009 or 3/31/2014 list but appeared on a weekly list. | |||