It is becoming increasingly clear that the Fed’s taper, the slowdown in the central bank’s balance sheet growth (chart below), is unlikely to damage credit expansion in the US.

|

| Fed’s balance sheet (YoY) |

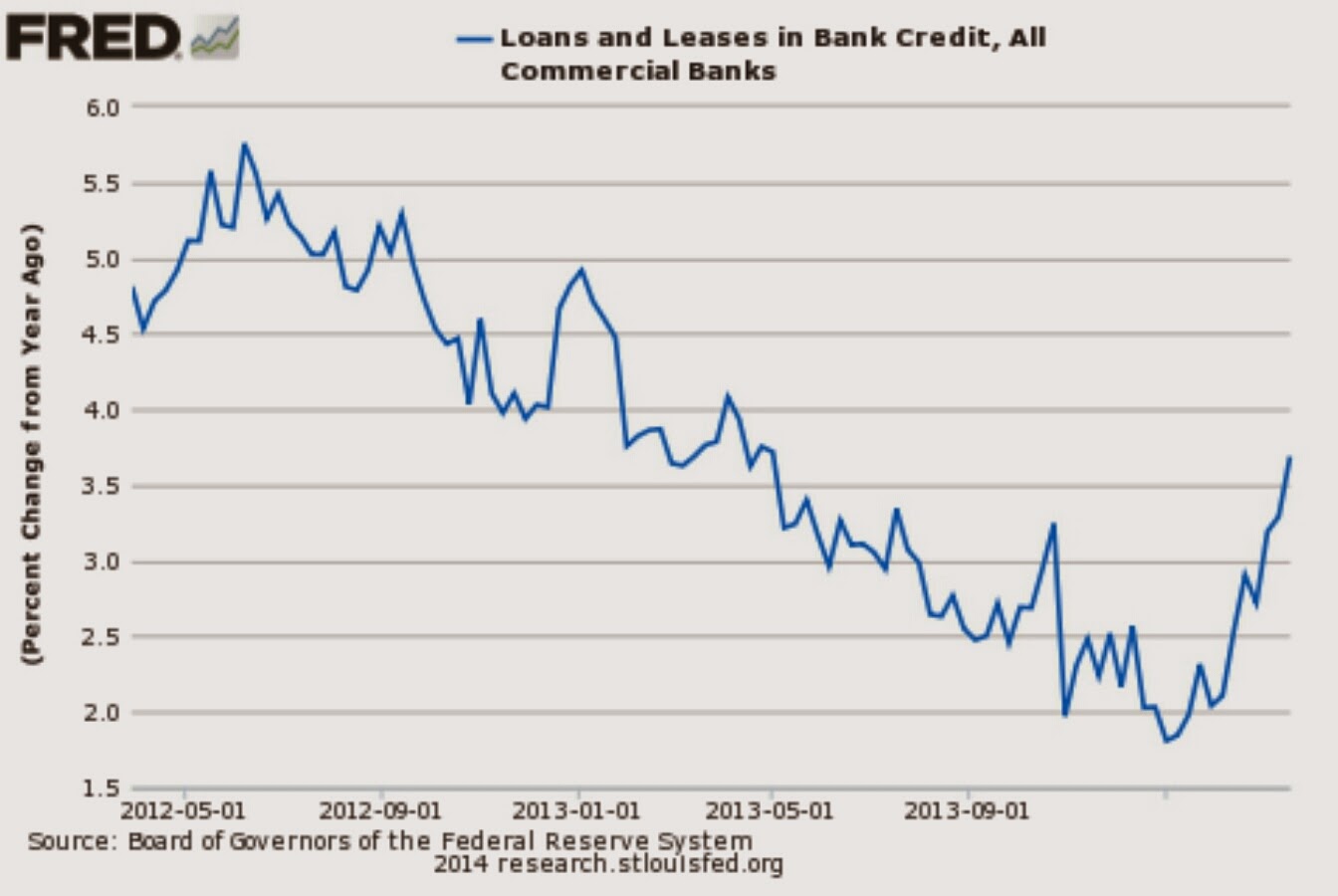

In fact – and many economists find this counterintuitive - the certainty of taper trajectory (which is effectively on autopilot) seems to be stimulating loan growth. The reduction in nearterm uncertainty with respect to the US fiscal impasse (see story on federal budget and on debt ceiling) is likely to be helping the situation as well. Loan growth acceleration in recent weeks has been quite pronounced.

|

| Total loans in the US banking system (YoY) |

This stabilization is in sharp contrast to what is taking place in the Eurozone (see post) and seems to be fairly broad based. Small US banks, where credit growth had slowed materially in the wake of US government shutdown, are now showing improvements in non-cash asset growth, especially corporate loans.

To be sure, much of this sudden recovery has less to do with banks suddenly easing credit and more to do with improving demand, especially in the corporate sector. That’s because banks typically don’t turn on a dime – they loosen credit policies far more gradually as a whole. This trend is more indicative of credit facilities being drawn, particularly for working capital. Having said that, the Fed’s senior credit officer survey does indicate lending standards easing last quarter.

The data on loan growth is supported by high frequency survey results. Last week’s ISI Bank Loan Survey index rose to the highest level since 2008. This is telling us that not only will the US economy withstand the gradual conclusion of QE3, but may actually benefit from the reduced monetary policy uncertainty.

From our sponsor: