Investors may not be aware that there is a VIX volatility index that measures expected volatility (and fear) for the Nasdaq-100. Currently, investors fear a Nasdaq breakdown much more than an S&P 500 breakdown. In fact, fear is at a 5-year extreme.

Here’s an intriguing phenomenon: Since March 14, the S&P 500 VIX (Chicago Options: ^VIX) dropped 19.1%. The Nasdaq-100 VIX (VXN) lost only 4.2% (see first chart).

Since March 19, the S&P 500 VIX is down 4.7%, while the Nasdaq-100 VIX is up 11.5%.

Just like the S&P 500 VIX, the Nasdaq VIX is a measure of expected near-term volatility.

This short-term divergence suggests that investors are more concerned about a possible Nasdaq (Nasdaq: ^IXIC) breakdown than an S&P 500 (NYSEArca: SPY) breakdown.

But is this diverging of expected volatility significant?

To make the divergence between the VIX and VXN easier to visualize I’ve calculated the VXN/VIX ratio.

The VXN/VIX ratio just spiked to 1.26, the highest reading in 2014 and 2013. In fact, 1.26 is a 5 ½-year high.

We haven’t seen too many extremes in the past few weeks, so I wanted to see what effect large VXN/VIX spikes (basically a ‘risk off’ signal) have on the S&P 500 (and Nasdaq).

The conclusion is quite enlightening. A chart plotting the VXN/VIX ratio against the S&P 500 (going all the way back to 2006) along with what it means for stocks going forward was featured in yesterday’s Profit Radar Report.

A more detailed short-term forecast is available here (for free): S&P 500 Short-term Outlook

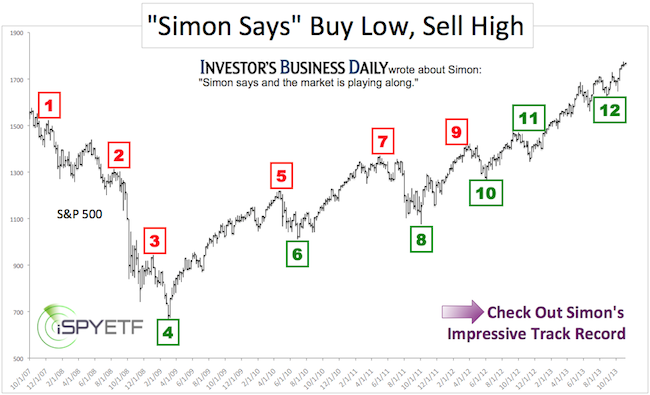

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.