In December 2013 it was tough to find the gold bugs (NYSEARCA:NUGT).

Either they went into hiding or at a minimum they were not nearly as vocal after gold (NYSEARCA:IAU) had fallen 30% on the year. Silver (NYSEARCA:SLV) fared even worse, declining 35%.

But, as we outlined back in the Spring of 2013, gold mania actually peaked in 2011 and has been steadily declining, along with prices, ever since.

Gold’s Bubble Bursting

As part of an analysis of market sentiment history provided to subscribers in March 2013 via the ETF Profit Strategy Newsletter, we examined the gold market and deduced it was in a bubble that was popping. We wrote:

“The peak of pop culture’s obsession with gold (NYSEARCA:GDX) occurred right around the time gold prices peaked at $1900, in late ‘11. We don’t see it as coincidence that Pawn Stars was the second highest rated television show in ’11 just as another popular gold focused television show, Gold Rush: Alaska, was in its inaugural season, right when gold prices topped out.”

The Gold Rush:Alaska show is still being produced, but ratings are now down to under 4.0 million viewers from the top season of 2011-12 when 4.6 million viewers on average tuned in.

Pawn Stars remains near the top of the ratings charts, a potential sign some euphoria still exists for precious metals and other collectibles.

No doubt if gold were to return to $1800/ounce, both of these shows would get significant ratings boosts. But the further metals fall in price, the more likely these shows’ ratings also will fall.

Sentiment Shifts

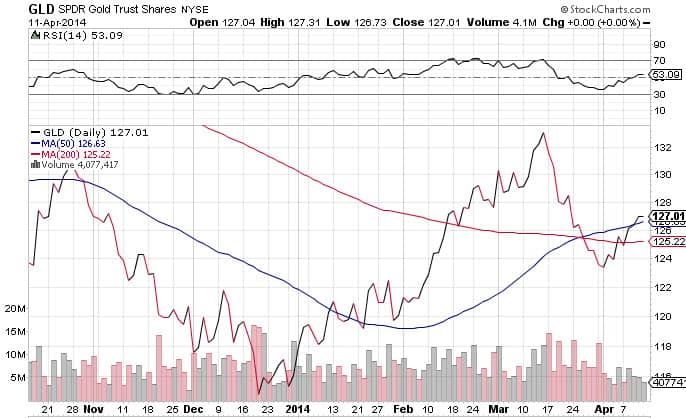

Bullish sentiment can change too, as it did in December 2013, when bearishness towards gold (NYSEARCA:DUST) replaced it by hitting extreme levels. Our article from then focusing on bearish sentiment explains how bulls were nowhere to be found and many former bullish speculators had even turned very bearish on metals. That was one big reason, among others, we went long gold with time stamped trades in our January 2013 newsletter.

My latest investing video shows why bought precious metals (NYSEARCA:AGQ) and gold miners in December, and how it helped us capture some hefty gains.

Combining sentiment with technical analysis has helped us identify multiple high profit opportunities in the metals (NYSEARCA:GDXJ) and another high probability trade is likely ahead.

The ETF Profit Strategy Newsletter and Technical Forecast uses sentiment and technical trends to get our subscribers on the right side of the markets. We publish the Newsletter monthly and the Technical Forecast twice a week.

Follow us on Twitter @ ETFguide