Russia is in deep trouble. Never mind that it’s on the brink of full-blown war with Ukraine. International sanctions were just imposed against 17 companies with close ties to President Vladmir Putin, and even more severe penalties are in the works.

A poll of economists by a large media enterprise* found that Russia faces a 50/50 chance of an economic recession. (*The identity has been purposely withheld in order to prevent the foolish results from this idiotic poll from tarnishing this particular media establishment’s fine reputation.)

AUDIO: 3 Steps for Beating the Retirement Income Shortage (with Ron DeLegge)

Presumably, none of these Big Economic Thinkers watch or follow the Russian stock market – the mother of all leading indicators – close enough to know that Russia is already in a recession. No wonder Paul Samuelson snapped that “economists have accurately predicted 9 out of the past 5 recessions.”

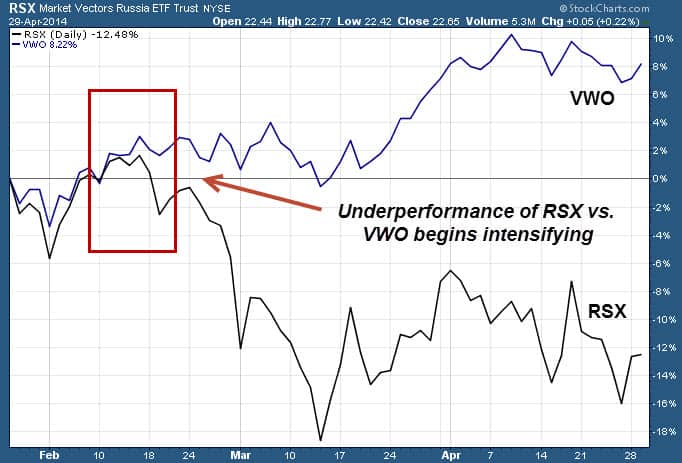

Russian large and mid-cap stocks (NYSEARCA:RSX) have fallen roughly 60% since hitting their 2008 spring high, while Russian small-caps (NYSEARCA:RSXJ) have been crushed around 80% since their 2007 peak. The chart below illustrates how the sub-par performance in Russian equities has intensified versus broader equity emerging markets (NYSEARCA:VWO) since mid-February.

As I understand it, the massive decline in Russian stocks (MCX:GAZP.ME) is too difficult for bargain hunters to pass up. They enjoy reminiscing about how wonderful things worked out when they placed back-tested buy orders on other assets that crashed 60% or more in value like gold in 2000 and Nasdaq stocks in 2002. Fanciful comparisons aside, Russian stocks are hardly the same demon.

But didn’t the great Baron Rothschild of the ultra-rich banking dynasty say the best time to invest in anything is “when there’s blood in the streets”? Had you followed Baron’s sage advice and abruptly purchased Japanese stocks in the early 1990s when there was “blood in the street” you’d be worse off today because Japanese stocks have kept falling. By now, that “blood in the streets” would be yours.

If Baron was alive today, what would he say about Russian stocks? He would’ve probably clarified his investing opinion to state that it’s only wise to “buy when there’s blood in the streets” after you’ve completely removed the blindfold from your eyes that’s blocking your view.

Lamentably, Russia cannot live on oil exports (NYSEARCA:OIL) alone and the vital capital that it requires is leaving fast. During the first three-months of this year, $50.4 billion left the house versus $63 billion for all of 2013. Not a bad pre-game warm up for more financial ugliness ahead.

Will Russian stocks (NYSEARCA:ERUS) ever recover? Why of course they will! And that’s the good news. But the bad news is not until they first get worse.

The ETF Profit Strategy Newsletter uses technical and fundamental analysis along with market history and common sense to keep investors on the right side of the market. We cover Russian stocks along with other major asset classes like bonds, gold, and currencies. In 2013, 70% of our weekly ETF picks were winners.

Follow us on Twittter @ ETFguide