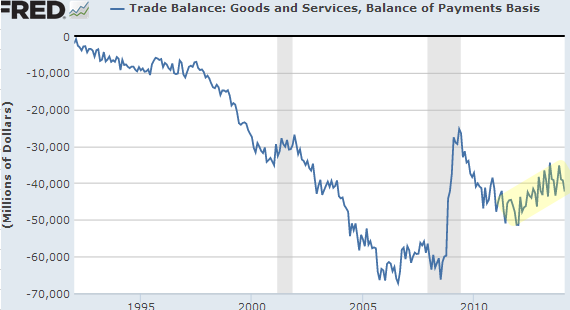

We’ve received a number of questions on the trajectory of US trade balance going forward. It seems that since 2011, US trade deficit has stabilized and has been improving.

The projections going forward however are all over the place. The key factor in the recent improvements has been is the reduction in US net energy imports – now the lowest in some 20 years. However, while the gap between energy production and consumption is expected to narrow some more, the US is not expected to become a net exporter of energy.

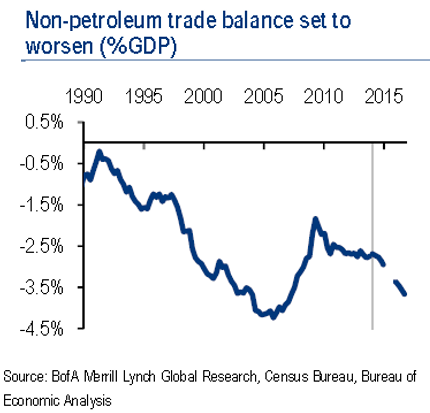

If these projections from the EIA are correct, the impact of lower net energy imports on US trade deficit will diminish over the next few years. That leaves us with the non-energy component of the trade balance, where the recent trends, and more importantly the projections, are not looking great.

|

| Source: Merrill Lynch |

While the recent improvements in US trade deficit are a positive, they are largely driven by lower net energy imports. As the economy improves, growth in imports due to stronger demand will become the dominant trend, resulting in some deterioration in the overall trade balance. This will be exacerbated by the aging population in the US, a shift that is likely to put downward pressure on savings rate relative to consumption, worsening the deficit (Savings – Investment = Exports – Imports). Here is a good overview of the situation from Merrill Lynch:

The pace of decline [in US current account balance] largely mirrors pre-crisis trends, and is motivated by the pickup in growth that strengthens non-petroleum goods import demand. While growth in US trading partners should help to boost exports over the period, stronger domestic import growth is set to dominate.

…

Recent improvements in the current account balance have been encouraging, but in order to be sustainable, trade in non-petroleum goods (a whopping 120% of the overall current account balance in 2013) will need to mirror trade dynamics elsewhere. Given our model results and recent weakness in the sector, we view that as a tall order. Looking further out, an aging population drawing down on pension funds and private nest eggs means further downward pressure on savings relative to consumption. That suggests the current account may struggle to hold on to any gains.

From our sponsor: