While the rest of the world is slowing down and in some cases dropping into actual deflation (see here and here, respectively) the US has, sort of, bucked the trend. Despite a horrendous first quarter in which the economy actually shrank, economists seemed content to blame the weather and simply push February’s lost growth into the current quarter. Goldman Sachs, ever the positive influence, now expects fairly robust 3% growth to be reported a couple of months hence.

But maybe not. The latest retail sales number came it at a positively European 0.1%, and since 70% of the US economy is derived from consumers buying (mostly, alas, unnecessary and useless) stuff, well, that’s not mathematically a good thing if your target is 3%. Here’s more detail from Wall Street Cheat Sheet:

U.S. Economy Enters Second Quarter With This Bad News

“Retail sales were very weak,” Cantor Fitzgerald interest rate strategist Justin Lederer told Bloomberg after the U.S. Department of Commerce released April’s figures. “It’s not a good start for retail sales for the second quarter.” And if retail sales began the current quarter weak, it is also likely that gross domestic product began the April-through-June period with little momentum, as well. In the first quarter of the year, GDP expanded an anemic 0.1 percent, the worst pace since the end of 2012.

Consumers were big spenders in the first quarter, propping up growth as they have for much of the recovery. But other sectors of the U.S. economy that have buoyed the recovery in recent quarters slumped in the early months of this year, dragging down growth substantially, with much of the hurt brought on by frigid winter weather. That reality left personal consumption expenditures as the single biggest boost to economic output in the first three months of the year.

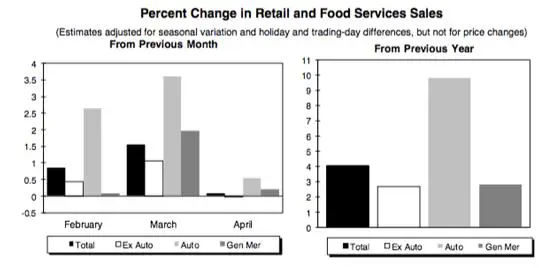

However, consumers spent significantly less at malls and restaurants last month than they did in March, meaning receipts at those retailers were less. Reflecting that reality, retail sales amounted to just $434.6 billion, an increase of 0.1 percent. That growth, which reflects an equally meager pickup in consumer spending, represented a far smaller gain than analysts expected and a far more modest jump than March’s upwardly revised 1.5 percent.

Automobile sales, a nearly perennial driver of consumer spending growth, grew 0.6 percent last month, while sales at clothing stores grew 1.2 percent. However, those gains were nearly wiped away by declines in spending at restaurants, online retailers, and furniture and electronics stores. Excluding the volatile categories of automobiles and gasoline, retail sales fell 0.1 percent in April. As the above spending breakdown suggests, consumers are directing most of their spending dollars to immediate necessities, a pattern that has characterized much of the recovery.

Another part of the deflation-shock story is plunging European interest rates due to speculation that the European Central Bank will react to falling prices by monetizing the debt of basket case borrowers like Spain and Italy. The US, where the Fed has been scaling back its purchases of long term bonds, was supposed to go the other way with modestly rising interest rates a sign of economic vigor. But not this week. From MarketWatch:

10-year Treasury yield plunges to six-month low

NEW YORK (MarketWatch) — Treasury prices rallied Wednesday along with global sovereign bonds, sending the benchmark U.S. yield to a six-month low as investors reacted to low-rate monetary policy signals from the European Central Bank and the Bank of England.

The ECB was said to be preparing measures to combat low inflation, including using negative deposit rates, according to news reports. The Bank of England left its forecasts intact, while signaling that it may be on track to raise its key lending rates next year. The news was largely taken to mean that both central banks would continue to bolster markets with accommodative monetary policies.

On a broader scale, concerns about economic growth prompted the risk-off trade Wednesday, according to Adrian Miller, director of fixed-income strategy at GMP Securities LLC., who called the rally “global in nature.”

“If you continue to get data that questions the market’s expectations that Q2 growth will accelerate, then there is room for downside in yields,” said Miller.

The 10-year note yield sank 7 basis points on the day to 2.550%, the lowest level since the end of October on a closing basis, according to Tradeweb. The yield touched an intraday low of 2.525% on Wednesday.

The 30-year bond yield dropped 7.5 basis points to 3.379%, and the 5-year note yield dropped 5 basis points to 1.569%. Treasurys followed European bond prices higher in Wednesday trade. The 10-year German bund yield fell 4.5 basis points on the day to 1.373%, while the 10-year U.K. gilt yield fell 9.5 basis points to 2.585%. “The break of the 10-year German government bonds under 1.40% is really starting to have a magnetic pull on global rates,” said Goncalves.

Some thoughts

This is not what you’d expect for a global economy that’s five years into a recovery — at least as reported by government statisticians — and where the most important central bank is abandoning its downward manipulation of long-term interest rates. Basic economic theory and common sense both point towards rising rates, assuming that 1) the reported growth of the past few years was real, and 2) Fed tapering is honest and not just a shell game in which buying by Belgium of all places is secretly picking up the slack.

On the other hand, with debt rising pretty much everywhere, the economic headwinds are blowing harder each year and making sustained growth less rather than more attainable. Escape velocity, in other words, cannot be achieved if your rocket fuel is simply more debt.

So let’s say that US Q1 GDP is revised down to -0.5% and Q2 isn’t much better. The US would be back in recession or very close to it, Washington’s deficit would start growing again and the rest of the world’s problems (China’s credit crunch, Europe’s descent into deflation, Japan’s monetary death spiral) would look a lot more threatening than they do now. Wonder how the US will respond…