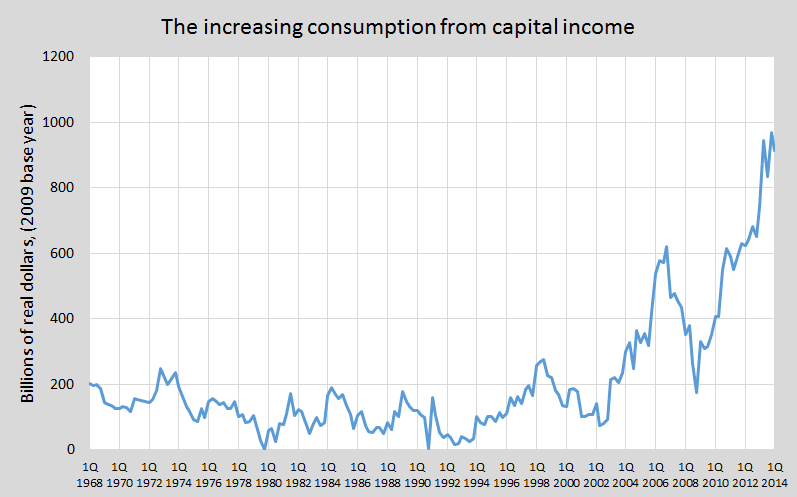

As the stock market moves sideways and house prices slow their march upward, 2014 is shaping up to be a less profitable year than 2013 for those with capital income. We saw consumption from capital income increase greatly over the last couple of years, but this year I expect it to stop rising and even decline.

Today we see that personal income rose, but spending went down in April.

“Personal income increased $43.7 billion, or 0.3 percent, and disposable personal income (DPI) increased $44.6 billion, or 0.3 percent, in April, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $8.1 billion, or 0.1 percent.” (source)

I expect that any spending increase from increased personal income will be offset by declines in consumption spending by capital income. April is showing this effect. Data for the 2nd quarter in general will reveal more whether this trend is growing.

Here is the graph (updated to 1st quarter 2014) of consumption as a percentage of capital income according to calculations using the NIPA accounts.

The percentage of capital income used for consumption rose through 2011 to 2013. Yet, for almost a year, it has peaked at around 22%. With the April numbers of lower Consumption alongside rising Income, I expect the percentage of capital income used for consumption to decline through 2014.

Total real dollar spending of consumption by capital income has peaked too. It is not too much of a stretch to imagine consumption by capital income falling to $800 billion on an annual basis. That is over a $100 billion drop. Real personal labor income would have to rise by more than $100 billion just to maintain consumption spending.

The effect of declining capital income consumption will be too mute the effect of wage inflation to generate price inflation. So will rising personal income with stable price inflation signify more consumer power? Yes… but up to a point.

I can hear you asking… Up to what point?… If capital income gets so weak as to fall too much in its spending, there is an underlying concern of a recession among capitalists. However, if capital income can accept lower returns and be content, then the economy can enjoy a steady-state. The problem is that capital income has little psychological tendency to accept a steady-state that is “mediocre” in their eyes. If they don’t get “adrenaline-motivating” returns, they get nervous, too nervous. Eventually the capitalists create a recession by pushing against a steady-state too much.