With German and French 10 yr yields comfortably below 2%, heading into the balmy summer months of 2014, doing “The Hugh Hendry” or getting long US treasuries as the deflationary vortex grabs hold is your no brainer trade of the summer. You might be able to make 10-50% on a wide array of solar and chinese burrito stocks. You might enjoy the lavish accoutrements that this planet has to offer after a gigantic biotech win. But no trade is as simply and seemingly assured as getting long TLT as July progresses.

Any dip shall be purchased with extreme vigor and perverted intentions.

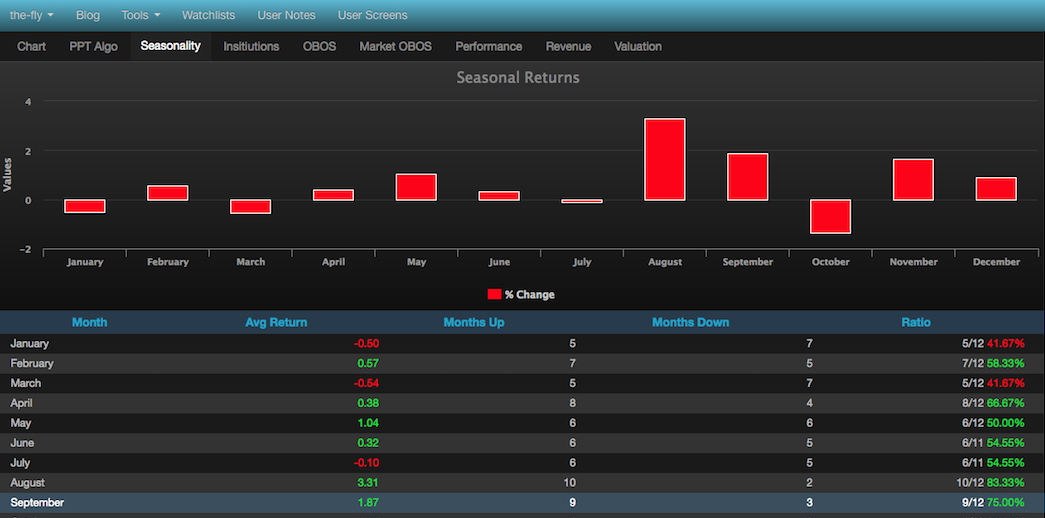

Over the past 12 years, during the month of August, TLT has gone down twice–in 2012 and 2013. In both years, the bond ETF fell a little less than 1.5%, not including the 0.3% it paid out in monthly dividends. I believe this year will be different than the past two. I believe, with every fabric of win in my body, that bonds will continue to go higher because the government cannot afford for yields to go up. Plain and simple.

My strategy will be to enjoy my wins; but steadily divest myself from equities over the next 5 weeks until I am overweight TLT for the month of August.