The BLS released the Metropolitan Area Employment and Unemployment report for May today.

Unemployment rates were lower in May than a year earlier in 357 of the 372 metropolitan areas, higher in 11 areas, and unchanged in 4 areas, the U.S. Bureau of Labor Statistics reported today. Twelve areas had jobless rates of at least 10.0 percent and 93 areas had rates of less than 5.0 percent. …

Yuma, Ariz., and El Centro, Calif., had the highest unemployment rates in May, 26.5 percent and 21.1 percent, respectively. Bismarck, N.D., had the lowest unemployment rate, 2.2 percent.

It is interesting to look at a few areas I’ve been tracking. As an example, the unemployment rate in Sacramento has fallen from a high of 12.9% to 6.7% in May. No wonder housing has improved!

And another area I’ve been tracking is the Inland Empire in California. Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. The good news is the Inland Empire is now recovering.

Click on graph for larger image.

Click on graph for larger image.

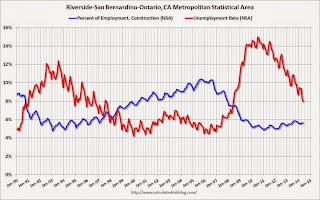

This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate is falling, but still high at 8.0% (down from 15.0% in 2010). And construction employment is still low, but starting to increase.

Obviously the outlook for the Inland Empire is much better today.

Wednesday:

• Early, Reis Q2 2014 Apartment Survey of rents and vacancy rates.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in June, up from 180,000 in May.

• At 10:00 AM, Manufacturers’ Shipments, Inventories and Orders (Factory Orders) for May. The consensus is for a 0.3% decrease in May orders.

• At 11:00 AM, Speech by Fed Chair Janet Yellen, Financial Stability, At the Inaugural Michel Camdessus Central Banking Lecture at the International Monetary Fund, Washington, D.C.