When British Prime Minister, Winston Churchill, was informed that Italy joined the side of the Germans in the Second World War, he infamously replied, “Well, that’s only fair. They were our allies in the First World War.”

Many investment strategists are similarly vexed today, trying to decide what to do about the home of the Roman Empire. Over the past 12 months, the Italy iShares ETF (EWI) has added a blistering 57%, beating the Dow, the S&P 500, and yes, even the shares of much worshipped Apple (AAPL).

The land of Cicero, Seneca, and Julius Caesar has produced one of the world’s best performing stock markets. The problem is: Now What?

That question becomes particularly urgent when one examines the recent price action of the Italian stock market, which is showing a distressing topping action.

Has the world suddenly fallen in love with pasta, Parmesan and polenta to deliver such performance? The answer is a little more complicated than that.

First and foremost, you can thank plunging Italian interest rates. Since the bad old days at the end of 2010, the yield on ten-year Italian government bonds has cratered, falling from 7.2% to 2.7%. Cheaper money brings lower costs and larger profits for companies south of the Alps.

It also encourages investors to borrow money to buy assets, pushing prices northward. This is all great news for the stock market. Flip the chart of the Italian bond market for the past four years upside down, and you get a chart of the Italian stock market.

Another positive development has been the long awaited departure of bad boy prime minister, Silvio Berlusconi. Voters grew weary of the media magnate’s tawdry personal behavior, relations with underage prostitutes and criminal tax convictions.

The “bunga bunga” room, which I drove past on the island of Sardinia a few weeks ago, is no more. In fact, Berlusconi’s palatial estate there is now on the market for a staggering $630 million. Whatever happened to humility? The new, more responsible government has inspired investors to pour even more Euro’s into Italian shares.

Just looking at the numbers, Italy is not a country where you would rush to pour your entire life savings into. The Economist magazine expects Italy to generate a microscopic 0.2% in economic growth in 2014. Inflation is at zero. Yet the headline unemployment rate is at a monstrous 8.6% and the real figure is probably much higher.

Europe’s third largest economy disturbingly has a smaller GDP, or gross domestic product, per person than it did in 1999. Its national debt exceeds a staggering $134 billion and is almost in as much trouble as nearly bankrupt Greece.

These numbers are hardly a ringing endorsement for investment.

Italy suffers from two gigantic structural problems.

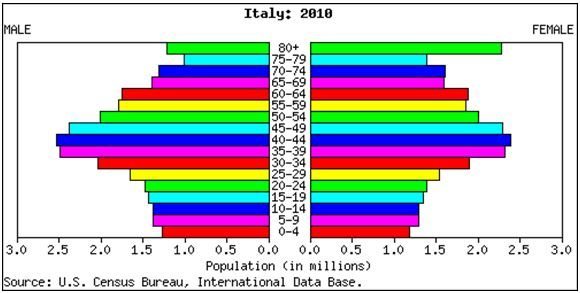

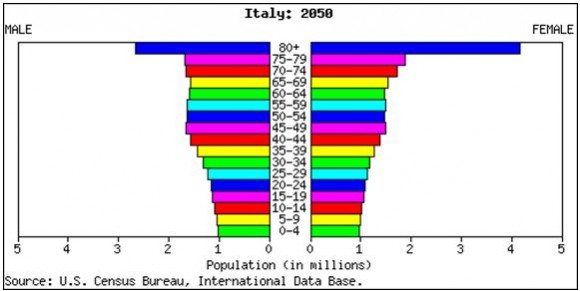

One is that they’re just not making Italians anymore. Each Italian couple is producing only 0.9 children between them. That compares to 1.9 in the US and a replacement rate of 2.1. This means the country is suffering from a demographic implosion of Biblical proportions.

The population pyramids are going from bad to worse (see below). This predicts that a shrinking young population will have to support an ever growing number of old age pensioners. Countries with these characteristics have historically suffered from weak economies, falling currencies, burgeoning debt, and are usually terrible investments.

The second is the structural problem that has plagued the European Monetary System since its inception. Before the Euro was invented in 1999, a country with a weak economy, like Italy, could simply devalue its way to prosperity. It could also borrow and spend heavily to reflate the economy, with few consequences.

A lower currency means that its products become cheaper and more competitive in the international marketplace. Italy did exactly that, taking the Lira down from 600 to the dollar when I first visited there in the 1960’s, to 1,800 just prior to its entry to the European currency block. That effectively dropped the cost of anything you bought in Italy by two thirds, which is great for business.

Since then, all of Europe has shared a common currency, the Euro. That means that Italy now shares a currency with Germany, perennially the strongest economy on the continent. The Germans are only interested in pursuing policies that suit a healthy economy. That means no borrowing and keeping a lid on inflation as a top priority.

The devaluation, borrowing and spending tools have thus been thrown out of the Italian monetary toolbox. So while business is weak, there is not much anyone can do about it. Greece, Spain, and Portugal all face the same dilemma.

The solution to these structural problems would be for Europe to more closely mimic America by creating a true United States of Europe. An empowered and centralized Ministry of Finance would coordinate all continent wide borrowing and spending. The European Central Bank would be given vastly expanded Federal Reserve type powers.

The new agency would issue a single pan European bond, much like the Treasury bonds in the US. As a result, Germany would have to pay slightly higher interests in this brave new world. But the weaker countries would pay much lower interest rates, as the risks for such borrowing would be spread among the Community’s 28 members, thus boosting their economies.

The problem is that such ground-breaking reforms would require a far greater level of trust and cooperation than the Europeans have managed until now. It has been 15 years since that last important structural change in Europe. It could take an additional 15 years before we see another big one.

Until then, Italy twists slowly in the wind.

That is, not if the new Italian Prime Minister, Matteo Renzi, has anything to say about it. The mildly socialist Democratic Party’s standard bearer has behaved much like a bull in a china shop, proposing desperately needed changes for the economy as fast as his overworked printer can print them. His goal is to bring Italy into the 21st century, kicking and screaming all the way, and end a half-century of economic torpor.

The 39 year old former mayor of Florence is now the youngest prime minister in history. He is next in line to become the president of the entire European Community. German Chancellor, Angela Merkel refers to him as the “Matador.”

Renzi has already implemented important tax reform, cutting the monthly bill for low waged workers by $110 a month. Deregulation is in the air, and Renzi has promised to take the scalpel to the country’s notoriously bloated bureaucracy.

It costs an eye popping $150,000 in fees and licenses to open a restaurant in central Rome. That’s why your eggplant Parmesan is so expensive these days. When I first came to the Eternal City 46 years ago, I lived on $2 a day. Now, I can barely scrape by on $2,000. (My tastes have gotten more expensive).

Renzi plans to privatize many government entities, modernize an arthritic legal system, and bring institutional corruption to an end.

It all reminds me of when Margaret Thatcher was elected PM in 1979 and proceeded to read the riot act to her people for a decade. The London stock market skyrocketed as a result.

If Renzi is successful, the bull market in Italian stocks is not ending; it is just taking a breather before another leg up.

The easiest way to participate is through the iShares Italy ETF (EWI). You could also take rifle shots at single companies, based around your favorite sector call.

Fiat (FIATY) is prospering from the new renaissance in the US car market, where miracle worker, Sergio Marchionne, has engineered a spectacular turnaround at its Chrysler subsidiary.

ENI (E) is a play on the global energy boom. Telecom Italia Media is your classic big cap communications play. Luxottica Group (LUX) is the world’s largest maker of eyeglass frames and gives you participation in a global consumer spending rebound. ST Microelectronics is headquartered in Switzerland, but has the bulk of its operations in Italy, and is a favored technology bet.

If you do decide to participate in the delights of the Italian stock market, don’t forget to hedge out your currency risk, as the Euro is expected to remain weak against the US dollar for years. Eventual 1:1 parity is not out of the question. You can do this through selling short the Euro (FXE) against your Italian holdings, or via buying the short Euro 2X leveraged ETF (EUO).

Or you can let someone else do all the work for you. The Wisdom Tree Europe Hedged Equity ETF (HEDJ) buys a basket of European stocks, and hedges out the currency risk. It has been a favorite of hedge fund managers for the past year.

As for me, it’s arrivaderci for now. The spaghetti carbonara beckons!

Italian Ten Year Government Bond Yields

Italian Ten Year Government Bond Yields

It’s All About Renzi

It’s All About Renzi