Savers in sterling, whether the UK remains as is or fractures, are at risk of a weaker currency environment. Diversification of a percentage of one’s savings out of pounds and into gold will act as a hedge against currency volatility and act as a store of value in an environment of depreciating paper currencies.

Gold in GBP – 1 Year (Thomson Reuters)

Scotland Independence Risk Sees British Pound Dive

Sterling fell sharply yesterday as traders became nervous of a possible vote for Scottish independence. The referendum on Scottish independence from the United Kingdom takes place on Thursday 18th September.

While the referendum and the potential impact of an independent Scotland have been on the horizon for some time, the approaching vote in two weeks is causing upheaval for the British pound in currency markets, and also more general macro uncertainty in the regional economic and monetary system.

Sterling fell sharply yesterday after an opinion poll on the referendum question signalled that the pro-independence vote has caught up significantly with the pro-union vote. Further confusion was also added yesterday on what exactly Scotland will use as its currency if the independence vote goes through.

Gold in GBP – 1 Year (Thomson Reuters)

In answer to the question ‘Should Scotland be an Independent Country?’, the YouGov poll of Scottish voters yesterday showed that 53% of the respondents are against independence and 47% for. These results are significantly different from a similar poll in early August which showed 61% against and 39% for.

With the gap narrowing now to only 6 points, a swing of more than 3 points, would, according to the poll, signal that the referendum may go the way of the pro-independence voters.

The pro-independence movement wants to continue to use the pound sterling in the event of independence as it would benefit intra-UK trade and economic stability. Ideally this would be as part of an official currency union with the rest of the UK.

However, the three main parties in the Westminster parliament in London, the Conservatives, the Liberal Democrats and Labour, are firmly against this currency union proposal since essentially they are actively against Scottish independence, and will not support such a plan.

Beyond a formal currency union, the next best method to keep using the pound sterling is for Scotland to use Sterling informally, which has become known as ‘Sterlingisation’. This would be similar to the way that some countries use the US Dollar as their currency, for example, Panama.

In the UK banknote system, in addition to Bank of England banknote currency, some commercial banks are legally allowed to print their own banknotes.

This explains why three Scottish banks, the Royal Bank of Scotland, the Bank of Scotland, and Clydesdale Bank, currently have their banknotes in circulation. Ironically, these Scottish banknotes are printed by De la Rue, the banknote specialist, in Hampshire in England. This is not surprising however since De la Rue prints banknotes for many central banks around the world.

Interestingly, since Scotland does not have its own currency coin mint, the question arises as to whether Scotland would continue to use the Royal Mint in Wales for future Scottish coin issues, and whether it would seek to issues its own gold bullion coins, such as a Sovereign or a Britannia, in an independent Scotland.

There is nothing illegal about the informal use of Sterling in this way, but this informal plan is complicated by the fact that the pro-independence alliance also plans to re-join the European Union after independence, and this roadmap was also thrown into disarray yesterday.

Olli Rehn, currently one of the vice-presidents of the European parliament, said yesterday in a letter to HM Treasury that Scotland could not apply for EU membership while informally using the pound sterling because it doesn’t have its own monetary authority and would not have the necessary monetary instruments to prepare for entry to EMU.

Note that Scotland does not have its own central bank, and the Bank of England would not act as a central bank for another country that was preparing to enter the Eurozone.

The letter from Rehn was in response to a query from Danny Alexander, the Chief Secretary to the Treasury, who is himself Scottish. The Chief Secretary to the Treasury (HM Treasury) is the second most important official in the Treasury after George Osborne, the Chancellor of the Exchequer.

Olli Rehn was European Commissioner for Economic and Monetary Affairs and the Euro from 2010 to 2014, so his opinion is being taken seriously by the currency markets, adding further uncertainty to the situation in the run up to the referendum.

Danny Alexander said that if Scotland votes for independence then it will either have to join the Eurozone if it wants to join the EU, or else establish its own currency.

There are also the unresolved questions of how the current UK sovereign debt would be treated if Scotland walks away. The technical solution would be to apportion the debt in some way but there have been threats by the pro-independence political parties that they might renege on the national debt if Westminster doesn’t agree to a currency union. This is viewed as more of a threat than anything else.

The bigger question is how the UK’s North Sea oil wealth would be apportioned in the event of independence and this question is one of the the most critical issues for the main UK political parties, although they are downplaying it.

Since the North Sea still has immense oil reserves, and therefore huge potential oil revenues, the way a future demarcation of marine oil boundaries would be redrawn is crucial.

The question of the UK’s gold reserves has also not been discussed. The UK now has 310 tonnes of gold in its official reserves, following the disastrous auctioning off of nearly 400 tonnes of gold at fire sale prices between 1999 and 2002 under the stewardship of the then Chancellor Gordon Brown, another Scottish man. These auctions would become known as the ‘Brown Bottom’.

The Bank of England holds the UK gold on behalf of HM Treasury in an account called the Exchange Equalisation Account (EEA). The EEA holds the Treasury’s gold, foreign exchange reserves, and other instruments such as IMF SDRs.

Since the whole point of the EEA is to help stabilise Sterling, there is little doubt that HM Treasury would not allow Scotland to apportion the gold reserves and walk away with some gold.

Therefore an independent Scotland would walk away with no gold, although it could buy more gold with its oil revenues. This could create a surprising demand source for gold on the world gold market.

The pro-independence parties have proposed that they would set up a short term stabilisation fund for an independent Scotland and its currency, as well as a long term savings fund modelled on the Norwegian state savings funds which are funded primarily by oil revenues.

Thus, a future Scottish sovereign wealth fund or similar could easily purchase some gold reserves as part of its asset allocation. Scotland may also need gold reserves if it joined the Eurozone, since every other major economy that joined the Euro has contributed some of its gold reserves to the European Central Bank.

With continued sterling volatility and uncertainty about future Scottish currency over the next two weeks and possibly for the foreseeable future if the pro-independence vote wins, the Scottish independence question is a major macroeconomic and monetary risk to the UK and its trading partners.

Savers in sterling, whether the UK remains as is or fractures, are at risk of a weaker currency environment. Diversification of a percentage of one’s savings out of pounds and into gold will act as a hedge against currency volatility and act as a store of value in an environment of depreciating paper currencies.

MARKET UPDATE

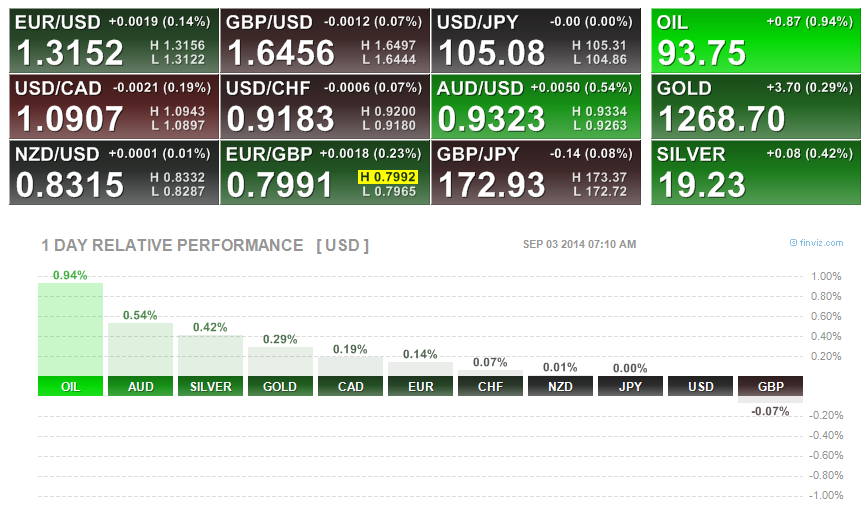

Today’s AM fix was USD 1,268.50, EUR 965.67 and GBP 769.39 per ounce.

Yesterday’s AM fix was USD 1,277.75, EUR 974.42 and GBP 773.27 per ounce.

Gold fell $22.10 or 1.72% to $1,265.20 per ounce and silver slipped $0.32 or 1.64% to $19.16 per ounce yesterday.

The gold price rose overnight in Asian trading and tried to consolidate near $1,270. In Singapore, gold finished higher at $1,268.10 after turning around above the June low of $1,262.40.

Gold fell sharply yesterday but is trading at $1265.70 in London this morning, unchanged from yesterday’s New York close. Yesterday’s fall of 1.7% was the biggest one day decline in the gold price since mid-July. Technical support for gold lies at $1,265/oz.

Gold and silver struggled after the US dollar strengthened near a 14 month high due to stronger than expected US manufacturing data. The European Central Bank (ECB) meets tomorrow to discuss a potential further easing in monetary policy measures to counter deflationary threats.

The ECB discussions, the ongoing geopolitical tensions in the Ukraine, and the uncertainty for sterling over the Scottish independence vote are currently acting as a counterbalance to the strength of the US dollar and should support gold.

Receive our award winning research here