Whenever we begin a journey, the excitement of getting started frequently overtakes us. We begin with unrealistic expectations and end disappointed. The investing experience of many people follows this unfortunate pattern. If you’re in this situation, there’s hope.

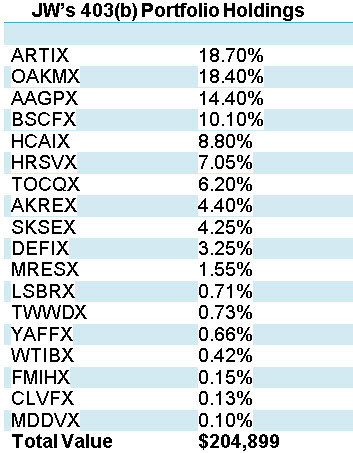

Before I do a Portfolio Report Card for J.W. in Nashville, TN, here’s some background on him: He’s 48 years old, he’s married, and he works in the healthcare field. His 403(b) plan is worth $204,899, it contains 18 mutual funds and he’s saving around $12,500 annually.

J.W. explained to me that one of his greatest fears is not having enough money to retire. Who of us doesn’t identify? His retirement plan has a brokerage window, which gives him access to a wide variety of investments. He’s been choosing the mutual funds within his 403(b) plan with the help of a mutual fund newsletter service and he told me he’s been dissatisfied with the results.

(AUDIO) 10 Blue Chip Stocks You Should Hate

What kind of Portfolio Report Card does J.W.’s retirement plan get? Let’s evaluate his investments in five crucial areas and I’ll assign him a final grade.

Diversification

Satisfactory portfolio diversification is never about how many holdings you have, but rather how well your holdings are distributed across a variety of different asset classes.

It’s good to see that JW’s retirement portfolio has exposure to both domestic (Nasdaq:OAKMX) and international stocks (Nasdaq:ARTIX), bonds (Nasdaq:LSBRX), and real estate (Nasdaq:MRESX). He’s also made an attempt to own small cap (BSCFX) and value stocks (CLVFX).

But his portfolio comes up short on lack of exposure to other key areas like emerging market stocks, commodities, and cash.

Also, none of the 18 mutual funds he owns in the other areas are broad and acceptable proxies for those asset classes. His diversification needs to improve!

Risk

Deliberately overweighting your portfolio in a certain asset class, individual stock, or ETF for strategic reasons is one thing. But when that overweighting happens inside a portfolio by accident or without purpose, it’s problematic.

In J.W.’s case, he has 97.32% of his money in stock funds, 1.55% in real estate securities, and 1.13% in bonds. Is this by design or by accident? Needless to say, J.W has a hyper-aggressive asset mix. This is true even for a 48-year old aggressive investor who, as J.W. told me “needs to make as much money as possible.”

WATCH: Should Your Portfolio be 100% Tactical?

The risk characteristics of a portfolio should always be 100% compatible with not just how we want to invest our money, but our age and life circumstances.

Cost

Nobody can control the direction of interest rates or how the stock market will behave. But what we can control is how much our investment portfolios cost. Simply put, paying less results in more money over the long run in your own pocket.

J.W.’s three largest holdings ARTIX (international stocks), OAKMX (large cap stocks), and AAGPX (large cap value stocks) account for 51.5% of his portfolio and charge annual expenses between 0.93% up to 1.20%. The rest of his portfolio gives little attention to minimizing fund fees. I estimate the total annual cost of his portfolio to be 1.10%.

Tax-Efficiency

The money inside J.W.’s 403(b) plan, like other retirement plans such as 401(k), grows tax-deferred. He has no outstanding loans or premature distributions and I observed no problems in the overall tax liabilities of his plan.

Performance

After deducting J.W.’s annual contribution, his retirement plan grew from $173,000 in Aug. 2013 to $192,399. That’s a one-year return of 11.2% compared to 15.98% gain for blended portfolio of index ETFs matching his asset allocation.

J.W.’s underperformance relative to our yardstick at a time when stocks have performed strongly and for a portfolio that is so heavily concentrated in stocks is unacceptable. He has every right to be disappointed.

Summary

The final Portfolio Report Card grade for J.W.’s 403(b) is “D.” He joked with me that he was going to get a “double F minus.” The good news is that he beat his own depressed expectations. The bad news is he got a “D.”

But even with poorly designed investment plans, I always try to find one positive thing because it’s something a person can build upon. J.W. is a definitely a good saver, he’s got the desire to be smarter investor, and his portfolio’s strongest area is diversification.

Cutting excessive risk, minimizing investment costs, and tweaking his diversification are good places to start. And if J.W. tackles these weaknesses within his retirement plan, I’m confident sustainable and satisfactory performance will follow.

Ron DeLegge is the Founder and Chief Portfolio Strategist at ETFguide. He’s inventor of the Portfolio Report Card which helps people to identify the strengths and weaknesses of their investment account, IRA, and 401(k) plan.