If you think the stock market is a volatile place, you ought to get a load of ETFs that use leverage.

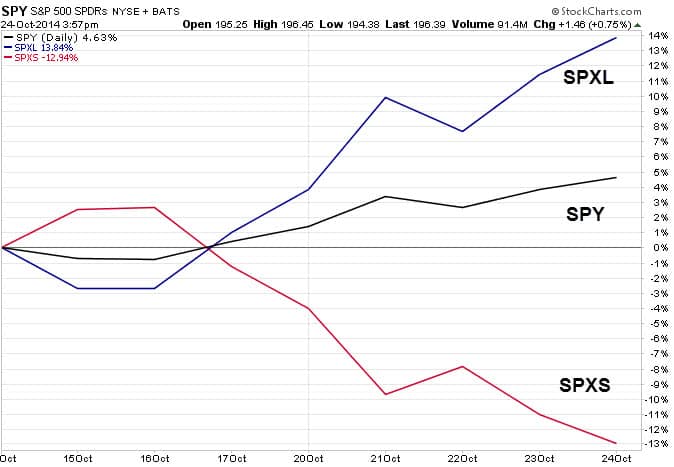

From Oct. 10 to Oct. 15, the Direxion Daily S&P 500 Bull 3x ETF (NYSEARCA:SPXL) collapsed 10.07%. But from Oct. 15 through today, SPXL soared 13.40%. That’s a breathtaking swing of 23.47% from negative to positive gains in just a matter of two weeks!

These types of performance extremes shouldn’t be a shock because leveraged ETFs are designed to do just that: magnify performance. Of course, if you’re on the wrong side of the trade they can also magnify losses.

(Audio) Pass or Fail? Ron does a Portfolio Report Card on a $696,000 Retirement Plan

For example, SPXL is a “bullish fund” and it aims to deliver triple daily performance to the S&P 500 (NYSEARCA:IVV). That means if the S&P 200 is up 1%, SPXL should theoretically be up 3%. On the other hand, if the S&P declines 1%, SPXL will be down 3%.

The chart below plots SPY, SPXL, and SPXS to help you visually understand these not so subtle differences.

SPXS is the “bearish fund” that does the exact opposite of SPXL. In this case, SPXS shoots for triple daily inverse performance to the S&P 500.

Leveraged ETFs are often criticized by people within the financial services industry because 1) they don’t understand the products, 2) they don’t understand how and where leverage belongs in portfolio construction, or 3) they have an anti-leveraged ETF bias.

In my video, “3 Rules for Using Leveraged ETFs,” I talk about the time and place for leverage. Along with this, here are a few more guidelines.

Don’t focus on too many markets

Leveraged ETFs follow a variety of asset classes beyond stocks including bonds (NYSEARCA:TMF), currencies (NYSEARCA:EUO), commodities (NYSEARCA:CMD), real estate (NYSEARCA:DRN), and even volatility (NYSEARCA:SVXY). While it’s nice to have a breadth of choices, simultaneously trading too many markets can become distracting. And distraction often leads to losses.

Leveraged ETFs aren’t long-term investments

If you’re buying a leveraged ETF, understand that you’re making short-term trade, not a long-term investment. Generally, a short-term trade is one that lasts anywhere from one day up to several weeks. If you’re buying a leveraged ETF as a long-term investment, you’re using the tool the wrong way and is comparable to using a screwdriver to do a hammer’s job.

Stick with sharply trending markets

Big performance gains with leveraged ETFs can be had in sharply trending markets. In a bearish market, bear funds that aim for inverse or short performance are likely to excel, whereas in a bull market the bull funds with leverage should be large gainers.

The ETF Profit Strategy Newsletter uses sentiment, history and common sense to keep investors on the right side of the market. All readers get email and text alerts.

Follow us on Twitter @ETFguide