Staying with the theme of the Federal Reserve’s experimentation with new policy tools, the central bank is expected to introduce a term (vs. overnight) reverse repo program (RRP – see overview). This offering will be specifically targeting the year-end (the so-called “turn”of the year). The amount of term reverse repo is expected to be $300bn – effectively doubling the total RRP available.

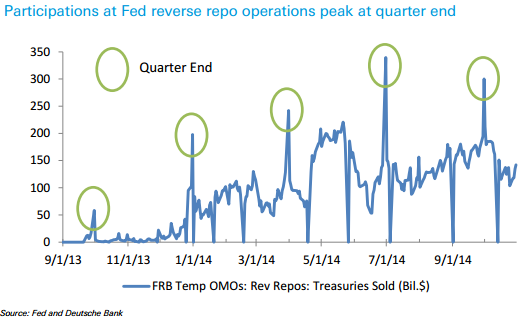

The Fed has been surprised with the degree to which “window dressing” activities’ played a role in money markets (see post). The demand for RRP at quarter-ends (paying 5 basis points on overnight money) has been higher than expected. The Fed ended up capping the overall size of the program to $300bn in order to avoid disrupting the repo markets.

|

| Source: Deutsche Bank (note that the decline between Q2-end and Q3-end has to do with the introduction of $300bn verall cap) |

The point on window dressing was driven home at the end of September, when quarter-end driven demand for quality collateral resulted in over $400bn in RRP bids. The final transaction was executed at zero rate (as opposed to the usual 5bp). Participants were willing to park quarter-end overnight cash with the Fed for free (in fact the low bid was -20bp) in order to maximize riskless assets on their reported financials.

| Source: NY Fed |

This means that the year-end demand is likely to far exceed the $300bn currently made available. In December the Fed will therefore begin offering term reverse repo maturing around January-2. Doubling the availability over the turn will feed the repo markets, temporarily releasing $600bn of treasuries from the Fed’s balance sheet.

_________________________________________________________________________

Sign up for our daily newsletter called the Daily Shot. It’s a quick graphical summary of topics covered here and on Twitter (see overview). Emails are distributed via Freelists.org and are NEVER sold or otherwise shared with anyone.

From our sponsor: