The new jobs numbers provide one more bit of evidence in support of the claims I’ve been making in this blog:

1. Job growth in the first 10 months of 2014 was almost 2.3 million, roughly the amount for the entire 12 months of 2012 or 2013. Thus the total for 2014 will end up being about 400,000 more than the average of the previous two years. That may reflect the expiration of extended unemployment benefits. Ditto for the still sluggish nominal hourly wage growth (stuck at 2.0%.) The household survey (less reliable) shows nearly 2.6 million jobs so far this year.

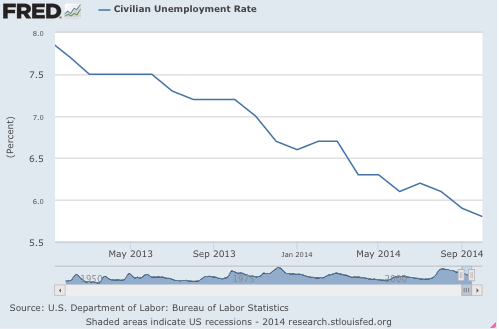

2. I’ve often referred to the fact that since the beginning of 2013 the unemployment rate has been falling at 0.1% per month, and will continue to do so. It did so again in October, down from 5.9% to 5.8%. That means we are only 4 months from the Fed’s definition of “full employment.”

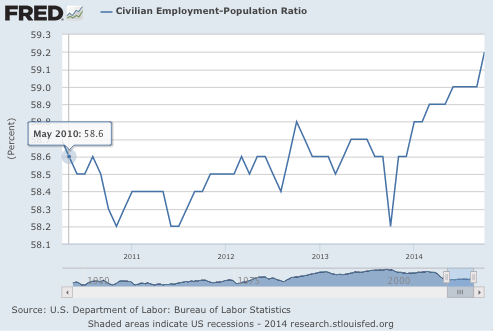

3. Some have pointed to the low employment/population ratio as evidence that we are not recovering. After being stuck in the trading range of 58.2% to 58.8% from October 2009 (when unemployment was 10.0% (exactly 5 years ago)) to February 2014, we finally have a decisive breakout on the upside:

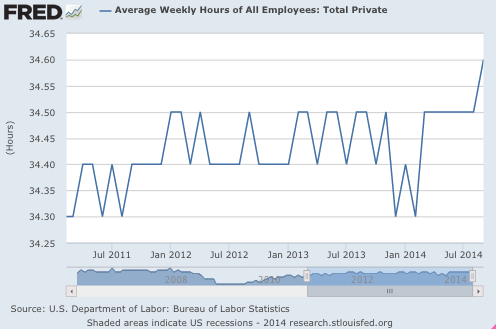

We also have a breakout for average weekly hours, which were stuck in the 34.3 to 34.5 range for years:

New claims for unemployment as a share of the workforce keep hitting all-time lows. Never in all of history did workers have less need to fear layoffs.

No Fed chairman ever had an easier job that Janet Yellen has right now. Normally you want to tighten before nominal wage growth accelerates. But in this case the Fed can wait for nominal hourly wage growth to accelerate from 2.0% to 2.5% before tightening, as the 2.0% figure is too low to hit their inflation target. So the Fed merely needs to wait until wage growth accelerates. No need to read the tea leaves.

(BTW, when I say “tighten,” I mean raise the fed funds target–policy is already tight.)

The last two years disproves several theories:

1. In January 2013 unemployment was still 7.9%, and many conservatives were pessimistic about the prospect for monetary stimulus to lower unemployment. They claimed we had “structural problems.” Now unemployment is 5.8% and still falling fast. We had a demand shortfall—in early 2013 wages hadn’t fully adjusted to the huge plunge in NGDP growth in 2008-09, and slow recovery.

2. Liberals claimed “austerity” in 2013 would slow the recovery. Exactly the opposite happened.

3. Liberals also claimed that ending extended unemployment benefits would not reduce unemployment (which was itself odd, because prior to 2008 liberals did believe that ending extended unemployment benefits would create jobs.) In fact the 2008 liberals were right, job growth accelerated in 2014 without any acceleration in wages. The acceleration was a “supply of labor-side” story. So while the overall recovery since late 2012 is a demand-side story, the acceleration in job growth after the first of the year was a modest supply-side addition to the recovery.

Despite all this good news, we could have done much better with a more expansionary Fed over the past 6 years. There are some “structural problems” in America, but they never had much to do with the near 10% unemployment rate of 2009-10.

PS. Tim Duy has an excellent post demolishing the conservative argument that the Fed is creating growth with “inflation.”

PPS. Here’s the steady fall in unemployment since January 2013. In contrast, from January 2012 to January 2013 unemployment had only fallen from 8.2% to 7.9%, which is why so many people were pessimistic “structuralists” at the time.

PPPS. The employment-population ratio for the all important 25-54 age group also rose, and has regained 2 points of the slightly over 5 points lost during the Great Recession. There’s still some slack out there.

HT: Garrett McDonald