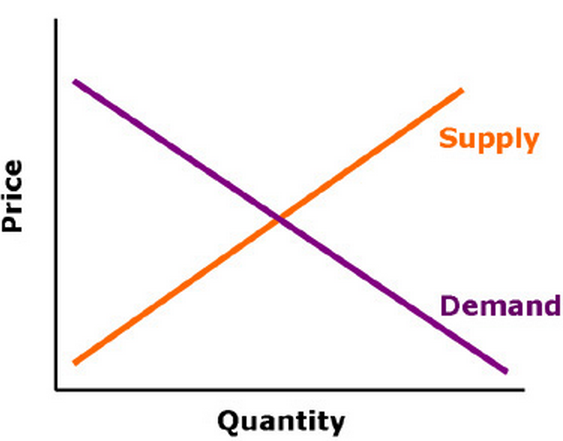

I don’t know how many times I have to keep saying this before the rest of the profession figures it out. Never reason from a price change. It makes no sense to argue whether a higher price will increase or decrease quantity. Here is a S&D diagram. I dare you to show me how price changes affect quantity.

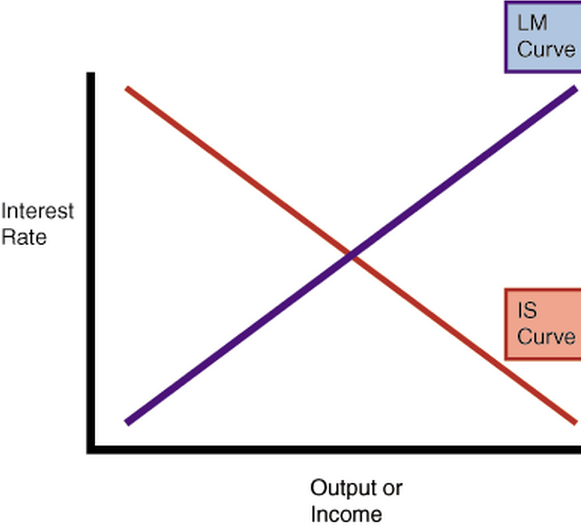

And here is an IS-LM diagram. Interest rates are the price of credit. Changes in interest rates do not have any effect on quantity of output, price of output, or any other variable. It’s not even an “other things equal” deal; price changes have no effect.

At this point some economists will say; “I meant an interest rate change caused by a change in monetary policy.” The problem is that higher interest rates can be produced by both easier and tighter monetary policy. And easier and tighter monetary policy have opposite effects on prices and output. So I’m sorry, but it’s still a meaningless debate. It’s not that there is a right or wrong answer; there is no coherent question. Monetary policy can shift the LM curve, the IS curve, or both.

Consider this analogy: A debate over whether high oil prices increase or decrease global oil consumption. The debate is meaningless. Price has no effect. Here’s how the issue should be discussed:

A. An Arab oil embargo caused higher prices and lower consumption in 1974.

B. Booming Chinese auto sales caused higher oil prices and higher consumption in 2007.

Prices are not a cause of anything; they are an effect. And interest rates are a price. So please stop these silly posts discussing the impact of a change in interest rates. Talk about the effect of expansionary and contractionary monetary policies—that’s an interesting question.

This criticism applies to both sides of the debate. John Cochrane and Noah Smith should not be discussing the possibility that higher rates lead to higher inflation, and Paul Krugman should not be claiming that the standard model suggests that higher rates lead to lower inflation. Actually, both claims are true in specific situations. But without specifying the specific situations in which each claim is true (especially the path of the money supply and IOR) the claims becomes utterly meaningless.

Truly a debate about NOTHING.

PS. If you are still having trouble with this, consider the following. A 1/4% rise in the fed funds rate today can be accompanied by a near infinite number of simultaneous expected changes in the future expected path of variables like the fed funds target, the monetary base, the interest rate on reserves, the reserve requirement, and all sorts of other policy levers. Those variables in turn have a near infinite number of effects on all sorts on market variables other than short term interest rates, including TIPS spreads, commodity prices, forex prices, future expected real estate prices, stock prices, corporate bond risk spreads, etc., etc. And all that happens immediately.

Here’s another example. Assume Japan has run zero percent inflation for 20 years while the US has a credible 2% inflation target. Zero inflation is expected to continue in Japan. Suddenly they depreciate the yen 17% and set up a rigid currency board with the US. PPP tends to hold in the very long run; so long term Japanese inflation expectations immediately rise from 0% to 2%. Interest parity holds even in the short run, so Japanese interest rates immediately rise to US levels. That’s a case where Cochrane is right, and it’s 100% consistent with IS-LM. In contrast, in January 2001 the Fed cuts rates more than expected, and TIPS spreads rise sharply on the news. That’s a case where Krugman was correct, and it’s 100% consistent with IS-LM.

The correct answer is “it depends.”

PPS. Question for Nick Rowe. Does my yen/dollar peg solve the coordination problem you discuss in this post?

HT: TravisV.