I still see confusion about the never reason from a price change concept. So let’s try again, looking to see whether “other things equal” helps.

Most people accept that fact that lower prices caused by less demand means something different from lower prices caused by more supply. But what about lower prices, “other things equal?”

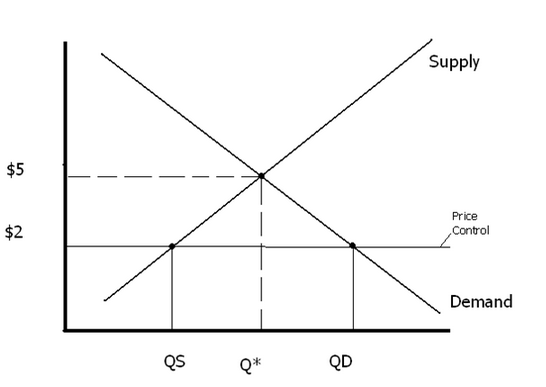

As you can see the quantity demanded exceeds the quantity supplied. In that case the actual quantity bought and sold and consumed equals the quantity supplied, unless demanders put a gun to the head of suppliers. So “other things equal” lower prices will reduce the amount that consumers purchase. If either supply or demand shifts, then other things are not equal. My “never reason from a price change” refers to equilibrium movements, you certainly can reason from a price or wage control set by the government, which moves prices away from equilibrium. But as this case shows, not necessarily in the direction that you might assume.

As you can see the quantity demanded exceeds the quantity supplied. In that case the actual quantity bought and sold and consumed equals the quantity supplied, unless demanders put a gun to the head of suppliers. So “other things equal” lower prices will reduce the amount that consumers purchase. If either supply or demand shifts, then other things are not equal. My “never reason from a price change” refers to equilibrium movements, you certainly can reason from a price or wage control set by the government, which moves prices away from equilibrium. But as this case shows, not necessarily in the direction that you might assume.

When I said price changes have no effect, I should have said “other than to subjective states of mind.” A price change, in and of itself, will change the amounts that people prefer to buy and sell. But a price change doesn’t affect any observable economic variable, unless it is an artificial price change that moves you away from equilibrium.

Ditto for interest rate changes and investment. Many people stubborning refuse to stop thinking in terms of “interest rate change equals interest rate change caused by the Fed,” and even worse, “interest rate change equals interest rate change caused by the liquidity effect of a Fed action.” The latter claim isn’t even close to be true. It’s not even true 20% of the time. But it seems to be what many of my commenters and most economists assume is the case. Here’s a typical comment from my previous post:

If interest rate rises stifle investment . . .

Stop right there; interest rate rises do not stifle investment.

I’m not sure why so many economists are confused on this point. Perhaps they think: “The liquidity effect impacts rates in the short run. The term ‘short run’ means roughly what’s going on right now. And a long time series is just a long series of ‘right nows.’” If that’s not what they are thinking, I’d love to hear alternative theories.

PS. The term “short run” does not in any way mean “what’s going on right now.”