Here are three contrarian picks for die-hard contrarians and those who missed the latest stock market rally. Two trades are true bottom pickers, one trade is 2x contrarian, which almost makes it a mainstream trade.

If contrarian investing came with a label, it might as well be ‘no guts, no glory.’ It takes guts to bet against the crowd, but it can pay off big.

I use sophisticated software and crosscheck with basic media sentiment (headlines) to identify extreme sentiment delights for contrarians. Here are my top three choices:

Gold Anyone?

Gold prices have dropped almost $800 since September 2011, and according to many pros, gold will shed another $300 – $400. Here are a few recent doom and gloom headlines:

- “A final purge to $700? What gold bulls surrender might look like” – Nov. 12

- “Here’s why gold could be headed to $800” – Nov. 12

- “Gold bulls beware: More pain coming” – Nov. 10

If gold is going to drop another few hundred bugs, why would anyone hold on to it? That’s the crux of contrarian investing. In the midst of extreme pessimism, there are not enough sellers left to drive prices much lower.

It appears that gold is at or near this point, often called the ‘puke point’. Gold ETFs like the SPDR Gold Shares (NYSEArca: GLD) and iShares Silver Trust (NYSEArca: IAU) are likely to surprise many to the up side.

Fill up The Car Honey

According to the U.S. Energy Department, low gas prices aren’t going away anytime soon. I don’t recall the Energy Dept predicting a 30% drop a few months ago, but that’s what happened.

According to one ‘pro’ interviewed on CNBC, gas may drop to $30.

Catching a bottom in oil prices is a bit like catching the proverbial falling knife, but simply based on investor/media sentiment, this slippery, oily knife is closer to the kitchen floor (a bottom) than the hand that dropped it (top).

The United States Oil Fund (NYSEArca: USO) and Energy Select Sector SPDRs (NYSEArca: XLE) are two ways to play a bounce.

The Ultimate 2x Contrarian Trade?

Back in May I noticed, and reported on, the unusual amount of bearish media coverage. Russ Koesterich (chief investment strategist at BlackRock), Wilbur Ross (billionaire investor), Carl Icahn (billionaire investor), David Tepper, Marc Faber and Peter Schiff predicted a serious correction or outright market crash.

In the spirit of no guts, no glory, I wrote back then: “Here’s a message for everyone vying to be the next Roubini: A watched pot doesn’t boil and a watched bubble doesn’t burst.”

Some of the recent headlines make we wonder if we’re in for a May/June repeat:

- “Sentiment is ‘off the charts’ bullish” – Nov. 12

- “Don’t get suckered by stock market winning streak” – Nov. 12

- “Marc ‘Dr Doom’ Faber: I will soon be proven right” – Nov. 13

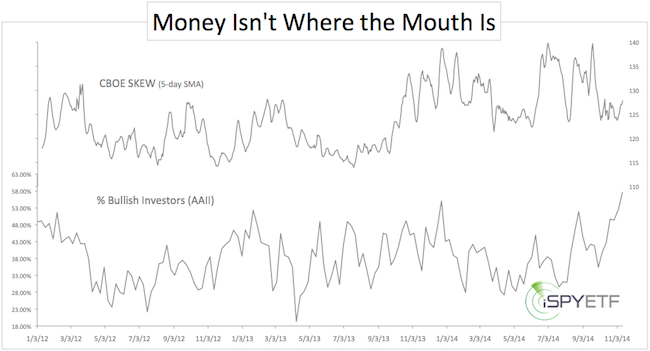

Yes, sentiment polls show excess optimism, but can it still be considered a contrarian indicator if everyone reads about it? Will two negatives make a positive?

Another factor to keep in mind is that actual money flow indicators do not confirm sentiment polls. Investors don’t seem to be putting their money where their mouth is.

Therefore, owning stocks into next year may be more of a true contrarian move than selling stocks. Instead of owning broad market ETFs like the S&P 500 SPDRs (NYSEArca: SPY), I would probably opt for certain sector ETFs that offer more up side.

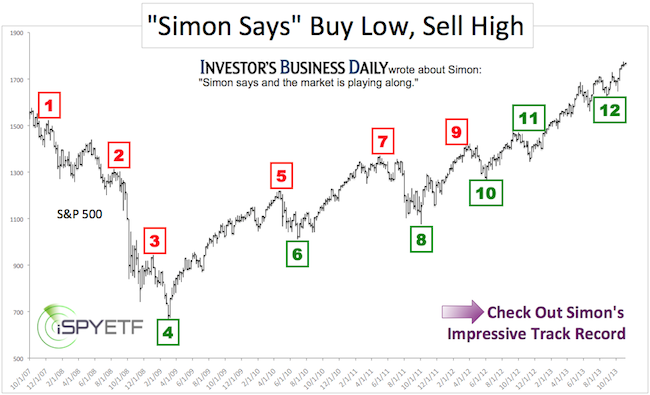

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.