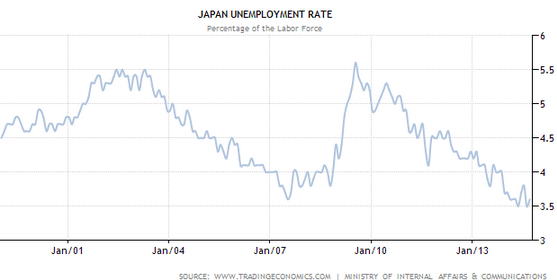

The media says yes. I say if Japan is in recession it’s time to redefine the term. Here is the Japanese unemployment rate over the past few years:

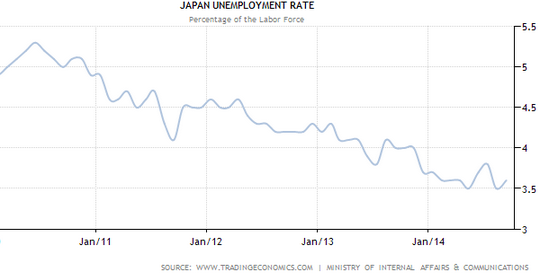

The unemployment rate in Japan is currently 3.6%, one of the lowest figures in decades. It’s true that the Japanese unemployment statistics are a bit peculiar, but so are all their other data. And when they are unquestionably in recession, as during 2008-09, the unemployment rate in Japan rises just as in any other country.

The unemployment rate in Japan is currently 3.6%, one of the lowest figures in decades. It’s true that the Japanese unemployment statistics are a bit peculiar, but so are all their other data. And when they are unquestionably in recession, as during 2008-09, the unemployment rate in Japan rises just as in any other country.

Welcome to the new world of business cycles. Japan is a country with low productivity growth and a working age population that is shrinking by 1.2% per year. The trend rate of RGDP growth is somewhere near zero, perhaps negative. Japan will have lots more “recessions” during the 21st century.

A few months back I very reluctantly supported the sales tax increase, as their debt situation is so scary. That was probably a mistake. For some strange reason I thought that a country engaged in monetary expansionary to try to boost growth, that was also raising sales taxes by 300 basis points, must have been raising the sales taxes for the purpose of reducing the budget deficit. Silly me:

The government approved a 5.5 trillion yen extra budget in December to help the economy weather April’s tax hike. Finance Minister Taro Aso has signaled readiness to boost stimulus and Abe said last week he would consider compiling an extra budget depending on the economy.

(OK, commenter dtoh, you win.) So let me get this straight. You raise the sales tax by 3 percentage points to reduce the budget deficit, and simultaneously raise spending by about 1% of GDP? And the goal of all that activity is what?

In any case, Japanese stocks are still doing well, which suggests that Abenomics is still on track. (But on track to where?) Adverse factors that have a multiyear impact on RGDP lead to higher unemployment. The global recession of 2008-09 is a good example. On the other hand temporary growth pauses don’t raise unemployment—the 2011 tsunami is an example. This looks like a temporary pause, like 2011, as unemployment is not rising. Even so, with zero or negative trend growth in Japan, expect many more negative quarters, many more “recessions.” And that public debt? I have no idea what they plan to do about it.

This line from the Lewis Carroll classic seems relevant, in a reverse sort of way:

“When you say ‘hill’” the Queen interrupted, “I could show you hills, in comparison with which you’d call that a valley.”

BTW, here’s a story that you would not have seen 6 years ago:

Kuroda last month led a divided BOJ board to step up asset purchases, with the aim of delivering 2 percent inflation. [Deutsche Bank’s chief economist for Japan] Matsuoka says there is more the central bank should do to rebuild the economy. He suggests “level targeting,” in which policy makers pledge to keep stimulative monetary policy until the inflation index or nominal GDP resemble what they looked like in the late 1990s.

HT: Stephen Kirchner

PS. This graph shows what the recessions of 2001 and 2008 looked like: