Reader poll: What’s among the most depressed asset classes in the world? If you answered “volatility” you’re right on! The problem for volatility bulls (NYSEARCA:VXX) is we haven’t had a sustained level of stock market volatility. That hardly means a lack of opportunities to profit from short-term volatility exist. The opposite in fact is true.

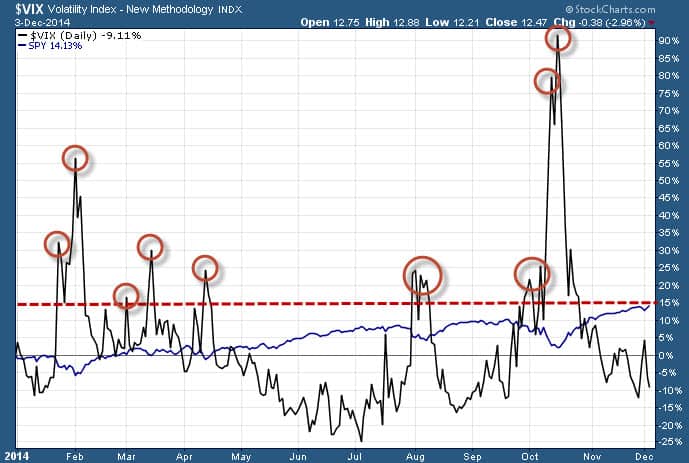

The chart below plots the SPDR S&P 500 ETF (NYSEARCA:SPY) alongside the S&P 500 Volatility Index (ChicagoOptions:^VIX). You’ll notice how the red circles on the chart highlight an important aspect of the volatility dynamic in 2014. As you can see, although the VIX is down around 9% year-to-date, it’s experienced jumps of at least 15% or greater 11 times this year – with one of these moments being an 85% gain from mid-September to mid-October. Were you caught by surprise?

(Video) You Don’t Need to Buy a Farm to Invest in Commodities

Ahead of the 85% autumn surge in VIX, we prepared our readers via our Weekly ETF Picks on Sept. 3 which featured the ProShares Short-Term VIX Futures ETF (NYSEARCA:VIXY) along with a tandem call options trade. Our message was clear: Now is the time to be long volatility! How did it turn out?

On Oct. 21, we exited VIXY at $22.36 for a 20% timestamped profit and we also sold the final leg of our VIXY DEC 2014 19 calls (VIXY141220C00019000) for a 90% blended one-month profit. The only thing that makes us more excited than those types of sizzling returns is the opportunity to do it all over again.

Volatility is a non-core asset class and it is best traded or used as a temporary hedge versus a buy-and-hold approach that is common with other types of assets like stocks (NYSEARCA:DIA), bonds, and real estate.

In summary, we know that while stock market volatility may be quiet right now, but it never goes completely away.

Follow us on Twitter @ ETFguide