If anyone knows fundamental supply/demand forces, seasonal patterns and the potential for curveballs, it’s commercial traders.

Commercial oil traders work with oil in their day-to-day business. It’s the only commodity they deal with. Commercial traders make up about 60 – 75% of the trading volume in futures markets. That’s why they are considered the smart money.

So, is the smart money buying oil?

The chart below plots the price of crude oil against the net futures positions of commercial traders (as reported by the Commitment of Traders report).

Commercial oil traders are almost always net short as futures are used as hedge against falling prices.

Here are the key takeaways:

- The smart money reduced short exposure steadily as oil prices tumbled. In itself, that’s good news.

- However, net short positions fell to an all-time low and are still well below the levels seen at prior oil price trough. That’s not bullish.

- Although oil prices managed to inch higher last week, commercial traders added to their hedges (red circle). That’s bearish.

Technical analysis shows an improving picture for the Energy Select Sector SPDR ETF (NYSEArca: XLE). Click here for detailed XLE analysis.

But oil ETFs like the United States Oil ETF (NYSEArca: USO) and iPath S&P GSCI Crude Oil ETN (NYSEArca: OIL) have yet to catch their footing.

Commercial oil traders are not yet convinced oil has found a lasting bottom. Unless we know something they don’t, it appears too early to buy.

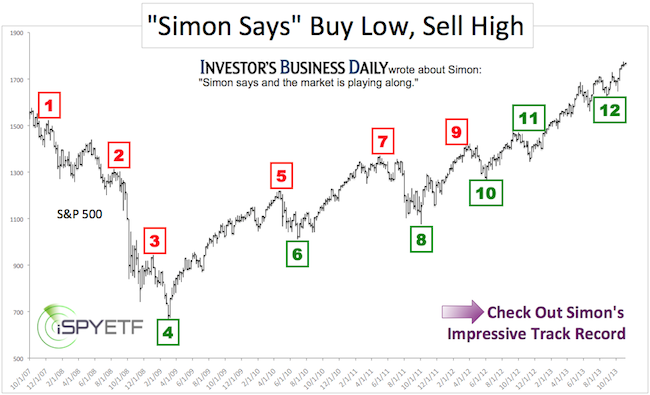

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.