The Financial Select Sector SPDR ETF (NYSEArca: XLF) has been leaping from one new recovery high to the next.

But its Wall Street cousin, the SPDR S&P Bank ETF (NYSEArca: KBE), has been stuck in a 12-month trading range.

The chart below plots KBE against XLF. KBE is back at key resistance around 34.

KBE is at an inflection point. Could KBE become the (sector) tail that wags the (broad market) dog?

The December 21 Profit Radar Report showed two S&P 500 projections (one long-term bullish, one short-term bearish) and stated:

“Stocks may hit an inflection point once the S&P 500 and Russell 2000 record new all-time highs. Depending on measures of market breadth at the time, we will either scale down (or protect) our long exposure or add to it.”

The S&P and R2K did hit new all-time highs and are close to their inflection point.

I’m not sure if KBE will be the tail that wags the dog, but KBE confirms that the market should be watched carefully for either acceleration or temporary breakdown.

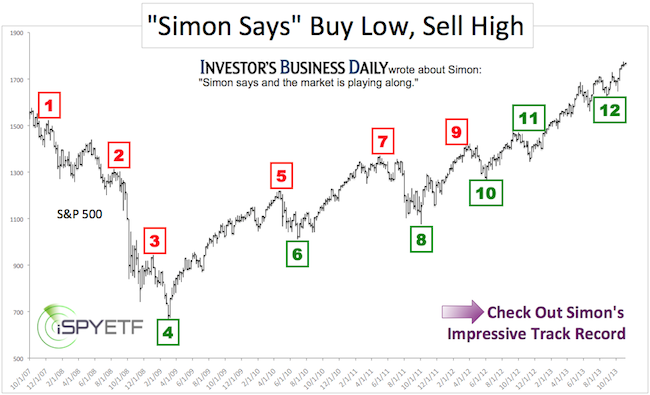

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.