All investment portfolios are comparable to a novel, where each individual chooses their own personal genre and classification. If your investment portfolio was a novel, what genre would it be? Adventure? Comedy? Drama? Mystery? Horror?

My latest Portfolio Report Card is for MD in Temecula, CA and he’s got an adventurous portfolio. He’s also 61-years old, married and semi-retired. He self-manages his $496,000 retirement accounts and he works for a transportation company.

(Audio) Pass or Fail? Ron DeLegge @ ETFguide analyzes and grades a $1.5 Million Investment Account

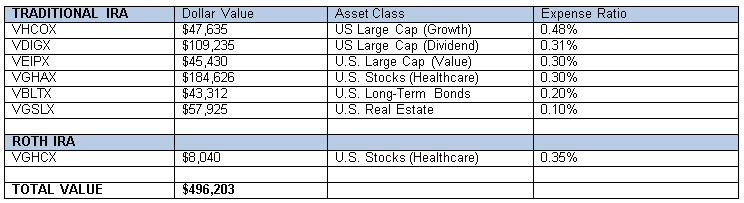

M.D.’s investment portfolio consists of a traditional IRA and Roth IRA. His $496,000 nest egg is spread across seven different Vanguard mutual funds and around $8,000 is invested in his Roth IRA while the rest is in his traditional IRA. He told me “growth is my main goal” and “my money will be used as an income source over the next few years.”

What kind Portfolio Report Card grade does M.D.’s retirement plan get? A, B, C, D, or F? Let’s analyze and grade his investments together in five crucial areas.

Cost

Reducing investment costs should be every prudent investor’s priority. And of course, investment portfolios with excessive trading activity or elevated fund expenses are major red flags. But so are portfolios with hidden 12b-1 fees, loads, and advisory fees that don’t commiserate with the actual advisory work being done.

M.D.’s portfolio consists of seven Vanguard mutual funds with annual expenses between 0.10% and 0.48%. In addition to contained fund expenses he has little trading activity, so his portfolio grades well on cost.

Diversification

Investment portfolios that lack exposure to all the major asset classes including stocks, bonds, commodities, real estate, and cash are not truly diversified. It’s an irrefutable truth.

M.D.’s self-managed retirement accounts have exposure to U.S. stocks (Nasdaq:VHCOX), U.S. bonds (Nasdaq:VBLTX), and U.S. real estate (Nasdaq:VGSLX). That’s good, but he still misses major categories like international and emerging market stocks, international real estate, commodities, and cash. Additionally, his portfolio has overlapping exposure in U.S. large cap dividends (Nasdaq:VDIGX) and large cap value (Nasdaq:VEIPX), which creates unnecessary clutter.

Risk

M.D. describes himself as an aggressive investor, yet his current asset mix of 91% stocks and 9% exposure to bonds is more than that – it’s hyper-aggressive. Almost 40% of his investments are concentrated in healthcare stocks (Nasdaq:VGHAX) alone.

Overall, I estimate that a 20% to 40% stock market (NYSEARCA:SCHB) correction will expose M.D. to potential losses between $90,000 and $180,000. That’s more heat than he can probably handle.

Tax Efficiency

All well-built investment portfolio deliberately minimize the negative impact of taxes. That means smart tax location like putting tax inefficient assets like bonds and REITs into tax-deferred accounts while stock funds can generally be kept in taxable accounts.

M.D.’s retirement plan had no observable problems with tax-efficiency.

Performance

The correct standard of performance aren’t distorted peer groups, which are common in the mutual fund industry, but rather how a person’s portfolio performs relative to a blended mix of passive index ETFs that correspond to the person’s asset allocation.

MD’s one-year performance was a 36% gain compared to a 15.22% gain for a blended benchmark that matches his asset allocation. What was the mains reason for MD’s sizzling returns? The answer is he concentrated almost 40% of his portfolio in healthcare stocks via the Vanguard Healthcare Admiral Shares mutual fund (VGHAX).

The Final Grade

MD’s final Portfolio Report Card is a “B.” His portfolio graded well on minimizing cost, it’s a tax-efficient portfolio, and his performance beat a blended benchmark.

While “B” is a good overall grade, it’s not perfect and MD’s portfolio flunks on diversification and risk. His asset mix of 91% exposure to stocks is hyper-aggressive even for a 61-year old “aggressive” investor. Also, his portfolio completely misses exposure to key asset classes like international and emerging market stocks, global real estate, commodities, and cash.

A 20% to 40% market correction exposes MR’s portfolio to potential very large losses. The good news is this can be alleviated by adjusting his overall asset mix and earmarking a portion of his money toward other non-U.S. equity asset classes.

While M.D.’s current portfolio could be classified as “adventurous” he’s probably reached a point in his life that requires a lot less adventure.

Ron DeLegge is the Founder and Chief Portfolio Strategist at ETFguide. He’s inventor of the Portfolio Report Card which helps people to identify the strengths and weaknesses of their investment account, IRA, and 401(k) plan.

Follow us on Twitter @ ETFguide