I saw an interview of Robert Shiller and Kenneth Rogoff at Davos, where they were asked about the sluggish level of investment in the US. They spoke of a lack of animal spirits, lingering effects of the financial crisis, etc. I wonder if we are underestimating the role of population growth.

For instance, suppose houses lasted forever. In that case a permanent reduction of population growth from 2% to 1%/year would cut housing investment in half. Even in a more realistic model, where a small fraction of houses are demolished each year, housing construction might fall by 20% or 30%.

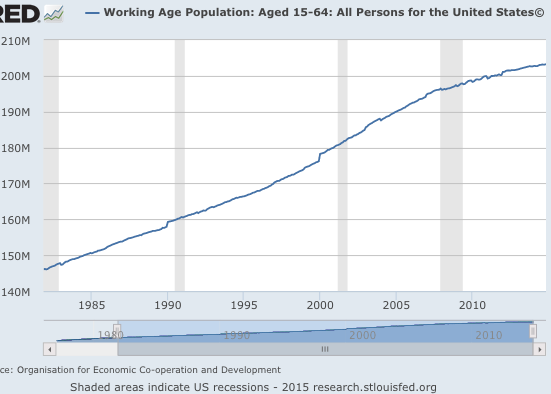

It also seems to me that the working age population might be especially important, as they need workplaces, which are provided via new investment. Here’s a graph of the US population from age 16 through 64:

It looks to me as though working age population growth suddenly slowed down around the onset of the recession. Because the most recent datum is November 2014, I went back seven years to November 2007. The total growth from 2007-14 was 3.63%. For the seven years before that it was 9.61%. For the seven years before that is was 9.15%, and from 1986 to 1993 it was 7.21%.

So in the late 1980s and early 1990s working age population was growing at about 1% per year. Then growth sped up to well over 1% for 14 years. Then when the recession began growth slowed to about 0.5%. That seems significant.

Is it just the recession? We are now seeing unemployment falling sharply, but growth seems to be declining even further, to just 0.31% in the last 12 months, far below the growth rates that America has seen for many generations. And with rising disability rolls, presumably the number of non-disabled working age people is growing even more slowly.

Two theories:

1. Boomer retirements.

2. Less immigration.

I’d guess some of each–does anyone have the data?

Whatever the cause, this seems like it might be able to explain at least some of the sluggish investment and low interest rates. And if it was just the recession, obviously yields on 10 year bonds would not be below 2%. After all, unemployment is down to 5.6% and falling rapidly. The past 10 years have been subpar, but cyclical factors can’t very easily explain low yields for the next 10 years. On the other hand, if working age population growth continues to slow, then we’ll begin to look more like Japan—the country that first entered the low investment/low interest rate environment.

BTW, Check out my post on Keynesian economics and the 2013 austerity, at Econlog.

PS. With the appreciation of the Swiss franc, shouldn’t the Davos meetings be moved to Innsbruck, which uses the now “worthless” euro.

PPS. James in London directed me to an article showing that the SNB is itching to get back in there buying assets to hold down the value of the SF. No surprise to readers of this blog.