Have market participants underestimated the possibility of a divorce between Greece and the euro?

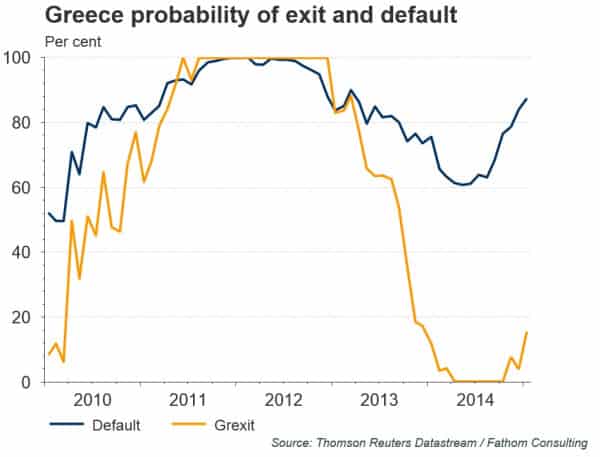

The chart below illustrates the market implied probabilities of a Greek default along with an exit from the euro (“GREXIT”) since late 2009. As you can see, up until early 2013, both scenarios moved in virtual lockstep with each other. But not anymore.

(Audio) Portfolio Report Card: A $818,000 Investment Account with a Winning Philosophy

Although the risk of a Greek default seems like a foregone conclusion (+80% implied probability), the risk of GREXIT is less than 20%. Here’s what it means: Despite all the political rhetoric, economic threats, and ghostly headlines, Europe and the rest of the world still doesn’t see much possibility of Greece leaving the euro.

Over the past eight months, the euro (NYSEARCA:FXE) has slipped around -16% from the $1.33 range to $1.11. (In July 2014, we alerted readers with a piece titled “Why the Euro has Topped” along with corresponding ways to profit from the downdraft.) Over that same time frame, the ProShares UltraShort Euro ETF (NYSEARCA:EUO) which aims for double daily inverse performance to the euro, has jumped almost +34%.

The immediate challenge facing Greece (NYSEARCA:GREK) is to secure short-term funding over the next several weeks before it runs out of money. For now, Athens is betting on the European Central Bank (ECB) to provide funding via another loan or indirect financing that allows Greek banks to buy newly issued short-term Treasuries and allowing them to be refinanced with ECB facilities.

Despite Greece’s ongoing crisis, European stocks (NYSEARCA:VGK) have posted a modest loss of -1.67% over the past year compared to a +3.02% gain for developed market stocks ex-U.S. (NYSEARCA:CWI).

Descrepancies in borrowing costs between Greece and its fellow euro bloc members are once again climbing. The yield on 10-year Greeke debt is 941 basis points (9.41%) higher compared to Germany and 917 basis points higher (9.17%) compared to France.

Follow us on Twitter @ ETFguide