Some illnesses can go undetected for many years. Others are accompanied by obvious warning signs like coughing, sniffling, shortness of breath, and other red flags.

Similarly, we can distinguish between a healthy investment portfolio versus a sick one by how each deals with important matters like taxes, investment cost, diversification, risk, and performance.

My latest Portfolio Report Card is for BDD in Ft. Worth, TX. He’s 55 years old, married and works as a doctor specializing in internal medicine.

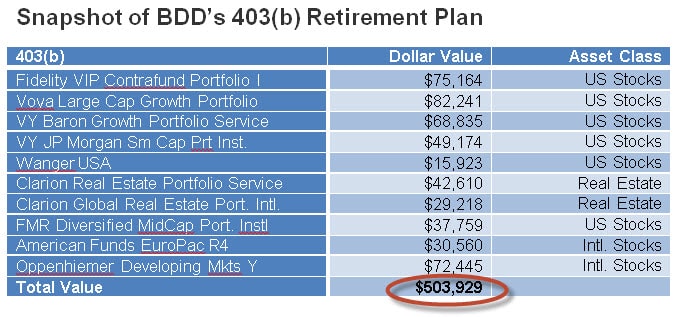

He asked me to analyze and grade his retirement plan to see if it’s healthy or sick. BDD owns 10 mutual funds in two 403(b) retirement plans with a combined value of $503,929 through the University of Texas retirement program.

(Audio) Portfolio Report Card: Ron Analyzes & Grades an $818,000 Plan for G.O. in Swarthmore, PA

His first 403(b) plan is voluntary and he contributed $22,500 over the past year. For the other plan, his employer takes 6.7% of his annual salary and gives him a generous 8.5% match on top. If only more employers were that generous with their workforce!

BDD told me his main investment goal is to accumulate $3 million in 10 years. Is he on the right course to reaching his financial goal? Does he get an A, B, C, D, or F?

Let’s do his Portfolio Report Card and find out.

Cost

One of the many important roles of a financial advisor to help their customers to reduce, not increase, investment cost. How is BDD’s financial advisor doing?

After digging through BDD’s retirement plan, I found that his portfolio is not deliberately minimizing cost. His mutual fund expenses, for example, are averaging 0.92% plus he pays another 0.45% for advisory fees. After tallying up the total cost, he paying almost 1.5% in annual fees. By comparison, my benchmark of index funds/ETFs cost four times less annually than his current holdings. Also, the opacity of his investment cost on certain funds with 12b-1 fees which are being subtly funneled to his advisor is problematic.

Diversification

Another role of financial advisors is to make sure customer portfolios are adequately diversified by holding exposure to all the major asset classes including stocks, bonds, commodities, real estate, and cash. Investment portfolios that lack market exposure to all the major asset classes cannot claim to be fully diversified.

BDD’s portfolio has exposure to domestic and international stocks and he has varied the market size of those stocks by holding small, mid, and large caps. Very well done! It’s also good to see that he owns global real estate, an area that many investors overlook.

Still, BDD’s retirement portfolio misses three major asset classes including bonds, commodities, and cash. This means his portfolio is under-diversified and needs some work.

Risk

BDD described himself to me as a moderately aggressive investor. But he also admitted that he needs to become more conservative and his goal of retiring in 10 years isn’t far off. Is his retirement portfolio compatible with his age and risk capacity?

BDD’s overall asset mix is 86% stocks and 14% real estate. This is not a moderately aggressive asset mix, but rather a hyper-aggressive allocation. Besides not matching BDD’s description of himself, this portfolio’s risk is not age appropriate for a 55-year old. A 20%-40% stock market correction – and it has happened in the past and will happen in the future – exposes this portfolio mix to potential losses between $86,000 to $173,000. What type of setback would BDD’s retirement plan suffer with potential losses of that magnitude?

Tax Efficiency

A correctly built investment portfolio takes active steps to cut the negative impact of taxes. This is done by investing in tax-efficient vehicles and through smart asset location.

BDD’s 403(b) retirement plan is tax deferred and he has not done anything to undermine the tax-efficiency of his nest egg. Good job!

Performance

Your portfolio’s investment performance will either validate or incriminate your portfolio’s strategy and design. Furthermore, the correct standard for performance is how a person’s portfolio performs relative to a blended mix of passive index ETFs that correspond to the person’s asset mix.

Over the past year, BDD’s portfolio gained +7.23% versus a +11.5% gain for a blended benchmark of passive index ETFs matching his overall asset mix. Simply put, underperformance of this magnitude – especially during a favorable market climate – is unsatisfactory.

The Final Grade

BDD’s final Portfolio Report Card grade is a “C.” This grade indicates BDD’s portfolio has major structural flaws in three or more grading categories. His weakest areas are cost, risk, and performance while his strongest area is tax-efficiency.

Putting it mildly, his goal of $3 million in 10 years is quite ambitious. Let’s do the math: He’s got just over $500,000 currently and if he saves money at his current pace (including employer matches) over the next 10 years, (roughly $40K annually), he’s going to need to average a 15% return over the next 10 years to wind up at $3 million. While it’s not an impossible feat, it is a very tall task and not a very likely outcome.

More realistically, let’s say he’s able to get an 8% return over the next 10 years. At that pace, BDD will wind up with around $1.7 million, which I think is a more realistic outcome. If he’s able to get more than 8%, count it as a blessing.

Unfortunately, BDD’s significant underperformance over the past year doesn’t instill much confidence he’ll be able to achieve lights out performance in the future. His current underperformance is indicative of problems with his portfolio’s strategy and design.

Thankfully, BDD is an aggressive saver. But reaching his financial goals through an aggressive savings program alone won’t get him to the finish line. He definitely needs to make adjustments to his investment plan to fix what’s wrong. And if he does that, I’m confident he can have the kind of investment portfolio that he deserves.

Ron DeLegge is the Founder and Chief Portfolio Strategist at ETFguide. He’s inventor of the Portfolio Report Card which helps people to identify the strengths and weaknesses of their investment account, IRA, and 401(k) plan.