The world is full of “carry trades” these days, and that’s a really bad thing.

In general terms, a carry trade involves someone borrowing money cheaply in one currency or market and investing the proceeds in something else that offers a higher yield. The strategy is profitable as long as the currency being borrowed doesn’t rise by more than the spread between the cost of the loan and the income from the investment.

The yen carry trade, in which institutions borrowed Japanese yen for next to nothing and bought developing world bonds yielding quite a bit more, was the dominant version for most of the past decade. It paid off nicely when the yen plunged in value last year. Then the dollar carry trade took over, with about US$9 trillion being borrowed worldwide and invested in everything from Brazilian bonds to Chinese infrastructure. That hasn’t worked out so well, since the dollar is up lately by more than enough to offset the income from those investments. The impact of this tidal wave of negative cash flow will be felt going forward and could be serious, since $9 trillion is about the size of the Chinese economy.

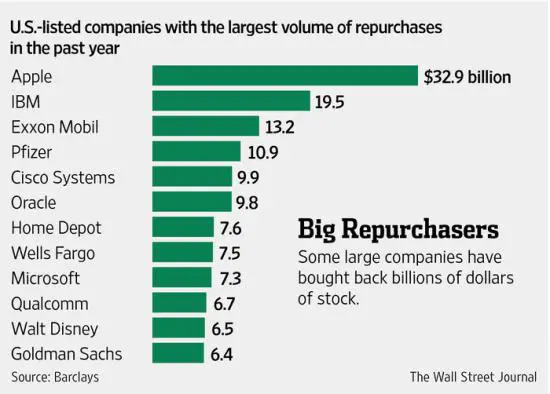

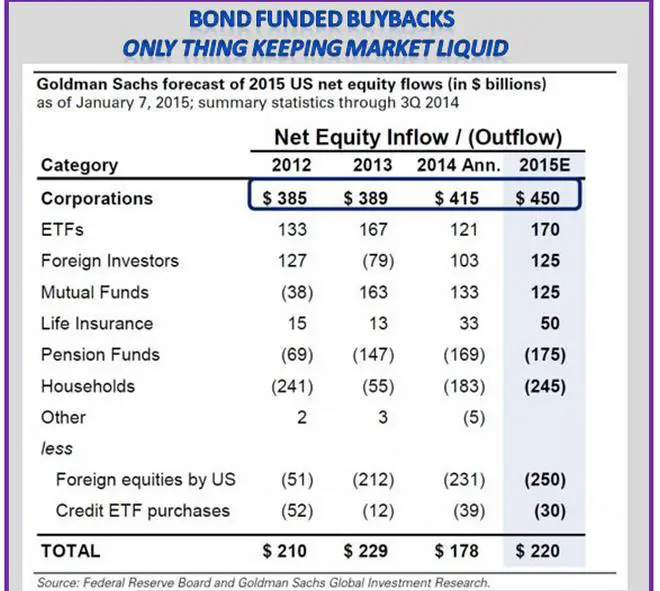

But the really interesting — and potentially even more dangerous — carry trade is happening here at home, where public companies are issuing low-interest-rate debt and using the proceeds to buy back their shares. When the bond interest is lower than the dividends on the stock that’s being purchased and retired, this is a cash flow positive trade — with the added benefit of pushing up the share price and therefore company execs’ year-end bonuses. Check out the following two charts for a sense of the magnitude of this trade:

So what happens if US equities have the kind of bear market that usually follows their recent spike to record levels? Well, the companies that have borrowed heavily will still owe interest on their bonds, but the shares they’ve bought will be worth 20%-30% less. This negative change in their net worth (real if not in terms of financial reporting) might make their shares even less attractive and put extra downward pressure on them, and so on, until a garden-variety bear market turns into something nastier.

This in turn will throw the “wealth effect” (in which higher share prices lead to higher consumer spending) into reverse, possibly turning a garden-variety slowdown into another Great Recession.

But of course this is unacceptable for the people running today’s governments, for whom rising asset prices are now up there with the war on terror and lobbyist pay scales, which is to say untouchable. So lately even minor stock price corrections are met with an army of Fed, Treasury and congressional talking heads promising fast action to keep the gravy train going.

All of which makes current speculation about Fed interest rate policy seem kind of irrelevant. The fact is, interest rates, monetary policy and pretty much every other government policy is now dictated by the need to keep the asset bubble from bursting.