Further evidence is emerging that China’s economic growth is likely to slow further. Even without thinking about growth fundamentals, when you have a 10 trillion dollar economy, a 7% growth is larger than the whole GDP of Sweden or Poland. The sheer size of China’s economy relative to the rest of the world will limit its growth rate. China’s authorities openly admit the growth challenges the nation faces.

FT: – [Premier Li Keqiang] gave his assurance in Beijing’s Great Hall of the People while warning that China would struggle to meet its annual growth target of “around 7 per cent” this year. “It is true we have adjusted down somewhat our GDP target, but it will by no means be easy for us to reach this target.” Mr. Li told reporters at the end of the annual parliamentary session. “China’s economy has already exceeded $10tn so a 7 per cent increase is equivalent to the entire economy of a medium-sized country.”

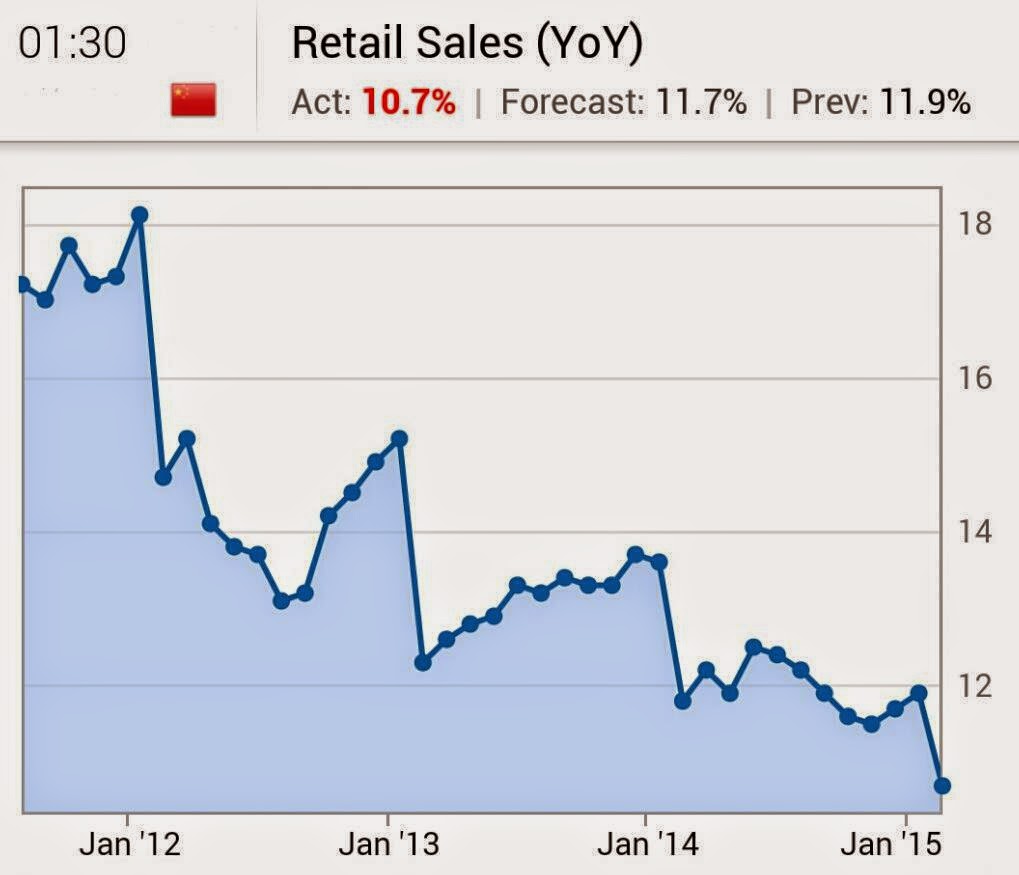

The question however remains: could we see growth that is substantially below even this reduced estimate? The latest fundamental economic reports seem to suggest a sharper slowdown than economists have been forecasting. Here are three examples: fixed asset investment growth, industrial production, and retail sales – all below consensus (see “Act” vs “Forecast”).

|

| Source: National Bureau of Statistics, Investing.com |

Furthermore there is a slew of indirect indicators that seem to support the view that China’s slowdown is sharper than originally thought.

1. China’s rail freight growth:

|

| Source: @SBarlow_ROB |

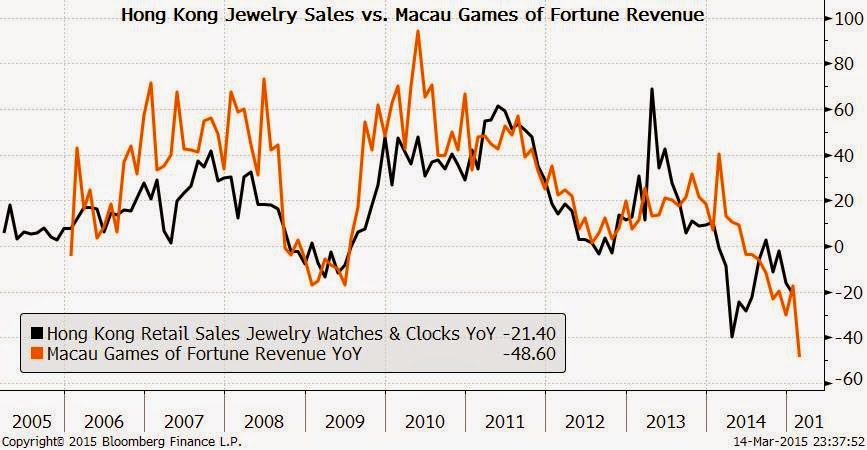

2. Hong Kong jewelry sales and Macau gaming revenue:

|

| Source: @M_McDonough |

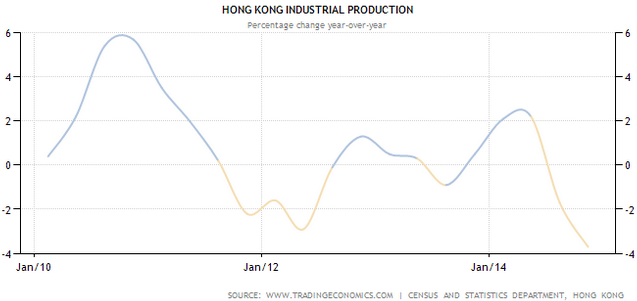

3. Hong Kong industrial production growth:

4. Price declines in China’s industrial commodities markets. Here is the Shanghai Futures Exchange hot-rolled coil May futures contract:

|

| Source: barchart |

When some of these as well as other metrics are combined into the Bloomberg China GDP Tracker, we are looking at a growth rate that is below 6.5%. While still tremendous relative to much of the world, this viewed as a significant slowdown for China.

| Source: @M_McDonough |

Monetary conditions such as the strong yuan (which has risen sharply with the US dollar) as well as unusually high real rates (discussed here) will further dampen economic growth. For example for certain types of manufacturing, a US firm may now choose Mexico over China as the yuan has become much more expensive relative to the peso (in addition to lower shipping costs due to proximity).

|

| CNY/MXN |

Slowing growth would suggest that China’s equity markets should be under pressure. Just the opposite is taking place however – the Shanghai Composite is near multi-year highs.

|

| Source: barchart |

The reason has to do with stimulus expectations. Economic weakness (relative to historical growth) has been so pronounced, Beijing is ready to provide monetary and fiscal support.

FT: – “Under this ‘new normal’ state we need to ensure that China’s economy operates within a proper range,” Mr Li told Sunday’s press conference. “If our growth speed comes close to the lower limit of its proper range and affects the employment and increase of people’s incomes, we are prepared to step up targeted macroeconomic regulation to boost market confidence.”

How effective such stimulus will be remains to be seen but Beijing will certainly make an all-out attempt to avoid a “hard landing”.

_________________________________________________________________________

Sign up for our daily newsletter called the Daily Shot. It’s a quick graphical summary of topics covered here and on Twitter (see overview). Emails are NEVER sold or otherwise shared with anyone.

_________________________________________________________________________

From our sponsor, Fitch Solutions: Sign-up for Inside Credit – a weekly wrap-up of noteworthy Fitch content delivered every Friday.

SoberLook.com