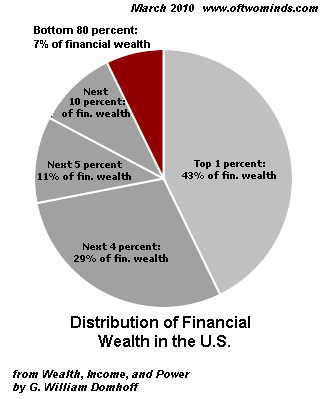

Despite the PR about how corporate profits benefit widows and orphans, this vast wealth is concentrated in the top 1% and the top 5%.

I am honored to share a remarkable data base of Corporate Fines and Settlements from the early 1990s to the present compiled by Jon Morse. Here is Jon’s description of his project to assemble a comprehensive list of all corporate fines and settlements that can be verified by media reports:

“This spreadsheet is all the corporate fines/settlements I’ve been able to find sourced articles about, mostly in the period from the 1990’s up to today (with a few 80’s and 70’s). This is by far the most comprehensive list of such things online. At least that I could find, because the lack of any decent list is what made me start compiling this list in the first place.”

What struck me was the sheer number of corporate violations of laws and regulations–thousands upon thousands, the vast majority of which occurred since corporate profits began their incredible ascent in the early 2000s–and the list of those paying hundreds of millions of dollars in fines and settlements, which reads like a who’s who of Corporate America and Top 100 Global Corporations.

I encourage you to open one of the three alphabetical tabs at the bottom of the spreadsheet on Google Docs and scroll down to find your favorite super-profitable corporation.

Many have a long list of fines and settlements, and many of the fines are in excess of $100 million. Many are for blatant cartel price-fixing, not disclosing the dangers of the company’s heavily promoted medications, destroying documents to thwart an investigation of wrong-doing, etc.

In other words, these were not wrist-slaps for minor oversights of complex regulations– these are blatant violations of core laws of the land.

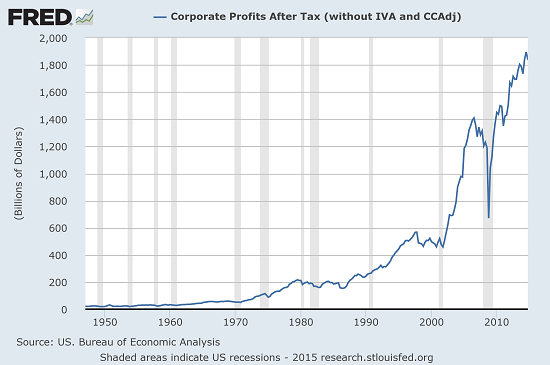

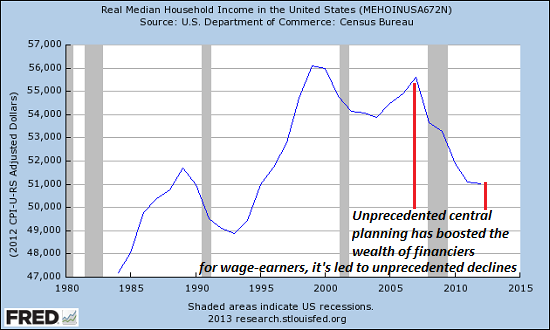

AS you can see in the chart of corporate profits, enormous wealth has been concentrated in the hands of corporate managers and owners since 2002. This alignment with the start of the Federal Reserve’s easy-credit policies is not coincidental.

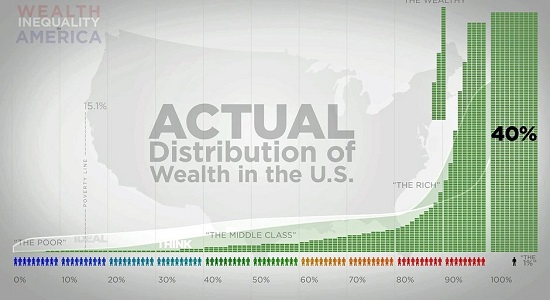

Despite the PR about how corporate profits benefit widows and orphans, this vast wealth is concentrated in the top 1% and the top 5%:

I asked Jon for his views on the meaning of this mind-boggling list of corporate malfeasance, price-fixing and other wrongdoing in terms of the concentration of wealth: here is his response.

As for the connection to the concentration of wealth: I see two ways in which they are related, the first one is pretty direct and that is the increasing size of the settlements. You will notice that as the settlement date gets later the average size gets much larger. Corporate profits after tax (without IVA and CCAdj) from 1st quarter to 1947 to 4th quarter 2014 went from $21,900,000,000 to $1,837,500,000,000 which is a 8290% increase, even from 1st quarter 1980 to 4th quarter 2014 went from $211,600,000,000 to $1,837,500,000,000 which is a 768% increase.

The second link is less direct. With the increases in concentration of wealth there has been a culture of idolizing wealth, one example is how prosecutors no longer find it appropriate to put banker’s and CEOs in jail. I think one side-effect of the culture changing has been an increased willingness to break the law to increase profits.

The settlements with the banks along with the ongoing investigations have shown that virtually every market is being manipulated; the stocks, metals markets, LIBOR, FOREX, everything. The companies would only break so many laws if they felt they would have a reasonable chance of getting away with it; they would also need a reason to do it, which is provided by the infinite growth model our economy is based on.

Thank you, Jon, for compiling a tremendously important and valuable database of corporate fines and settlements, and for connecting this staggering list of violations to the cultural worship of maximizing private gains at any cost. I am reminded of socio-economist Immanuel Wallerstein’s description of the current world-system of central-state/private-corporation collusion as “a particular historical configuration of markets and state structures where private economic gain by almost any means is the paramount goal and measure of success.”

Wallerstein and four colleagues explored the future of this wealth-concentration/maximizing private gain model in Does Capitalism Have a Future? (Oxford University Press, 2013).

Please consider these charts:

Of related interest:

Is There Capitalism After Cronyism? (August 30, 2014)

For the Love of Money

IN my last year on Wall Street my bonus was $3.6 million — and I was angry because it wasn’t big enough. I was 30 years old, had no children to raise, no debts to pay, no philanthropic goal in mind. I wanted more money for exactly the same reason an alcoholic needs another drink: I was addicted.