Britmouse is back blogging with lots of interesting new posts. A short one that caught my attention discussed this story from 2010:

I saw the governor of the Bank of England [Mervyn King] last week when I was in London and he told me whoever wins this election will be out of power for a whole generation because of how tough the fiscal austerity will have to be,” Hale said in an interview on Australian TV reported by Reuters.

Of course the Conservatives were recently re-elected, and indeed slightly improved their standing because they no longer rely on support from the Liberal Democrats. BTW, I agree with this comment from Britmouse:

. . . sad to see so many true liberal voices leaving Parliament. You’ll be missed, Vince.

King headed the Bank of England in 2010. So why was his political forecast incorrect? Perhaps he thought the economy would do poorly during the period of austerity. But why would he think that? Perhaps because he’s a Keynesian, like Ben Bernanke and most other central bankers. Maybe he doesn’t believe in monetary offset.

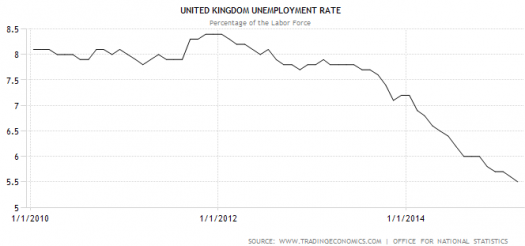

Of course there are other possibilities, maybe he thought austerity would be unpopular even if the economy did fine. But I think it more likely that he was making an implied forecast of slow growth and a weak job market. In fact growth was weak, but during 2013 the job market began improving dramatically:

Notice that British unemployment was at about 8% at the time of the May 2010 election, and still at about 7.8% in the spring of 2013. Not much progress in three years. But then the rate began falling sharply, and was at 5.5% in March, 2015, the same as the US and just slightly above Germany’s 4.9%. Total employment numbers did far better than the US. What happened? There are lots of possibilities:

1. Maybe the Keynesians are right and monetary offset was impossible in the UK. Austerity hurt. Recovery only occurred in 2013 because wage moderation finally allowed for the natural recovery forces in the economy to take hold.

2. More likely, the BoE felt additional monetary stimulus was risky, due to high inflation during 2010-13, often running at close to 4%. In that case the fiscal austerity had no impact on growth and employment, as the BoE was unwilling to tolerate higher inflation.

3. The most interesting hypothesis is that King failed to forecast that he would be replaced in 2013 by a more competent central banker, from Canada of all places. Mark Carney was appointed in late 2012, but didn’t formally join the BoE until June 2013, so it’s not quite clear where we should see his appointment impacting the economy.

Here’s Carney’s record at the Bank of Canada, from Wikipedia:

Carney’s actions as the Bank of Canada’s governor are said to have played a major role in helping Canada avoid the worst impacts of the financial crisis that began in 2007.[14][15]

The epoch-making feature of his tenure as governor remains the decision to cut the overnight rate by 50 basis points in March 2008, only one month after his appointment. While the European Central Bank delivered a rate increase in July 2008, Carney anticipated the leveraged-loan crisis would trigger global contagion. When policy rates in Canada hit the effective lower-bound, the central bank combated the crisis with the nonstandard monetary tool: the “conditional commitment” in April 2009 to hold the policy rate for at least one year, in a boost to domestic credit conditions and market confidence. Output and employment began to recover from mid-2009, in part thanks to monetary stimulus.[16] The Canadian economy outperformed those of its G7 peers during the crisis, and Canada was the first G7 nation to have both its GDP and employment recover to pre-crisis levels.

The Bank’s decision to provide substantial additional liquidity to the Canadian financial system,[17] and its unusual step of announcing a commitment to keep interest rates at their lowest possible level for one year,[18] appear to have been significant contributors to Canada’s weathering of the crisis.[19]

Canada’s risk-averse fiscal and regulatory environment is also cited as a factor. In 2009 a Newsweek columnist wrote, “Canada has done more than survive this financial crisis. The country is positively thriving in it. Canadian banks are well capitalized and poised to take advantage of opportunities that American and European banks cannot seize.”[20]

Carney earned various accolades for his leadership during the financial crisis. He was named one of the Financial Times ‘s “Fifty who will frame the way forward”,[21] and of Time Magazine ‘s “2010 Time 100″.[22] In May 2011, Reader’s Digest named him “Editor’s Choice for Most Trusted Canadian”.[23]

In October 2012, Carney was named “Central Bank Governor of the Year 2012″ by the editors of Euromoney magazine.[24]

So he’s a talented central banker. But how do we know the UK wouldn’t have improved even if King had stayed on? We don’t, and indeed I think the UK would have improved, but not as fast as with Carney. Mark Carney did take some aggressive forward guidance steps in 2013, and the markets took notice. Just as in Canada, he got better job market results than his peers at other central banks. That’s not proof, but I believe the balance of evidence suggests that Carney modestly boosted the speed of the UK recovery.

Years ago I did a post arguing that central bankers are grossly underpaid, and that we should pay whatever it takes to make sure that the FOMC has people like Michael Woodford, not community bankers from Hawaii. Even if it takes a billion dollars. Of course a billion dollar salary is not politically feasible, but it’s also not necessary. Carney was reluctant to take the BoE job for family reasons, and the British government eventually lured him over with a fairly generous pay package, including that all-important London housing allowance. It did get some attention in the press, which points to the difficulty of paying central bankers their marginal product.

BTW, you might wonder why I say central bankers are the most underpaid profession. What about the President, who only makes $400,000, and yet is even more powerful and consequential? Yes, but have you checked the non-monetary compensation of being President? Even Bill Gates can’t have state dinners in the White House with a glittering international set of celebrities, or fly in Air Force One with a military escort. The total compensation of being President is plenty high enough to attract talented people. Unfortunately, the close call on whether Carney was willing to take the BoE job, and the frequency with which Federal Reserve Board members resign before their term is up, suggests that central bankers are grossly underpaid. I’ve never seen a President resign after 2 years to take a more lucrative job with Goldman Sachs.

PS. I chose Michael Woodford precisely because he is not a MM. We need to get best people possible, and this has nothing to do with whether they agree with me, or they don’t. John Taylor is another person I sometimes disagree with, who is obviously extremely well qualified for being a central banker.

PPS. Check out Britmouse’s longer new posts, which are also quite interesting.