- ‘Death of gold’ greatly exaggerated

- Vital context: gold rose sharply in years preceding crisis and during crisis

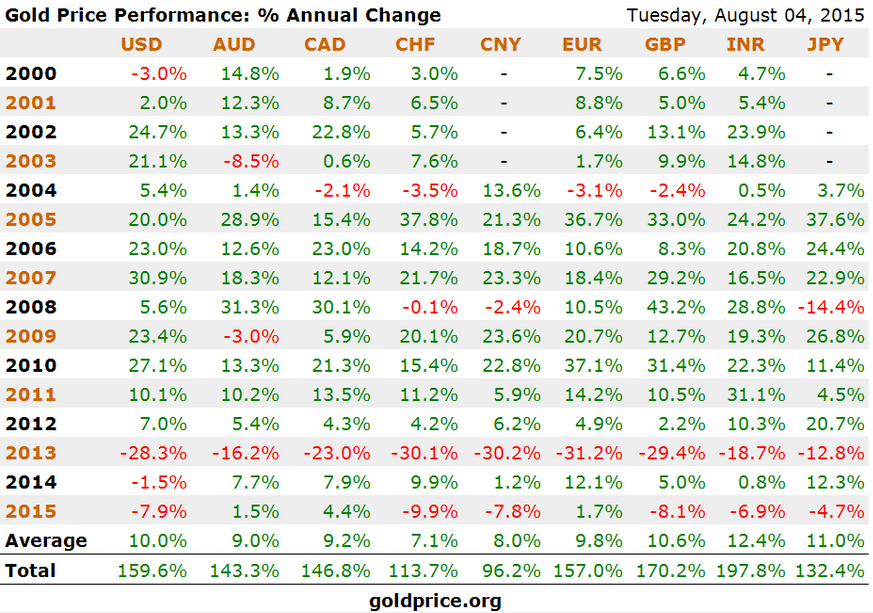

- Important to consider gold in local currency terms

- In euro, gold is up 2% in 2015, after 13% gain in 2014

- Gold at €300 in 2001, rose to €1,400 during crisis and at €1,000 today

- History, academic and independent research shows gold is a safe haven

- Sharp fall in value of commodities means global economy is weakening

The deluge of negative publicity regarding gold in recent weeks would give one the impression that it was now worthless and serves no function in a portfolio. We believe this publicity is greatly exaggerated and will be seen as folly in the coming months.

In the years running up to the financial crisis of 2008 gold rose dramatically despite the warning signs being widely ignored. It continued to act as a reliable store of value as the crisis deepened and then began to fall back following the stability – temporary, we believe – provided by central banks creating more debt to deal with a crisis of over-indebtedness.

The negative publicity has generally focussed on the performance of the gold price in dollar terms which is not particularly relevant to investors and savers in other currencies.

Gold rose from €300 in 2000 to around €1,400 at the height of the crisis. It has since fallen back to €1,000. In this context, one can see that gold’s function as a store of value and as a safe haven is still clearly evident. Gold’s recent performance in euro terms has been reasonably strong with a very respectable 13% rise last year and 2% gains so far this year.

History, academic research and independent research show unequivocally that gold acts as a safe haven. As GoldCore’s research director Mark O’Byrne pointed out on RTE Radio 1’s Morning Ireland this morning [click to listen] gold has an inverse relationship to other financial instruments.

The recent negative publicity points out that gold should have seen gains during the recent crisis in Greece and thus failed to act as a safe haven. This is not strictly correct. The uncertainty caused by the crisis should equally have caused stock markets and bond markets to falter. They did not and therefore gold’s inverse relationship to these assets was never tested.

Mark also made the point that the sharp drop in the value of commodities in recent months should not be viewed as a triumph for non-tangible assets such as stocks and bonds. Indeed it indicates latent weakness in the global economy and possible trouble on the horizon.

“It’s interesting because the fall in value of all commodities and oil prices suggests that the global economy is much, much weaker than people actually think and that should give pause for concern in terms of the outlook in the coming months.”

The lower price for gold at this time should be viewed as an opportunity to acquire physical gold as a financial insurance against the unresolved debt crisis which must assert itself again in the coming months or years and may be imminent.

Mark, let’s go through the price movements with regard to gold over the past few years. We’ve seen it go from $700 to $1,900 during the financial crisis and it has come back to about $1,100?

Exactly, yes, and more important for Irish people, it’s important to think in local currency terms – which is obviously euros for Irish people – so there has been a similar big price move in euro terms. It actually went from €300 in the year 2000 to €1,400 at the height of the financial crisis after Lehman Brothers and indeed then the euro-zone debt crisis. So it’s very much a case of two steps forward in the early part of the decade and then one step backwards in recent months and years and we’ve had a very sharp correction, particularly in dollar terms. It’s actually more a story of dollar strength rather than gold weakness because gold in euro terms is actually up 14% last year and this year gold is actually up in euro terms but you wouldn’t know that from the headlines. It’s up 2% so far in 2015.

We had the Greek situation in July and a fall in [gold] price in July. Might we have expected to see it go up in July because of that Greek situation?

Yeah, absolutely, and I think a lot of people were scratching their heads. It is a safe haven asset – there is a huge body of academic research and indeed independent research from asset allocation experts who have shown that gold is a safe haven asset. It has an inverse relation so it goes up when everything else is going down. I suppose the Greek crisis did not lead to a correction in the stock markets and bond markets as some people were expecting and therefore that could be a reason that gold did not react as people expected.

Also, physical demand did increase but it didn’t increase hugely. There was a lot of safe haven buying going on particularly out of Germany because the Germans are worried about what is going to happen to the euro and, of course, in Greece itself. But also, there wasn’t any sudden selling of gold by central banks or investors in physical coins and bars. The selling was actually on the futures market so a lot of the speculative money that’s in the global financial system – which is a bit of a casino – and the hedge funds are momentum-driven and they follow trends. The trend in the gold price has been down in recent months and these guys are shorting the marketplace and pushing prices lower.

We also had the situation in China with very heavy losses in stock markets in July and that was accompanied by pressure on commodities. Why was that the case?

China is one of the biggest economies in the world with 1.3 billion people and a growing middle class and the narrative was that this is creating huge demand for commodities – as it was – as China industrialises. Now obviously there are concerns about China and we would have serious concerns about the Chinese economy going forward given – like most economies – a lot of the growth has been driven by huge increases in debt levels and obviously we’ve seen property markets there fall quite a bit in most of the cities around China and then we’ve had the huge wallop on the stock market over there. So people are beginning to question that story. It’s interesting because the fall in value of all commodities and oil prices suggests that the global economy is much, much weaker than people actually think and that should give pause for concern in terms of the outlook in the coming months.

You can listen to the full interview with Mark O’Byrne RTE’s Morning Ireland website.