- Simplistic gold analysis speculates solely on price

-

Forgets vital importance of diversification

-

Lorcan Roche Kelly’s analysis lacks all context

- Ignores huge physical demand for gold coins and bars

- Today’s world is very different to the world of the 1980s and 1990s

- Alas, financial crisis has been postponed not averted

- Physical gold will have value when paper and digital wealth is devalued, confiscated or inaccessible …

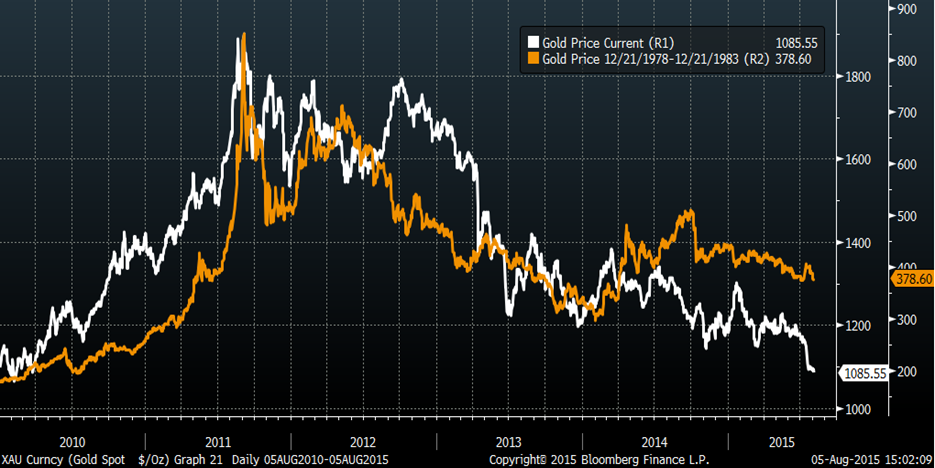

An article on Bloomberg comparing the gold market in the late 1970s – dramatically peaking in 1980 – to that of recent years has suggested that “gold could soon get very boring” and a “repeat of that trend would leave gold at around $1,000 an ounce in 2035.”

We have long noted the importance of focussing on gold as a diversification and therefore not focussing solely on gold’s price. Price predictions are foolhardy at the best of times and when we occasionally venture into that space, we are always cautious and give caveats.

What is odd about this call for gold to fall nearly 10% in dollar terms in the next 20 years is that it is completely devoid of any kind of all important historical, geopolitical, macroeconomic or indeed monetary context.

So too it completely ignores the supply demand fundamentals in the physical gold market and the huge demand for gold coins and bars today that is leading to bottlenecks, delays and rising premiums.

The article on gold by Lorcan Roche Kelly says that “the 2011 gold price spike looks a lot like its 1980 spike” and provides charts that indicate the same. Price spikes in many assets can frequently look remarkably similar when overlaid in a chart.

Especially if you are selective in the time periods shown. If you only select a certain time period, it can be used to support a hypothesis. But given the very limited set of data and singular comparison, such comparisons are simplistic, may not be representative and may be liable to mislead.

If such analysis regarding the stock market was done, it would be roundly laughed at and dismissed out of hand.

Following the 1980 parabolic price move – when gold rose 24 times in 9 years – prices fell sharply and then remained fairly static for the next twenty years. On this basis, Kelly concludes that another prolonged and “boring” period may be ahead for gold prices.

He argues that the price stabilised in the 1980’s because the inflation “panic” of the 1970s had subsided.

The actual significant bout of inflation and indeed stagflation did indeed subside but only after Fed Chairman, Paul Volcker had increased interest rates to over 15%.

Similarly, he argues that the “panic” of the financial crisis caused the 2011 spike and that those fears are now subsiding and so gold prices have fallen and are now stabilising at lower levels.

While those fears may indeed be subsiding – and we are not convinced that they are given the incredible demand for physical gold and silver coins and bars across the world in recent weeks – we doubt that they will remain subdued for long.

The issues which led to the crisis – i.e. excessive debt at every level of society – have not been dealt with. Ultra-easy monetary policy and QE have, in fact, caused global debt levels to balloon since 2011. Central banks are now stuck in a debt-trap.

Leveraged speculation has led to massive inflation in financial assets and yet the real economy globally remains stagnant – as demonstrated by collapsing commodity prices. The companies that use these commodities are cutting back due to lack of demand and deflation once again looms on the horizon.

Western central banks continue to postpone raising interest rates because if and when they do it may pop the last vestiges of the economy which give the illusion of health – the stock and bond markets.

Incidentally, many commentators erroneously suggest that rising interest rates are automatically negative for gold but not, somehow, for the other financial assets which are utterly dependent at this stage on low interest rates – particularly property.

Historical data does not back this up and shows that in periods of rising nominal rates – when rates are chasing inflation – gold also rises.

The period to which Kelly refers, the 1980s and 1990s followed a period of severe monetary discipline and came about at the end of a long period of interest rate tightening.

The metaphorical chaff had been separated from the wheat and it was followed by a period of strong economic activity. We are now in a twilight zone period following a bout of unprecedented monetary profligacy and experimentation the consequences of which are yet to manifest.

The 1980s was a period of stabilising geopolitical tensions. The enmity between the global superpowers, the U.S. and U.S.S.R. were being resolved peacefully. With the end of the Cold War, for a time it seemed like peace might prevail globally.

Unfortunately we are now in a period of increasing destabilisation across the Middle East and North Africa and rising tensions between the U.S. and Europe on one side and Russia and China on the other.

We are in a period of historic indebtedness which will have a devastating effect on the currencies of the U.S. (debt to GDP, 101%), Japan (debt to GDP 230%), and the Eurozone when rates rise and debt can no longer be serviced.

Indeed, the 1980s and 1990s could not be more different than the present period.

We would like to believe that a period of peace and prosperity lies ahead of us. Unfortunately, the facts do not support this panglossian assertion.

If history truly repeats it is more likely that we see hyperinflation and the sharp devaluation of paper and digital currencies in the coming years given that no experiment with money printing has ever had a positive outcome.

The macroeconomic, geopolitical and monetary conditions today or more akin to the challenging 1970s than the more benign, declining interest rate environment of the 1980s and 1990s.

Therefore, seeking historical parallels the 1970s may be a better guide to future gold prices:

Gold 1970-1980

The recent price falls were not a surprise. We said in an interview on Bloomberg when gold was near $1,900 that there was going to be a correction and that in a worst case scenario gold could replicate the 1970s bull market when gold fell nearly 50%.

In the 1970s, gold rose from $35/oz in 1971 to over $197/oz by January 1975. In the next 21 months, gold fell in value by nearly 50% to $103/oz by late August 1976.

This led to many pronouncements that gold’s bull market was over and the bubble had burst.In the next 40 months from August 1976 to January 1980, gold rose 8 fold from nearly $100/oz to $850/oz.

We see think there is a real possibility of the same pattern playing out in the coming months.

Roche Kelly’s piece makes a historical price comparison which lack any sense of all important historical context. Indeed, it does not even look at gold’s last bull market and the clear precedent of a 50% correction.

As an Irishman, Roche Kelly should also understand the importance of considering assets including gold in local currency terms. In Ireland, people who owned gold during the property and stock market crash protected and grew their wealth.

Similarly, people in Greece who owned gold during the property and stock market crash protected and grew their wealth. Indeed, gold was one of the few forms of physical savings and money that Greeks could access during the draconian capital controls and deposit withdrawal restrictions which continue to this today.

In euro terms, the currency used by some 337 million Europeans on a daily basis, gold rose 12% in 2014 and is another 2% higher in 2015. People in Ireland, in Greece, in Germany and throughout Europe invest in physical gold in euros, not dollars. This underlines once again gold’s importance as a way to hedge currency risk.

We would remind readers of the words of Ray Dalio, founder of one of the most massive hedge fund companies in the world, Bridgewater, and regarded by Bloomberg Markets as one of the “50 Most Influential People”.

In May, when addressing the Council on Foreign Relations he said, “it’s not sensible not to own gold.”

He added

“there is no sensible reason other than you don’t know history and you don’t know the economics of it”.

Owning physical gold is a historically – and academically – proven safe haven asset. This means that it preserves wealth and protects people in times of crisis. When one buys physical gold it is as a form of insurance rather than as a speculative means to make a profit. Profit is a secondary motivation.

We do not buy house insurance with the expectation of a dividend or interest payment. Nor should we expect such from gold. It can and has made many people very wealthy indeed but this should not be the primary reason for owning gold.

To conclude, Lorcan Roche Kelly may be right and gold prices may be at $1,000 per ounce in 2035. This in itself is the value of gold – it will always have a value. There is no guarantee that the government bonds, nor the fiat and digital currencies throughout the world today will have a value or indeed will be accessible.

Diversification and holding some of your investments, savings and pension in gold outside of the current fragile financial system remains prudent.

MARKET UPDATE

Today’s AM LBMA Gold Prices were USD 1,091.35, EUR 998.99 and GBP 703.01 per ounce.

Yesterday’s AM LBMA Gold Prices were 1,085.00, EUR 996.05 and GBP 694.56 per ounce.

Gold and silver on the COMEX were nearly unchanged yesterday – up $4.30 and up 5 cents respectively – to $1,089.30/oz and $14.65/oz.

Gold futures for December delivery rose 0.2 percent to $1,092.50 an ounce on the Comex in New York. Silver for immediate delivery gained 0.5 percent to $14.83 an ounce.

Platinum rose 0.4 percent to $958.46 an ounce, while palladium gained 1 percent to $608 an ounce.

Both PGM metals reached multi year lows on Tuesday, with platinum sinking to a six-year low of $945.24 and palladium to $589.10, the lowest price since October 2012.

Breaking News and Research Here

Follow GoldCore on Twitter, GoldCore on Facebook, GoldCore on LinkedIn