Serious volatility watchers are always attending a three ring circus. The left ring holds the general market. Center ring has options on the S&P 500 and the various CBOE VIX® style indexes and to the right are VIX futures, Volatility Exchange Traded Products like VXX, UVXY, TVIX, and XIV plus associated options.

Activities in the three rings usually follow a familiar choreographed pattern. The VIX moves in opposition to the market while VIX futures and their kin trail the VIX unenthusiastically. VIX futures converge to the VIX’s value at expiration but prior to that they following their own path—usually charging a premium to the VIX, but sometimes offering steep discounts. Meanwhile in the background the VIX maintains its reversion to mean behavior, a macro cycle the short term moves modulate.

One of my ongoing interests is monitoring the Volatility Circus’ rings two and three—the family ensembles of VIX and VIX Futures. I note unusual movements and try to determine which one of them is “right” more often—perhaps foreshadowing market moves. Recently I’ve developed a model that helps describe this relationship. It is presented later in this post.

Interpreting the values of VIX futures has been especially challenging. The price relationship of the next to expire VIX future and the VIX tends to be very dynamic in the last few weeks before its expiration. With only a single data point, the one active future with less a month to expiration, there hasn’t been much data to work with.

Of course there are mind bending mathematical models available for VIX Future pricing—but unless you have a PhD in quantitative finance they are probably too complex to be helpful.

Enter the CBOE’s Weekly Futures

By introducing VIX futures with weekly expiration dates the CBOE boosted the number of close-in data points from one to five—a dramatic improvement. One day while looking at Eli Mintz’s vixcental.com chart on these new futures a light bulb lit up in my head

The green dots are the newly introduced futures. Taken together the leftmost part of this curve looked logarithmic to me.

Sure enough, when plotted in Excel the logarithmic trendline match to the first two months of the futures was very good.

However around month 4 the trendline starts seriously understating VIX futures prices.

Apparently there’s an additional mechanism that boosts the futures’ value over time.

The Model

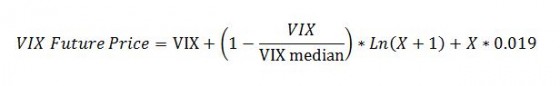

Using VIX Futures data from 2004 on I developed the following equation which does a surprisingly good job of estimating VIX futures’ prices given its simplicity. The only inputs are the current VIX value, the number of days (X) until the future expires, and the historical median value of the VIX.

The VIX closing median value from January 1990 through October 2015 is 18.01.

Example calculation: if the VIX is at 16 and a VIX future has 10 days before expiration this model predicts a price of 16.45.

16+ (1-16/18.01)* Ln (10+1) +10*0.019 = 16+ 0.1116* 2.3979 + .19 = 16.45

A near real time chart of the VIX Futures values predicted by the equation is posted here.

A Few Notes on the Equation

- At VIX Future expiration (X = 0) the equation sets the VIX futures price equal to the VIX. The convergence term in the middle is forced to zero because Ln (0+1) equals zero and the carry cost term on the right is forced to zero by X being zero.

- If the VIX matches its historical median price the convergence term is canceled out by the expression in front of the natural log, and the only difference in prices from the VIX will be the carry cost.

- If the VIX is relatively low (below the historic median) the equation predicts the typical premium prices of the VIX futures relative to the VIX. The market is in this state 75% to 85% of the time.

- Conversely if the VIX is high, the equation predicts the VIX futures will be cheap relative to the VIX levels.

- The daily carry cost factor was determined empirically by adjusting its value until the average errors for the 3rd, 4th, and 5th month futures from March 2004 through September 2015 were less than a percent or two.

Why A Model?

You might reasonably ask why bother with a model when you can just look up the current VIX futures prices on the web. This model is interesting to me because:

- It helps me understand the underlying mechanisms behind VIX Futures pricing

- I can determine how current VIX futures prices are behaving compared to their predicted behavior—useful for evaluating situations where event risk is distorting prices or the market is especially panicky

- I can predict future VIX futures prices for various VIX scenarios

Model Errors

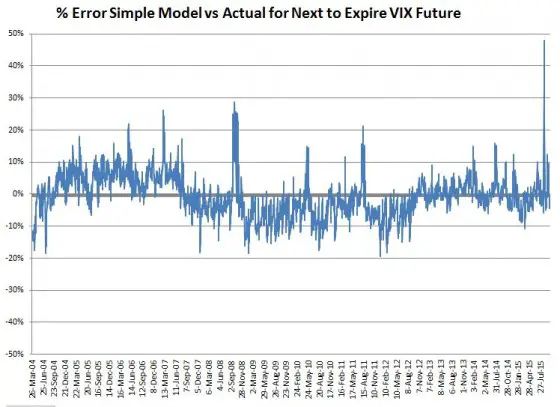

The model is very inaccurate at times, with errors on historic data sometimes exceeding plus/minus 25 percent. The chart below shows the model’s error terms for the next to expire futures since 2004.

The model tends to overestimate futures prices while in sustained periods of low VIX and underestimate the prices in bear markets. During big volatility spikes (Oct 08, Aug 11, Aug 15) the model predicts VIX futures values that far exceed the actual prices.

It isn’t surprising that the model doesn’t adroitly handle the impact of big jumps or drops in market volatility since it doesn’t incorporate any historical information at all—other than the long term median VIX value.

The error spike on the far right of the error chart is a whopper, nearly 50%. On August 24th 2015 the VIX closed up 45% at 40.74, but the front month future (September) only climbed 26% to 25.13. The model predicted a value of 37.16, up 39%.

Despite the chaos prevalent on August 24th the futures market did an impressive job of predicting the eventual (23 days later) expiration value of the September 2015 futures. Expiration was at 22.38, only 2.75 points away from the August 24th closing value.

A more accurate model would need to incorporate the effects of VIX jumps and slumps. It’s not a trivial problem. In general the VIX futures seriously lag big jumps in the VIX, but then stay higher than you’d expect after the volatility drops. I suspect at the very least a volatility of volatility term needs to be added.

Now instead of resembling Fellini’s circus the VIX futures moves in the Volatility Circus feel more rational to me. Their movements are often mysterious and complex—but a simple theme unites.