In normal times, the world’s major economies are a mixed bag. Some are up, some are down, some are placid, some are in crisis. It’s only at the boom/bust extremes that everyone finds themselves in more-or-less the same boat.

This is looking like one of those times — and the boat is sinking. Japan, for instance, is back in recession…

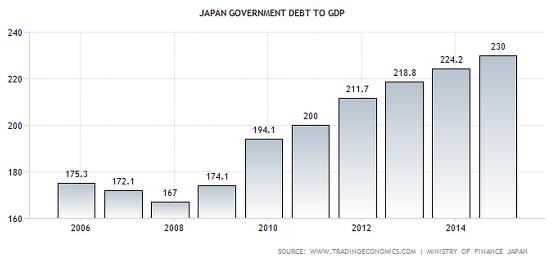

…while its debt continues to soar.

Brazil’s economy has been shirking since April, and the decline is accelerating. See Brazil in free-fall mode. Get ready for terrible Q3 print, analysts warn.

Europe is descending into a combination of financial and geopolitical chaos that might dissolve not just the eurozone but major parts of the European Union, notably the free movement of people across internal borders. See Europe is sliding towards the abyss and the terrorists know it.

China pretends that it’s still growing, but no one believes it anymore in light of things like this: China’s Steel Industry Peers Into Abyss as Output to Plunge.

The Middle Eastern civil war has now sucked France and China in alongside the US and Russia. See Beijing vows justice as ISIS kills Chinese, Norwegian hostages.

Even the US, which most of the world seems to view as an island of stability, has soaring debt and a slowing economy. See Housing starts just plunged to 7-month low and Retail reality: another sign a recession and crash are imminent.

The lone bright spot is financial asset prices — but market breadth has deteriorated alarmingly. Most stocks are flat to down (in some cases down hard) while the broad indexes are supported by just a handful of rising issues. See Nifty-Fifty becomes Fab-Five.

So why is the whole world simultaneously in financial/geopolitical crisis? Because the whole world has been making the same set of mistakes. Armed with unlimited monetary printing presses, most major countries have been operating with the sense of omnipotence that flows naturally from the ability to create money out of thin air. The US built a global military empire with borrowed money and proceeded to bully the rest of the world almost randomly, destabilizing the Middle East and stirring up resentment everywhere else. Europe adopted a fatally-flawed common currency on the assumption that it would paper over the resulting crises with new credit. China thought it could build roads, airports and entire new cities with borrowed money, and that all of those assets would magically generate copious free cash flow. And Japan has avoided making the structural changes necessary to deal with an aging population, simply borrowing and printing the yen needed to get through each budget cycle.

In other words, for quite a while everyone was able to ignore the bit of common sense that says “when you find yourself in a hole, the first thing to do is stop digging.” Instead they assumed that they could dig forever because their “modern money” would always be there to bail them out.

Now here’s where it gets really interesting. The debate has shifted to whether current policy has failed because it’s based on false assumptions and flawed models — or because it wasn’t pursued with enough enthusiasm. Since no one likes to accept blame or give up power, the folks in charge will almost certainly choose the latter explanation and give it one more go in 2016, bigger and better, shock and awe, NIRP, war on cash, QE for the people. Toss those things into the current mix and you’ve got a year for the history books.