Here’s Kevin Drum:

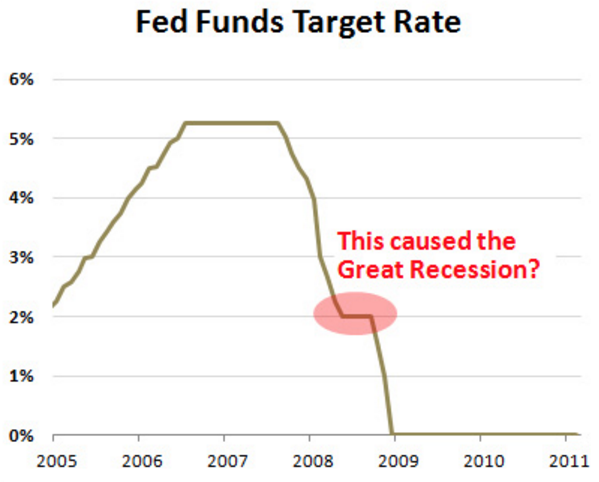

I think you can argue that the Fed should have responded sooner and more forcefully to the events of 2008, but the problem with Cruz’s theory is that it just doesn’t make sense. Take a look at the chart on the right, which shows the Fed Funds target rate during the period in question. In April 2008, the Fed lowered its target rate to 2 percent. Then it waited until October to lower it again.

So the idea here is that if the Fed had acted, say, three months earlier, that would have saved the world. This ascribes super powers to Fed open market policy that I don’t think even Scott Sumner would buy. Monetary policy should certainly have been looser in 2008, but holding US rates steady for a few months too long just isn’t enough to turn an ordinary recession into the biggest global financial meltdown in nearly a century.

Actually, according to New Keynesian (NK) economic theory (not my theory) it certainly could be enough. According to NK theory, when interest rates are positive the central bank controls the path of NGDP. Notice that interest rates were positive throughout 2008 (until mid-December.)

Also, according to NK theory, you can’t look at the path of the fed funds target to figure out the path of monetary policy. Ben Bernanke says you need to look at NGDP growth and inflation.

According to NK theory what really matters is the gap between the policy rate and the Wicksellian equilibrium rate. According to NK theory you’d expect the Wicksellian equilibrium rate to fall sharply in a housing crash/recession. And it did. According to NK theory that means Fed policy tightened sharply in 2008. According to Vasco Curdia (a distinguished NK economist who has published papers with Michael Woodford) the policy rate rose far above the Wicksellian equilibrium rate in 2008.

In other words, according to NK theory Kevin Drum is wrong; policy got a lot tighter. Now we can debate what the Fed might have accomplished with various counterfactual policies, but there is no doubt that the actual policy became extremely tight in the second half of 2008. Recall that in mid-year the Fed did not expect a severe recession, they thought the economy would grow between 2008 and 2009. So something unexpected went wrong in the second half of 2008, and we know from high frequency output data that the sharp deterioration of the crisis preceded the intensification of the financial crisis in October. Not for the first time, a crash in NGDP expectations led to a crash in asset prices, which led to the failure of highly leveraged banks.

Drum presents this graph:

and then wrongly assumes it tells us something useful, that it helps us to understand how policy played out in 2008. It does not. Yes, the rate cuts of April and October made policy less contractionary on those days than if rates had not been cut, but it doesn’t tell us anything about the overall stance of policy, and how that stance evolved over the course of 2008. As Frederic Mishkin says in his best-selling money textbook (and Ted Cruz agrees) for that you need to look at a wide range of asset prices.

Both the NK and MM models tell us that money got much tighter in the second half of 2008. Ironically, Ted Cruz seems more aware that fact than many of his critics.

PS. Notice that the Drum quote starts off, “I think you can argue. . .” Drum’s being too polite here. It’s like saying, “I think you can argue that the captain of the Titanic should have reduced the speed of the ship in the iceberg corridor.” Yeah, I’d say so.

PPS. On the other hand I wish more bloggers (including myself) were more polite, so no disrespect to Drum intended.