The Bank for International Settlements (BIS) has warned in its latest quarterly review that the current ‘uneasy calm’ in financial markets might be short lived, threatened by the Fed’s widely expected interest rate hike – the first rate increase in a decade.

Source: BIS Quarterly Review

This latest warning comes after BIS – the central bank of central banks – had previously cautioned that recent economic turmoil in the global stock markets “showed how developed and emerging markets were exposed to the unwinding of financial vulnerabilities built up since the 2008 crisis.” See: “BIS Warns of ‘Major Faultlines’ In Global Debt Bubble”.

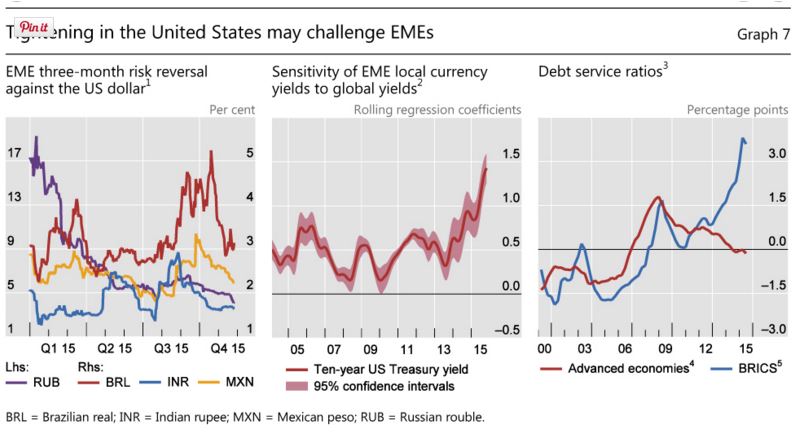

“The short-lived market response might suggest that EMEs (emerging market economies) could ride out the prospect of US monetary tightening. However, less favourable financial market conditions, combined with a weaker macroeconomic outlook and increased sensitivity to US interest rates, heighten the risk of negative spillovers to EMEs once US rates do start to rise in the United States”. BIS Quarterly report December 6th

Again, BIS warns that investors remain “hooked on every word and deed” of central banks and that recent turmoil in markets was not caused by isolated incidents but rather “the release of pressure that has gradually accumulated over the years along major fault lines”.

According to the the Telegraph today, “The central bank watchdog said emerging market households and businesses reliant on cheap debt faced a credit crunch that could trigger panic in a world of evaporating liquidity and fewer market makers.”

Public and private debt in the developed world has risen 36% since the crisis and is now 265% of GDP and the post-crisis problems have been dealt with with the same ineffectual policies that caused the crisis – prolonged ultra low interest rates and easy monetary policy.

Source: BIS Quarterly Review

Quoting Claudio Borio, head of the economic department at the BIS, the Telegraph report, ‘“Expectations of further ECB easing had led traders to place bets on the euro that caused huge market swings when the central bank was perceived as failing to deliver. “Against this backdrop, it is hard to imagine how the calm could be anything but uneasy. There is a clear tension between the markets’ behaviour and underlying economic conditions.’ ‘”At some point, it will have to be resolved”, said Mr Borio’.

Read more on the GoldCore.com blog

Other Sources:

BIS Quarterly Review, December 2015

BIS Warns of ‘Major Faultlines’ In Global Debt Bubble

DAILY PRICES

Today’s Gold Prices: USD 1082.70, EUR 1001.80 and GBP 718.26 per ounce.

Friday’s Gold Prices: USD 1063.00, EUR 977.56 and GBP 702.60 per ounce.

(LBMA AM)

Gold in Euro – 1 Year

Gold enjoyed a decent gain on Friday closing up $22.00 to close at $1085.20 for the weekend, a gain of 2.51% for the week. Silver was also up on Friday closing at $14.55, a gain of 3.19% for the week. Platinum jumped $34 to close at $878.

IMPORTANT NEWS

Vanishing Gold Trade Prompts Singapore to Refine Contract – Bloomberg

Gold near 3-week high after U.S. jobs data triggers short covering – Reuters

China Begins G-20 Leadership With Ideas to Reduce Dollar’s Role – Bloomberg

Hedge Funds Turning Record Bearish on Gold Miss Metal’s Rebound – Bloomberg

China’s Stocks Fluctuate as Brokerages Drop, Gold Miners Advance – Bloomberg

IMPORTANT ANALYSIS

You Have Questions, I Have Answers – Advisorperspectives.com

Extreme Gold Positioning Grows As Hedge Funds Add To Record Shorts – ZeroHedge.com

Don’t believe that central banks have too much power? Look at the euro – MoneyWeek.com

Physical Silver Investment Demand Great Deal Higher Than Official Estimates – Silverseek.com

Is This The Big Move We’ve Been Waiting For? – GoldSeek.com

Read more News & Commentary on GoldCore.com

Download Essential Guide To Storing Gold Offshore