Suppose you woke up and read this while drinking your morning coffee:

LONDON (Reuters) – At attempted rebound in European stocks quickly fizzled out on Monday after markets around the world and oil prices slumped to multi-year lows amid persistent worries over an inflationary global boom.

Unless you were a central banker, you probably would have spit out your coffee. Surely that must be a typo! Calm down, I changed the last three words from today’s news.

For years I’ve been arguing that slow NGDP growth reflected excessively tight money. People were skeptical. “The Fed’s out of ammo, there’s nothing they can do.” The funny thing is that this myth has become so deeply engrained that the media continues with it, even after we are no longer at the zero bound. The title of the actual article is:

Europe struggles to lift global gloom

Struggles? Um, didn’t the ECB disappoint markets at their last meeting by not cutting the policy rate (as markets had expected)? How is it a “struggle”, if you aren’t even trying?

Meanwhile in the US, the Fed “struggles” to boost our economy by raising the target rate. Seriously, the Fed actually believes the almighty dollar, the ultra strong dollar that is contributing to a global commodity price crash, is still too weak, too feeble, and needs to be even stronger. That’s because of a Phillips Curve theory that was completely discredited by Friedman and Phelps in the 1960s, but the Fed still holds on to, convinced that low unemployment causes higher inflation. Take a look at the graph below:

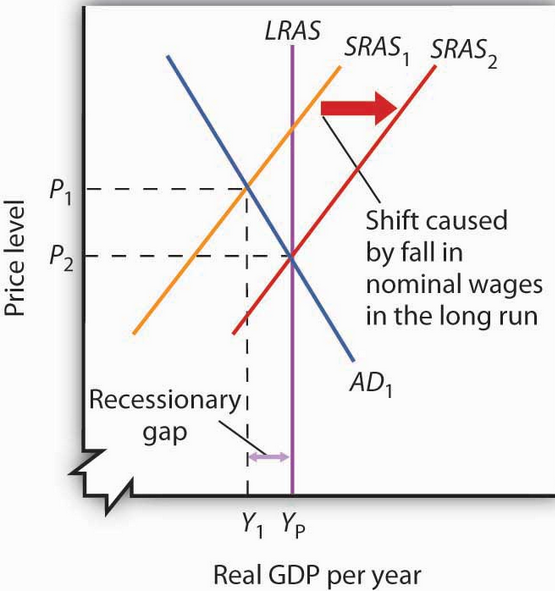

This is the textbook AS/AD model, showing the recovery from a demand-side recession. It probably makes more sense to view the vertical axis as the inflation rate, rather than the price level. Do you notice that inflation falls during both the recession and the recovery? That’s standard AS/AD. The Phillips curve, in contrast, is just an AD model, and hence only 1/2 as good as the AS/AD model. The Phillips curve model says falling unemployment is inflationary, whereas the AS/AD model says when unemployment falls during a recovery (due to wage moderation) it is disinflationary. Which one better fits the facts?

Now the Phillips Curve proponent might counter, “Yes, but once unemployment falls below the natural rate, inflation will rise.” Only if it is pushed below by an increase in AD, i.e. faster NGDP growth. But the bond market is telling is that NGDP growth will not increase. The Fed predicted its December tightening would raise bond yields this year, whereas it’s actually reducing them.

In the standard AS/AD model, once you return to the natural rate, inflation will stay at the new lower level. In the 1980s inflation stayed lower, it did not rise back to the level of the 1970s. In the 1990s inflation stayed lower, it did not rise to even the quite modest levels of the 1980s. There’s utterly nothing in the AS/AD model that tells us inflation will rise when unemployment gets back to the natural rate. But the Fed is assuming there is.

For years I’ve been saying the central banks could do more, but simply refuse to. NOW do you see what I was talking about? Everyone can now see that central banks don’t see anything “funny” about the joke at the top of this post. Only the markets get the joke. The central banks simply aren’t trying. Demand shortfall? What demand shortfall?

Here’s a more interesting joke. In December, some pundits said there was an argument that higher rates would reduce the risk of bubbles. OK, mortgage rates are now falling. Does that mean we need still higher rates? When will these higher fed funds rates bring us the higher mortgage rates that will prevent the bubbles?

(I should say, “supposedly will prevent bubbles”, as actual so-called bubbles tend to occur when rates are high, such as 1929, 2000, and 2006, not when rates are low (1932, 2002, 2009).