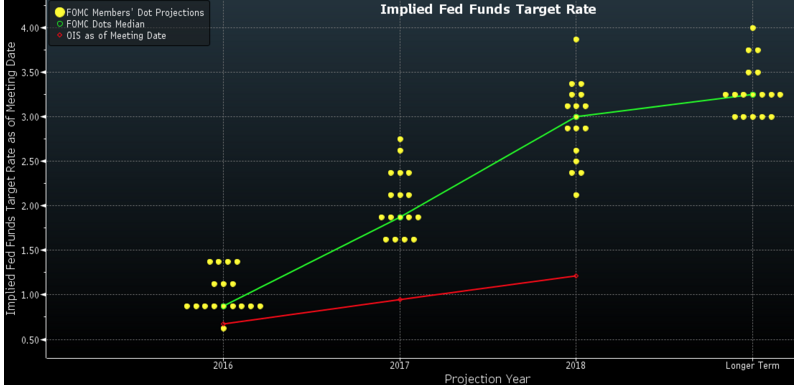

Last December the Fed forecast 4 rate increases during 2016. That’s still possible, but increasingly unlikely. The markets forecast 2 rate increases. Today the Fed threw in the towel, and admitted that the market forecast was better:

The Fed’s expectations for GDP growth in the near-term dropped since December, while forecasts for core inflation remained mostly unchanged, and the median expectation for unemployment fell slightly to 4.5% by 2018.

Fed officials’ projections for the federal funds rate indicate two quarter-point rate hikes this year, a slower pace of rate increases than envisioned last December. The Fed previously expected to raise rates four times this year.

The downshift in rate increases may not be due to new concerns over the domestic or global economy, but may simply be an extension of the Fed’s January decision to keep accommodative policy measures in place.

BTW, that third paragraph makes no sense. If anything, it was caused by the Fed’s decision in December to raise rates.

Here’s what I wrote last December:

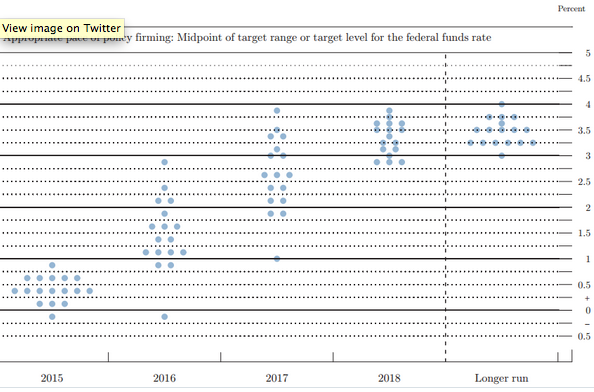

People laugh at how far behind Kocherlakota is on the dot graph, like the little boy that can’t keep up with his Boy Scout troop:

Only 1% interest rates in 2017? Yes, that’s probably too low, but it wouldn’t surprise me all that much if Kocherlakota had the last laugh. His 1% forecast is certainly far more plausible than the official who predicts 4% in 2017. Consider that Japan and probably even the eurozone are still going to be at zero in 2017. How plausible is it that the US has 4% rates when the rest of the developed world is at zero? Especially given that we are growing at just over 2% in a period of rapidly falling unemployment, and the unemployment rate will stop falling by 2017, and hence RGDP growth will slow sharply from the current pathetic levels. We might even have another recession, recall that America has never had an expansion that lasted 10 years.

It’s also important not to overstate the accuracy of market forecasts. Saying they are the best we have does not imply they are very good. There are certain things that are simply hard to predict—for instance markets are not very good at predicting recessions. (The yield curve is probably the best of a bad lot.) So the fact that the market was right and the Fed was wrong in this case (so far) does not prove anything. By analogy, examples where the market was wrong (and hence I was also wrong) also don’t prove anything.

For example, suppose the market forecasts 1.25% interest rates in 2018. The market might actually think 1.25% rates are unlikely, but that zero and 2.5% rates are equally likely. If we have a recession between now and then, rates will be at zero in 2018; if continued expansion, then rates might be 2.5%. Obviously I don’t know if that’s exactly right, it’s just something to keep in mind when looking at point estimates. I have no idea when the next recession will occur, but I do have a strong conditional forecast that when it does occur, rates will quickly fall to zero and stay there for many years.

This may explain the difference between the market and the new Fed forecast; only the market thinks a recession is possible:

Also note that the Fed’s new end of 2017 forecast is closer to Kocherlakota’s “crazy” 2017 forecast from back in December, than it is to the Fed’s own forecast back in December. And the market forecast is now almost identical to Kocherlakota’s December forecast for 2017.

You might say, “yeah, but he was wrong about 2016”. No, those are policy settings that the person deems appropriate. Thus they can only be viewed as predictions in the long run, as in the short run the Fed may be too tight to hit its inflation forecast.