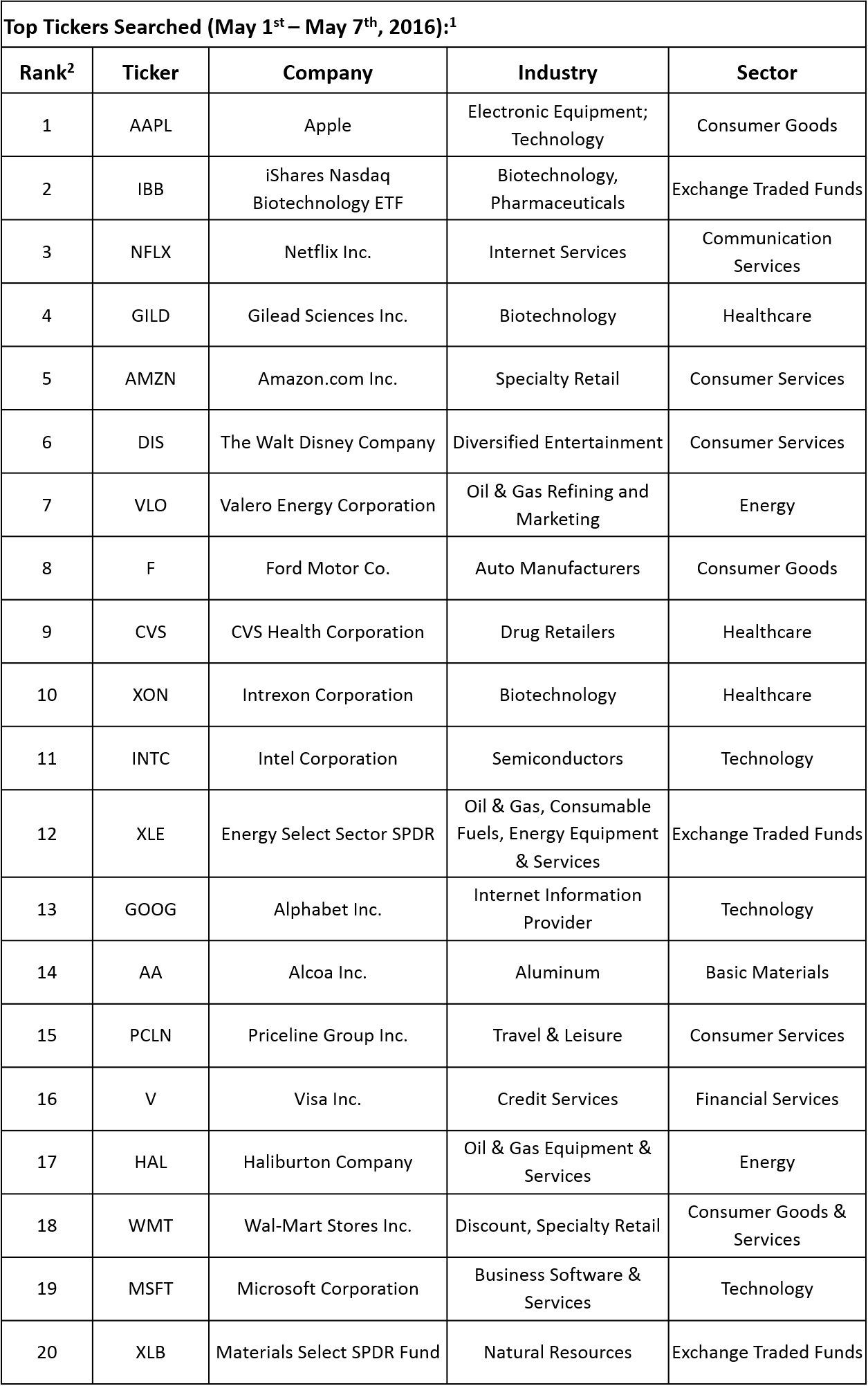

The US stock market declined slightly last week, as a strong start was offset by disappointing macroeconomic data. The Markit U.S. Manufacturing PMI showed a slowdown in production in April, with the Index amounting to 50.8, below the 51.5 registered in March and lower than the expectations of 51.0. On Friday, the Bureau of Labor Statistics released nonfarm payroll data, which showed the creation of 160,000 jobs last month and an unemployment rate at 5%. The unemployment rate was in line with analysts’ expectations, but the job growth missed the estimates of 202,000. Meanwhile, the market seems to have been focused on technology and healthcare. Among the 20 most searched tickers by financial advisors last week, the most companies were from these two sectors. This article takes a closer look at some of the highlights from the list of most-searched tickers, based on the data from TrackStar, which is the official newsletter of Intuition, an InvestingChannel business.

Click here to receive this data on a weekly basis.

Similar to the previous week, last week, Apple Inc. (NASDAQ:AAPL) ranked at the top of the list, as investors try to assess the company’s outlook. On Monday, CEO Tim Cook was interviewed by CNBC’s Jim Cramer on ‘Mad Money’, where he tried to reassure the viewers that Apple Inc. (NASDAQ:AAPL) has solid prospects and the market overreacted to the results.

Netflix, Inc. (NASDAQ:NFLX) and Amazon.com, Inc. (NASDAQ:AMZN) also made the list on the 3rd and 5th spots, respectively, amid the former releasing a new French series, ‘Marseille’ and the latter was featured at the Ira Sohn Conference, where hedge fund manager Chamath Palihapitiya projected a $3.0 trillion valuation for the e-commerce giant in the next decade.

Intel Corporation (NASDAQ:INTC), Alphabet Inc (NASDAQ:GOOG), Microsoft Corporation (NASDAQ:MSFT), and Priceline Group Inc. (NASDAQ:PCLN) made the list on the 11th, 13th, 15th, and 19th spots, respectively. Last week, reports emerged that Alphabet’s Google plans to build 100 self-driving minivans in partnership with Fiat Chrysler, while Microsoft announced that its latest Windows 10 operating system had been installed on 300 million active devices. Priceline reported its financial results on May 4 and managed to beat both top- and bottom-line estimates, while the increase in car rental and hotel booking showed that travel was only slightly affected by the last year’s Paris attacks and concerns about the Zika virus.

From the healthcare sector, aside from two biotech companies, Gilead Sciences Inc. (NASDAQ:GILD) and Intrexon Corporation (NYSE:XON), which frequently appear among the most-searched tickers, pharmacy healthcare provider CVS Health Corporation (NYSE:CVS) ranked on the 9th position in connection with its financial results posted on May 3, which showed EPS and revenue above expectations.

In addition, the second most-searched stock last week was iShares Nasdaq Biotechnology ETF (NASDAQ:IBB), which invests in a basket of biotech stocks. The top holdings of IBB reported their financial results in the last two weeks. Two other ETFs that made the top are Energy Select Sector SPDR (NYSE:XLE) and Materials Select SPDR Fund (NYSE:XLB).

Valero Energy Corporation (NYSE:VLO) and Haliburton Company (NYSE:HAL) caught the attention of financial advisors amid their earnings reports. Valero Energy reported EPS of $0.60, missing the consensus by $0.06, while the revenue of $15.71 billion was better than the expected $14.25 billion. Halliburton posted better-than-expected EPS and revenue of $0.07 and $4.20 billion, respectively. Also last Sunday, Halliburton and Baker Hughes (NYSE:BHI) announced the termination of their merger following opposition from EU and US antitrust regulators.

The consumer goods and services sectors were represented in the top 20 list by The Walt Disney Company (NYSE:DIS), Wal-Mart Stores Inc. (NYSE:WMT), and Ford Motor Co. (NYSE:F). Finally, Alcoa Inc. (NYSE:AA) was the only basic materials stock in the list, while Visa Inc. (NYSE:V) was the only financial stock.

CLICK HERE to subscribe to TrackStar and receive this data directly in your inbox!

Intuition is a global research, education, technology and creative solutions business, from InvestingChannel, Inc., that invests in intelligence to make the art of human-driven communication and decision-making more intuitive in financial services.

1Disclaimer: This newsletter is for information purposes only and opinion based on a financial advisor data across a selection of websites. Investors should be cautious about any and all investments and are advised to conduct their own due diligence prior to making any investment decisions.

2Rank is determined solely by highest amount of ticker searches by financial advisors in the given week across a selection of websites through our database