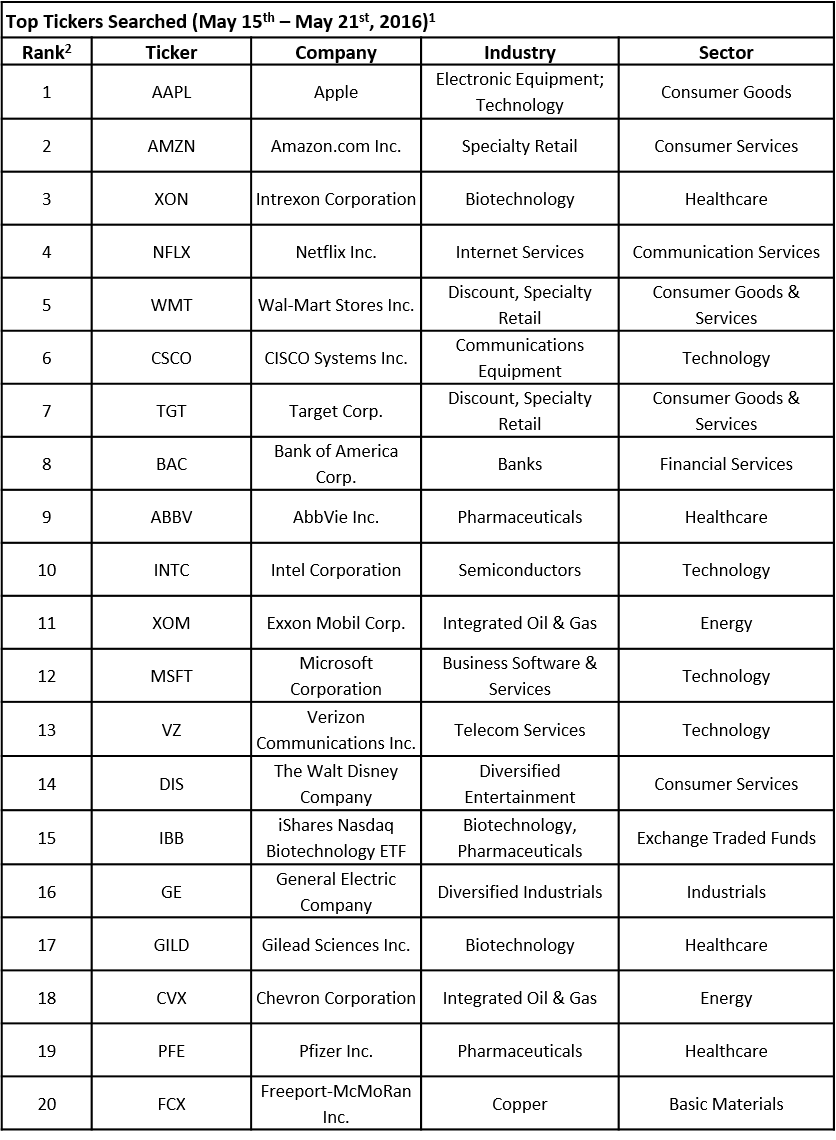

Last week started with the completion of the latest round of 13F filings, which means that all institutional investors with securities worth at least $100 million disclosed their US equity portfolios, which allowed the public to assess how these investors chose to allocate their capital during the first quarter. Filings from hedge funds were particularly scrutinized, since many of these firms are usually highly secretive and 13F filings is the only possibility for smaller investors to assess their moves. Financial advisors kept their focus on tech and healthcare stocks last week, as can be seen from the list of the most-searched tickers compiled by TrackStar, the official newsletter of Intuition, an InvestingChannel business. Let’s take a closer look at the stocks in question and see the notable events that put them in spotlight.

Click here to receive this data on a weekly basis.

Apple Inc. (NASDAQ:AAPL) had a strong run last week, having gained over 5% with good news emerging on Monday, when Berkshire Hathaway, led by famous value investor Warren Buffett, reported a new $1.0 billion-stake in Apple Inc. (NASDAQ:AAPL), acquired during the first quarter. The move was a signal to many that Apple might be a good value stock. According to reports, the position was acquired by one of Buffett’s lieutenants and despite the last week’s rally, the stock is still 13% in the red since the end of the first quarter. Overall, Apple Inc. (NASDAQ:AAPL) has many supporters among smart money investors and analysts, despite the fading iPhone sales trajectory, but in the near future everyone will be watching closely the developments surrounding the new iPhone, since it will be one of the key determinants of Apple Inc. (NASDAQ:AAPL)’s financial position.

Other tech stocks in financial advisors’ spotlight last week were Amazon.com Inc. (NASDAQ:AMZN), Netflix Inc. (NASDAQ:NFLX), CISCO Systems Inc. (NASDAQ:CSCO), Intel Corporation (NASDAQ:INTC), and Microsoft Corporation (NASDAQ:MSFT). In this way, with six stocks in the list, the technology sector was the most popular among financial advisors, which is a trend that has been lasting for the last couple of weeks.

Also similar to the previous weeks, the healthcare sector was the second most-popular, with Interxon Corporation (NYSE:XON) ranking on the third spot in the list of the most-searched tickers. A newcomer was Abbvie Inc. (NASDAQ:ABBV), which was trending amid news that Coherus BioSciences announced that it had received a positive decision from the Patent Trial and Appeal Board of the US Patent and Trademark office, following which the validity of AbbVie’s patent covering its top seller Humira drug will be reviewed. The other two healthcare stocks that made the list last week were Gilead Sciences (NASDAQ:GILD) and Pfizer Inc. (NYSE:PFE).

Just two energy stocks appeared among the most searched: Exxon Mobil Corp. (NYSE:XOM) and Chevron Corporation (NYSE:CVX). Among other developments, analysts at Argus upgraded Exxon to Buy from Hold with a $104 price target and reiterated its Buy rating on Chevron. The analysts stated that Exxon has a “diverse asset base, secure dividend and strong cost controls” and it will most likely focus on leveraging its integrated business model rather than dilute its earnings through an acquisition. Argus raised the price target on Chevron to $118 from $110, citing the growth in crude prices and conviction in the company’s dividend payments.

In addition, Wal-Mart Stores Inc. (NYSE:WMT) and Target Corp. (NYSE:TGT) represented the retail industry in the list of most popular tickers. Both retailers posted their financial results for the fiscal first quarter with Wal-Mart beating both top- and bottom-line estimates, while Target managed to beat analysts’ expectations for EPS, but its revenue missed the consensus.

From the telecom services industry, Verizon Communications Inc. (NYSE:VZ) made the list, replacing AT&T that was trending a week earlier. The company has been in the news lately in connection with the ongoing strike that involves around 40,000 union employees.

CLICK HERE to subscribe to TrackStar and receive this data directly in your inbox!

Intuition is a global research, education, technology and creative solutions business, from InvestingChannel, Inc., that invests in intelligence to make the art of human-driven communication and decision-making more intuitive in financial services.

1Disclaimer: This newsletter is for information purposes only and opinion based on a financial advisor data across a selection of websites. Investors should be cautious about any and all investments and are advised to conduct their own due diligence prior to making any investment decisions.

2Rank is determined solely by highest amount of ticker searches by financial advisors in the given week across a selection of websites through our database