This is a reprint of the August 24 Special Profit Radar Report:

The CBOE Volatility Index (VIX) is a popular index, but in itself is not investable. You can’t just go out and buy the VIX. The same is true for the S&P 500 or any other index.

But investment vehicles like the SPDR S&P 500 ETF, which aims to replicate the performance of the S&P 500 index, make it possible to invest in indexes.

Duplicating the performance of the S&P 500, however, is much easier than creating a vehicle that mimics the VIX. Fund managers simply purchase the stocks that make up the S&P 500 to create an S&P 500-like product.

It doesn’t work like this for the VIX. Here’s why:

There is no ‘VIX stock.’ The only way to invest in the VIX is via futures or options, which are complex financial instruments. ETFs, ETNs or other ETP’s use futures or options to attain ‘VIX-like’ performance. VIX futures and options generally suffer from some sort of time decay.

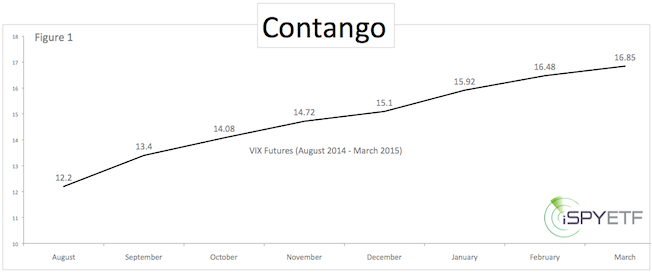

Explained: Contango

The VIX quoted in-day-to-day life is the CBOE Volatility Index (VIX) spot price (today’s VIX price). However, the futures used to create ETPs like the iPath S&P 500 VIX Short-Term Futures ETN (VXX) are based on the future VIX price, which is almost always more expensive than the spot price. Over time the more expensive VIX futures decline in value, eventually converging with the spot price at expiration.

Figure 1 compares the current spot price with various futures prices. The difference between the spot price (12.20) and the September futures (13.45) is 9.84%. In other words, it will take a 9.84% move in the VIX to neutralize the time decay between the spot and September futures price.

As time goes by, ETF providers are forced to continuously replace expiring futures with new (more expensive) futures (this process is called ‘rolling over’). The further away the futures expiration date, the bigger the time premium. This time premium and resulting value decay is called contango.

Contango generally exists when the VIX is flat or trending lower. Even gradual increases when the VIX is below 20 tend to occur in an environment of contango.

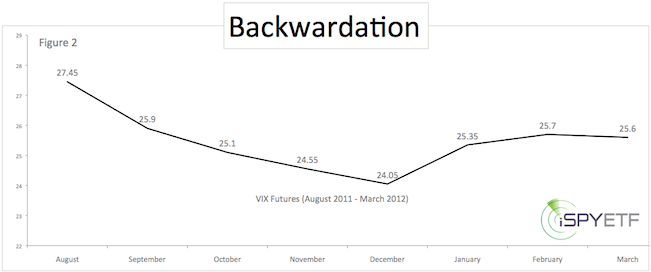

Backwardation (figure 2) is the opposite of contango. Backwardation generally appears only during times of panic and significant VIX spikes above 20.

To sum up, contango erodes investors’ returns during periods of a flat or falling VIX.

How to Profit from Contango

We don’t expect a major stock market top yet, therefore the period of low volatility is likely to continue (or resume after the seasonal October VIX high).

Is it possible to use contango in our favor?

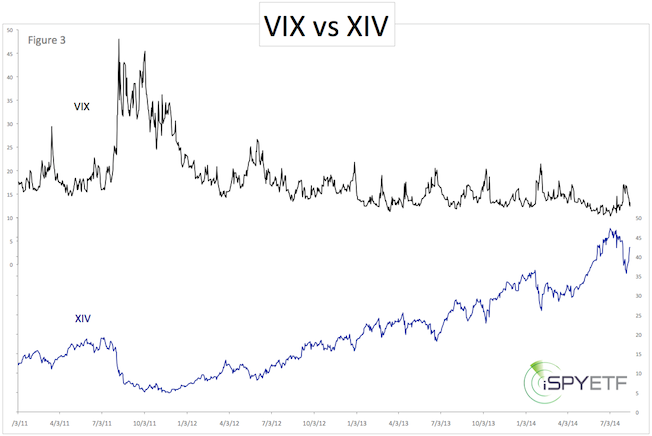

Figure 3 plots the VIX against the VelocityShares Daily Inverse VIX Short-Term ETN (XIV), and reveals a very simple truth: XIV has risen much more than the VIX has fallen.

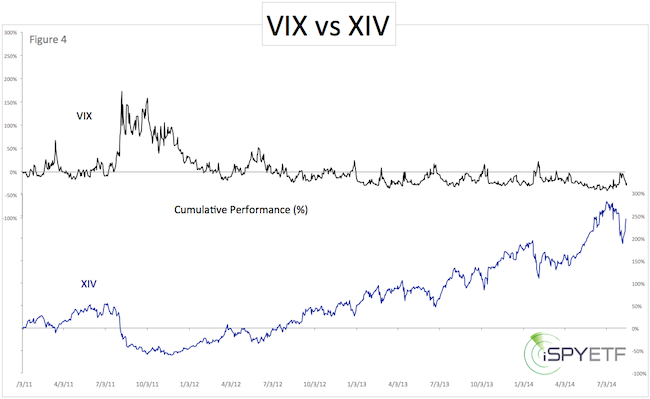

Figure 4 shows the cumulative gain/loss from January 3, 2011 to August 15, 2014. The VIX lost 25%. XIV gained 242%. XIV returned 217% more than the inverse VIX.

XIV’s objective (and the objective of every other inverse or leveraged ETP) is to replicate the daily (not long-term) inverse performance of the VIX, but regardless, this kind of excess return is worth exploring.

Here is a more detailed breakdown of XIV’s excess return.

XIV is an inverse VIX ETN. For an apples to apples comparison, we are comparing XIV with a simple inverse VIX.

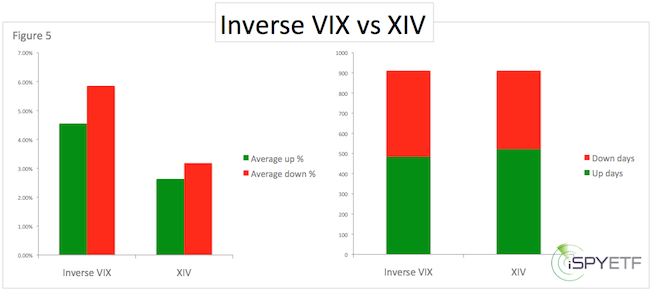

Of the 911 trading days from January 3, 2011 to August 15, 2014, the inverse VIX had 484 up days and 427 down days. The inverse VIX had 1.13x more up than down days.

The average gain of 484 up days was 4.55%. The average loss of 427 down days was 5.85%. The average loss was 1.28x greater than the average gain.

Of the 911 trading days from January 3, 2011 to August 15, 2014, XIV had 522 up days and 389 down days. XIV had 1.34x more up than down days.

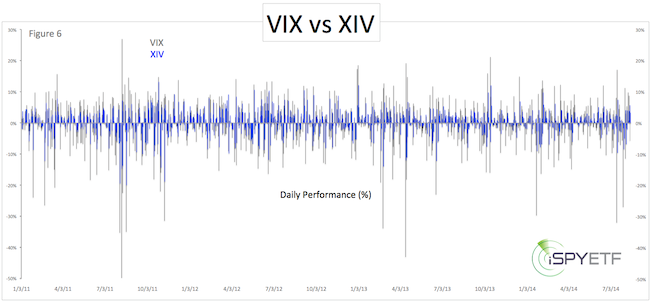

The average gain of 522 up days was 2.63%. The average loss of 389 down days was 3.18%. The average loss was 1.21x greater than the average gain (see figures 5 and 6).

Summary

Since 2011, XIV outperformed the inverse VIX by 217% (0.24% per day). Although there are other factors at work, the excess return of 0.24% per day is largely attributed to the effect of contango.

Contango does not guarantee a profitable trade or protect against losses. From July 7 – November 21, 2011 XIV lost 75%. There are also times where the VIX moves lower and XIV loses value (i.e. August 18 – 21, 2014).

Over time however, contango significantly enhances the odds of a successful XIV trade, especially when XIV is purchased during times of VIX spikes.

A list of VIX Exchange Traded Products that benefit from contango, a updated VIX seasonality chart, and actual buy/sell signals are available via the Profit Radar Report.

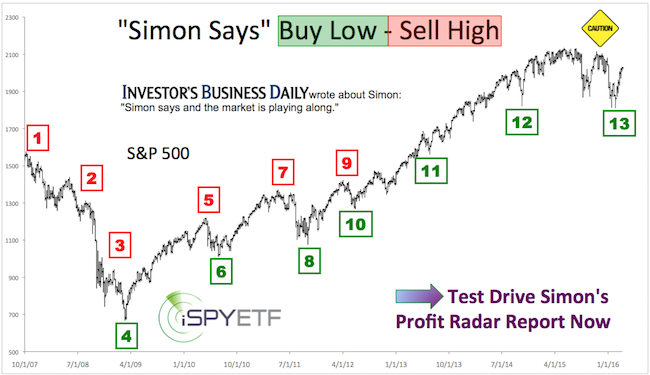

Simon Maierhofer is the founder of iSPYETF and the publisher of the Profit Radar Report. Barron’s rated iSPYETF as a “trader with a good track record” (click here for Barron’s profile of the Profit Radar Report). The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013, 17.59% in 2014, and 24.52% in 2015.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.