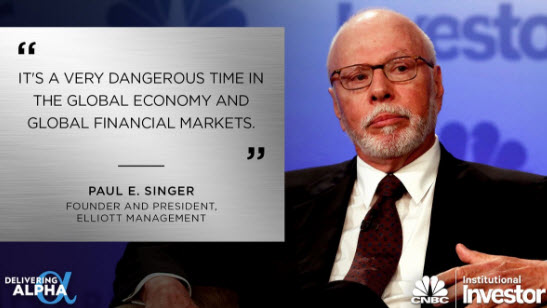

Buy gold as bonds are in the “biggest bubble in the world” and it is a “a very dangerous time in the global economy” according to billionaire investor, Paul Singer.

Speaking at the CNBC Delivering Alpha Conference, the respected hedge fund manager, Singer said he favours a diversification into gold right now.

He thinks that gold is “underrepresented in many portfolios as the only money and store of value that has stood the test of time.” He added that at current prices gold is “undervalued.”

For Singer, the founder of the $27 billion Elliott Management, owning gold is “opposite confidence in central banks” who have made the bond market “the biggest bubble in the world.”

Singer urged the room of investors to sell their bonds:

“I think owning medium to long-term G-7 fixed income is a really bad idea. By removing these things that are bad ideas, that’s a helpful thing. Sell your 30-year bonds. ” Read full story…