Oil is trading to a three-week high after The House of Saudi and Russia said they were extending supply cuts into 2018. Here’s a look at the pre-market action, up nearly 3%:

__

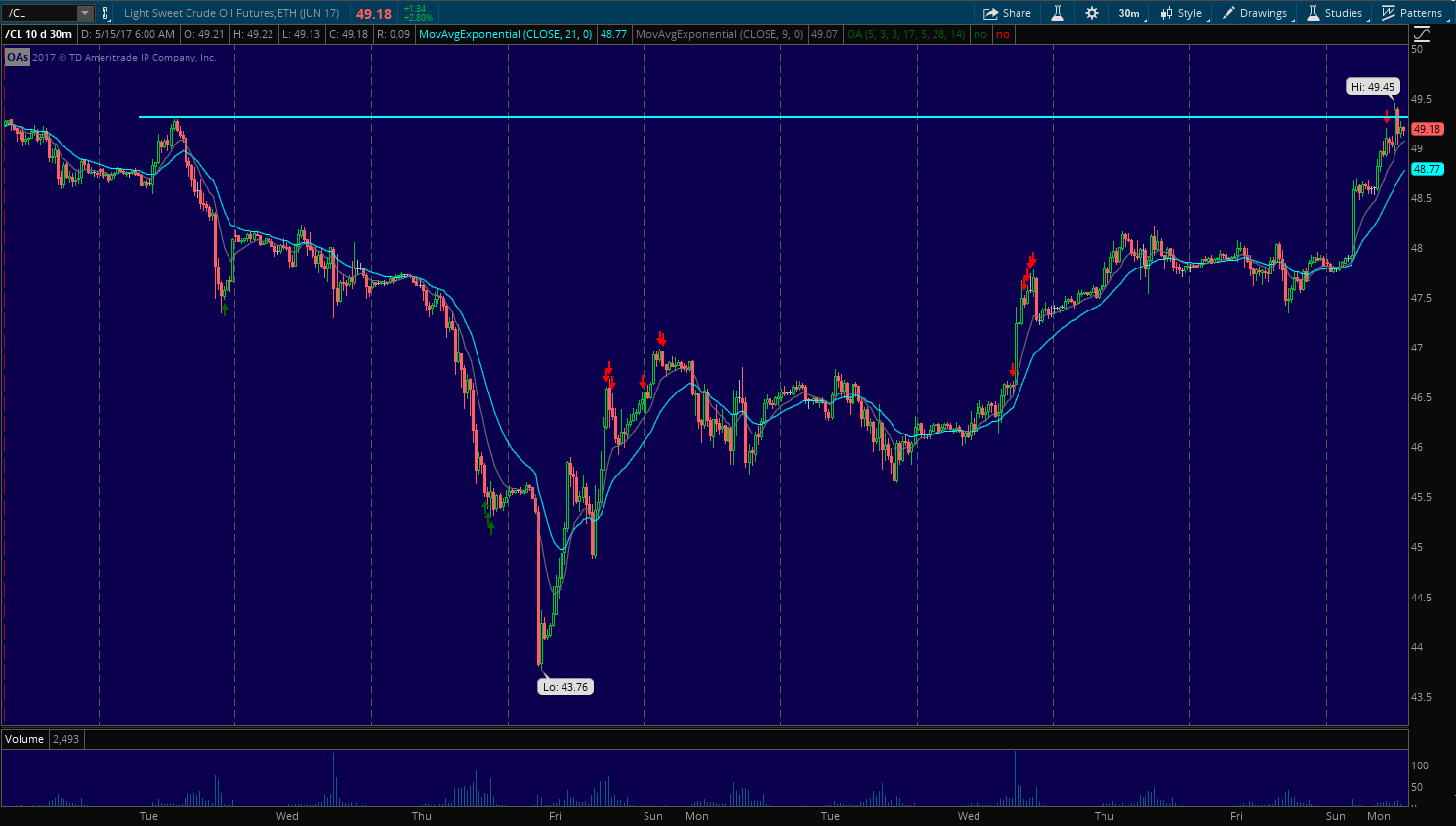

The 30 Minute chart shows resistance around $49, current levels:

__

Over the last year we have been basically range bound, with $55 being the lid. We are now right smack dab in the middle again near $50/brl:

__

__

Here’s the latest news from Reuters:

Energy ministers from the two countries said on Monday that supply cuts should be prolonged for nine months, until March 2018. That is longer than the optional six-month extension specified in the deal.

Brent crude, the global benchmark, had risen $1.54 to $52.38 a barrel by 1005 GMT (6.05 a.m. ET) and traded intraday at $52.52, the highest since April 24. U.S. crude was up $1.48 at $49.32 a barrel.

Oil traders were surprised by the strong wording of the announcement, although it remained to be seen whether all countries participating in the deal would agree with the Saudi-Russian stance.

Some analysts doubted producers would stick to a prolonged curb.

“Extending the cuts until March 2018 would take account of the fact that demand in the first quarter of a year is lowest for seasonal reasons,” said Carsten Fritsch, analyst at Commerzbank.

“That said, we are skeptical about Russia’s willingness to actively participate in any extended cuts.”