Commercial Property Market Is Inflated and May Burst Again

by David McWilliams

Dublin property investors had better hope that Brexit happens soon.

They should also hope that it’s not just a ‘hard’ Brexit, but a granite Brexit — a Brexit that’s as hard as possible. They should be betting on the buffoonery of Boris Johnson, down on both knees praying for a massive barney between Davis and Barnier.

A granite Brexit might prompt the migration of hundreds of corporate refugees from isolated London to the freewheeling safe haven of Dublin. If Brexit doesn’t drive a massive uptake in demand for prime property, we are in for a massive wobble in our inflated commercial property market.

Before we remind ourselves how this property story goes, let’s have a look at the facts: the glossy brochures are back, stockbrokers are packaging all sorts of property-related products to “investors”, the price of ad space in the property porn sections of the press is surging and of course the skyline is full of cranes and Armagh flags.

CBRE – a property-flogging outfit – tells us there are currently 31 office schemes under construction in Dublin, which is more than 380,000sqm in the pipeline. They tell us that more than 30% of this stock is already let. It also gushes that 44% of the office stock due for completion before the end of this year has already been pre-let. Meanwhile, agents tell us that prime office rents in the Dublin market stand at approximately €673 sqm.

It looks like things couldn’t be healthier.

Office take-up in Dublin surged 101,000sqm in the past three months, bringing total take-up in the first half of this year to more than 150,000 sqm. That’s a lot of space. 81 individual large office lettings were signed in Dublin since March (45 to Irish companies; 18 to US firms and 11 to the Brits). This is more than double the figure for the period from January to March.

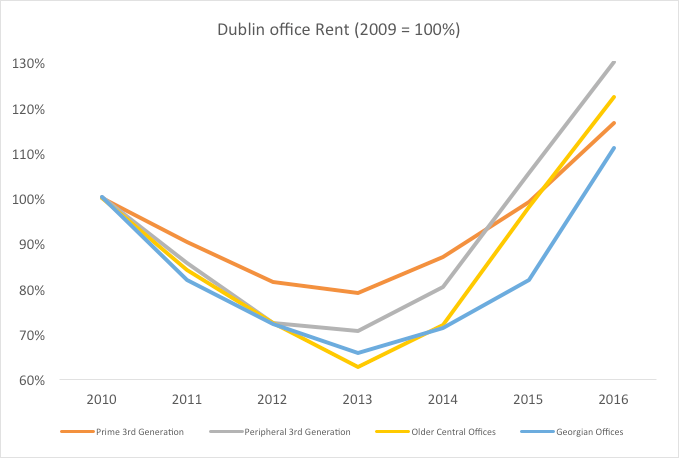

The market is tight, hence all the building. The vacancy rate in the city centre is only 4.5% and yields for investors are stable at 4.6%. This is only because rents have been surging to keep up with the soaring prices.

Before we get carried away, remember rents are a cost and Ireland is competing with other European countries, so let’s compare our prices, not with some of Europe’s poorest countries, but why not with its richest, Germany? This will give a bit of perspective.

Click here to read full story on GoldCore…

“It is important to note that all portfolios under all conditions actually perform better with exposure to gold and silver” – David Morgan

In the short video above, David Morgan, the Silver Guru, speaks briefly about the importance of owning silver bullion coins and bars as financial insurance in an uncertain world. He speaks about GoldCore Secure Storage and how he recommends GoldCore’s ultra secure allocated and segregated gold, silver, platinum and palladium bullion storage (Zurich, London, Singapore and Hong Kong) to his retail and high net worth clients.