Of all the things investors ask me about closed-end funds, the main one is leverage. (A close No. 2 is CEF return of capital, which I discussed in a recent article here.)

Yes, CEFs often borrow money and invest it in stocks or bonds. That scares some people, who then ask me if a leveraged CEF is safe.

The answer is: sometimes. (Below I’ll show you 2 CEFs with 6.5%+ dividend yields that are using leverage perfectly to slingshot their shareholders to double-digit gains.)

You see, leverage can boost your return in a bull market and magnify your loss in a bear market. The more you have invested in a down market, the more you’ll lose, so borrowing to bet on a losing asset is obviously a bad idea. But since bear markets are steep and sudden while bull markets emerge slowly, leverage tends to improve returns over time.

The key phrase is “tends to.” The real problem is when a fund gets too aggressive and borrows too much money. These are the ones I’ve found an ironclad way of dodging when picking funds for our CEF Insider service.

Avoiding the Leverage Trap

The reason this is a problem? Regulation.

CEFs can borrow money cheap (many pay around 1% interest!), so they can easily use that borrowed cash to amplify returns. But there’s a legal limit to how much CEFs can borrow: 33% of their net asset value (NAV, or the value of their underlying assets) in debt (e.g. taking out loans) and 50% of their NAV in equity leverage (issuing things like preferred stock to raise cash that is then invested in the market).

That sounds like a lot, but it also means there’s a ceiling to how much debt a CEF can hold at any one time. And since bear markets come suddenly, this can force a CEF to sell assets during a downturn to make sure its leverage ratio doesn’t exceed the legal limit.

This can be a nightmare for investors in CEFs caught in this trap, because one of the best things about CEFs is that they don’t have to sell assets in a bear market. That’s a key difference from ETFs and mutual funds, where managers have to sell during a panic even if they’re confident the asset will bounce back because they need to liquidate the fund’s holdings to give investors back their cash. This is one of the reasons why I love CEFs—but if you take away that one advantage, your returns will suffer.

So we want to choose CEFs that will never face that problem. And luckily, that’s easy to do, thanks to…

My 1-Step Test of CEF Safety

The trick, of course, is to choose a CEF that isn’t using too much leverage. But how much is too much?

To determine that, think back to 2007–09, one of history’s biggest market crashes. If we set that as our limit, how much leverage can a fund use before it’s forced to start selling assets?

The answer: 27%.

In other words, for every $1.00 in NAV, a fund could have borrowed $0.27 and still wouldn’t have had to sell assets in 2007–09. So assuming we never face a worse downturn, we can set 27% as our maximum acceptable leverage.

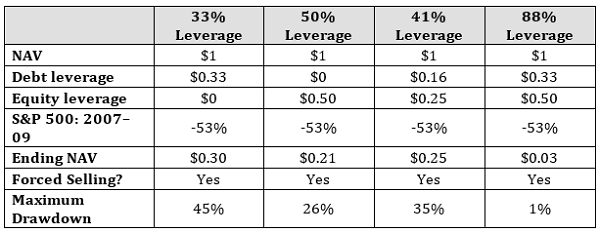

If we look at funds with more leverage, we see how their bear-market tolerance plunges. In the table below, I’ve laid out a fund that has the maximum amount of debt leverage, one that has the maximum equity leverage, one that has half of both and one that has the max for both.

So you can see here that each fund was forced to sell during 2007–09, but even more worrying is each fund’s maximum drawdown. This refers to how much of a downturn the fund’s NAV can face before managers need to start selling to cover their leverage requirements. A 33% levered fund can withstand a 45% crash, but bump that up to 50% and the max drawdown is 26%. And a fully levered fund can’t fall less than 1% without being forced to sell assets.

So you can see how too much leverage can cause a real problem.

How a Smart Leverage Strategy Fattens Your Gain

But that doesn’t mean leverage is always bad. Quite the opposite!

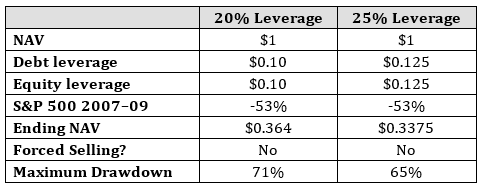

A fund with 20% to 25% leverage could withstand a crash on the scale of 2007–09 without being forced to sell anything:

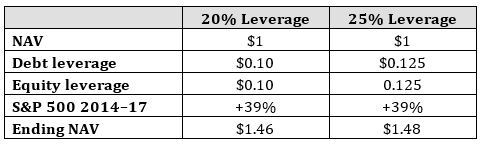

But what if we lever in a bull market? That’s where things get exciting.

As you can see, a fund that was 20% levered over the last three years has had a 46.4% return on its NAV, while a 25% levered fund saw a 48.4% return. This is how just a modest use of leverage can boost your return in an up market.

Leverage on Our CEF Insider Watch List Funds

Now let’s take a look at some of the 35 funds on our CEF Insider Watch List (which you can access when you take a no-risk trial to the service by clicking here) and pick out a few of the best levered funds of the bunch, as determined by my proven 5-step CEF-picking system.

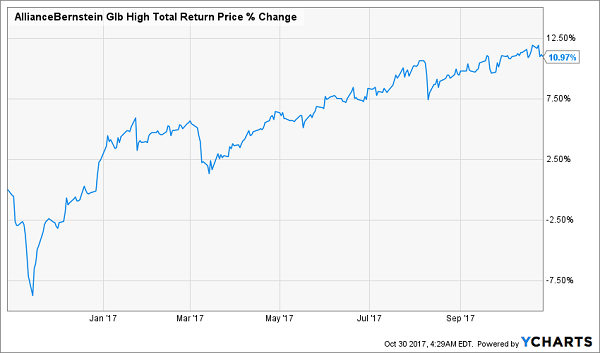

The AllianceBernstein Global High Income Fund (AWF) is using 46% leverage—which seems high, except when you realize that its focus is on global bonds, where the drawdowns in a bear market are lower than in stocks because bonds don’t fall as steeply as stocks do in a market panic. Plus, global bonds are on a tear thanks to the weak dollar, so that leverage has done this to AWF’s returns in the last year:

AWF’s Borrowed-Money Boost

If you want something closer to home that borrows less money, the Cohen & Steers Quality Income Realty Fund (RQI) has just 23.9% leverage (in our sweet spot for all markets) and pays a nice 7.7% dividend thanks to its US-focused REIT portfolio. The fund is also up nicely in the last year, although its recent sideways movement may signal a pause in its run-up:

RQI: Prudent Borrowing, Serious Gains

Thanks in part to the fund’s effective use of leverage, I expect those gains to resume when the REIT market gets healthier.

BREAKING NEWS From the Editor: I don’t normally speak up in Michael’s articles, but I’ve got some crucial news that simply can’t wait.

What I’m about to show you could easily triple your income and hand you an easy 30% return in 2018!

You see, just weeks ago, Michael—our in-house “CEF professor” and chief strategist of CEF Insider—released a FREE special report unlike any we’ve published before.

In its pages you’ll find his 4 favorite CEFs to buy now. Each pays a growing 7.4%+ dividend and is poised to hand you 20%+ price gains in 2018. For that impressive upside, we can thank their ultra-conservative leverage strategies, laughably cheap discounts and, of course, their sky-high—and growing—dividends!

Add it up and you’re looking at a nearly 30% total return in the next 12 months, with a big chunk of that in cash. And these picks come straight from Michael, the only analyst in the world who devotes 100% of his time to CEFs with market caps under $1 billion—the market “sweet spot” where the biggest gains live.

We’ve put everything you need in this new special report, and your copy is waiting for you as I write. Go right here to get the full story on these 4 “perfect” dividend investments now.