In a recent post I criticized a headline on cryptocurrency bubbles. Ryan Avent (who wrote the piece) told me to read the entire article, which is indeed much more nuanced in its discussion of whether Bitcoin is a bubble. I should have pointed that out.

I’m not sure when I first predicted that (misdiagnosed) bubbles would be the new norm of the 21st century. This is from January 2014:

I’ve also argued that low rates will create more “bubbles” in the 21st century.

And here’s what I said in July 2011:

My most important argument is that low real interest rates might be the “new normal.” . . .

But (seriously) are stocks now overvalued? Because I’m an efficient markets-type, the only answer I can give is no. So why does Robert Shiller say yes? Apparently because the P/E ratio is relatively high by historical standards. And he showed that for much of American history investors did better buying stocks when P/Es were low than when P/E ratios were high. Of course hindsight is 20-20.

[I feel so sorry for people who make their investment decisions based on Robert Shiller’s public statements.]

So how has my prediction held up? Are so-called “bubbles” the new normal of the 21st century?

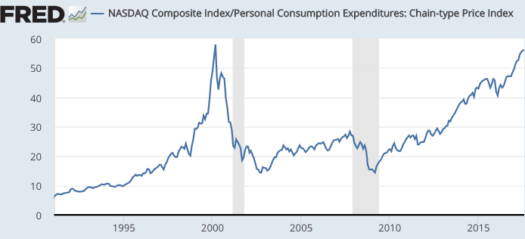

Here’s the real NASDAQ index:

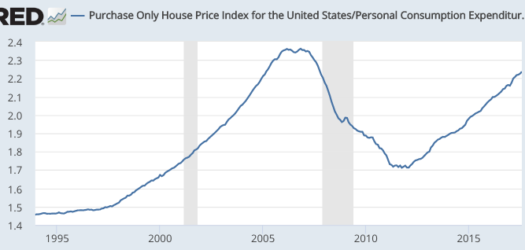

(Both indices deflated by the PCE price index.)

(Both indices deflated by the PCE price index.)

And Bitcoin:

All three major “bubbles” occurred after my predictions.

All three major “bubbles” occurred after my predictions.

Bubbles, bubbles, as far as the eye can see.